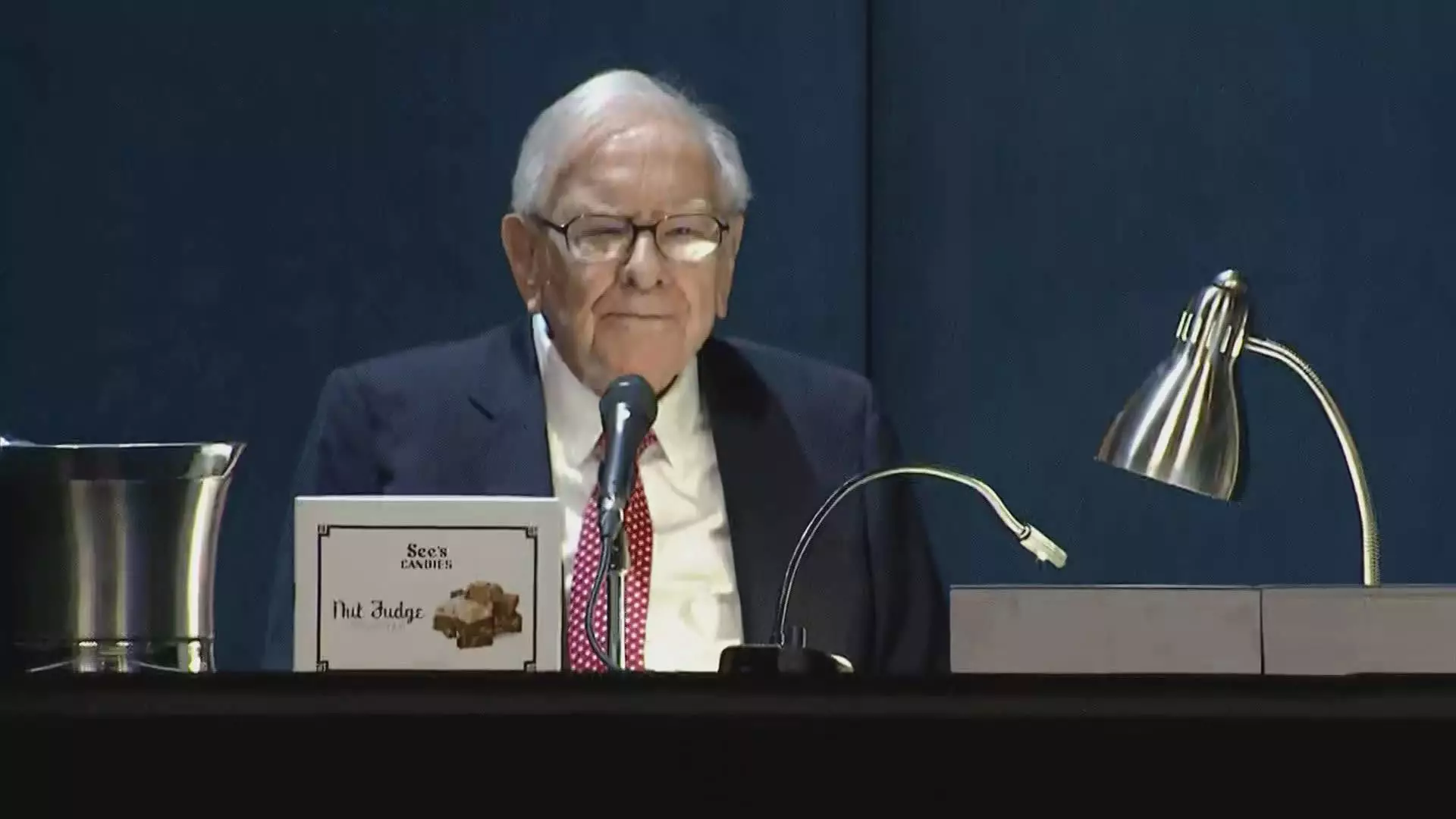

Warren Buffett, the iconic CEO of Berkshire Hathaway, has entered a phase of significant reevaluation regarding one of his company’s most substantial holdings: Apple Inc. For four consecutive quarters, Buffett has reduced his stake in the tech giant, which underscores a marked shift in investment strategy. As of the end of September, Berkshire Hathaway owned approximately $69.9 billion worth of Apple shares, a reduction indicating that the investment mogul had offloaded roughly a quarter of the total shares, leaving around 300 million remaining. This shift symbolizes a dramatic 67.2% decline from the previous year’s figures.

The motivations behind Buffett’s decision to sell off a large portion of Apple stock remain somewhat ambiguous. Analysts and shareholders alike have speculated that these moves might be attributed to various factors, including the high valuations of the stock and a strategic impulse to diversify and reduce concentration in one of its holdings. Berkshire’s association with Apple had once been so significant that it constituted nearly half of its entire equity portfolio, which is a level of concentration that many investors would find risky.

During the annual Berkshire meeting in May, Buffett alluded to another potential factor—tax considerations. He hinted at the prospect of a future increase in capital gains tax, potentially encouraged by the government’s requirement to address a rising fiscal deficit. While this consideration provides a glimpse into his fiscal strategy, the scale of the selling campaign raises questions about whether additional motivations were at play beyond just tax planning.

A Shift in Investment Philosophy

Historically, Buffett has operated with a clear delineation of industries he felt comfortable investing in. His gradual embrace of technology, especially Apple, marked a significant shift from his previously cautious stance. The investment was initially facilitated by the insights of his investing apprentices, Ted Weschler and Todd Combs, who recognized the long-term value in Apple’s customer loyalty and the integrated ecosystem of its products.

Despite feeling that Apple represented a revolution in consumer technology, Buffett has now altered his position. The raises in his Apple holdings showcased a deep-seated belief in the company’s potential. Yet, nearly a decade in, this reassessment emphasizes the importance of adaptability in investment strategy—a critical asset for any investor, particularly one of Buffett’s stature.

Amid these substantial changes, it’s noteworthy that Berkshire Hathaway reached an impressive cash reserve of $325.2 billion at the end of the third quarter, representing an all-time high for the conglomerate. Interestingly, during this time, Berkshire ceased its buyback program entirely, suggesting a strategic pivot towards maintaining liquidity in uncertain market conditions.

In contrast to the broader stock market, which has seen the S&P 500 attain a 20% increase, Apple shares have merely ascended by 16% this year, reflecting potential undercurrents affecting investor confidence. The divergence between Berkshire’s cash accumulation strategy and the broader market dynamics sheds light on the complexities of modern investment within fluctuating economic landscapes.

Buffett’s recent actions indicate not just a tactical shift in handling his Apple investments, but also reflect a broader strategy that balances caution with maintaining a robust financial position. As the fallout from these decisions continues to unfold, investors will undoubtedly be keen to watch how this iconic figure navigates the ever-evolving market terrain.