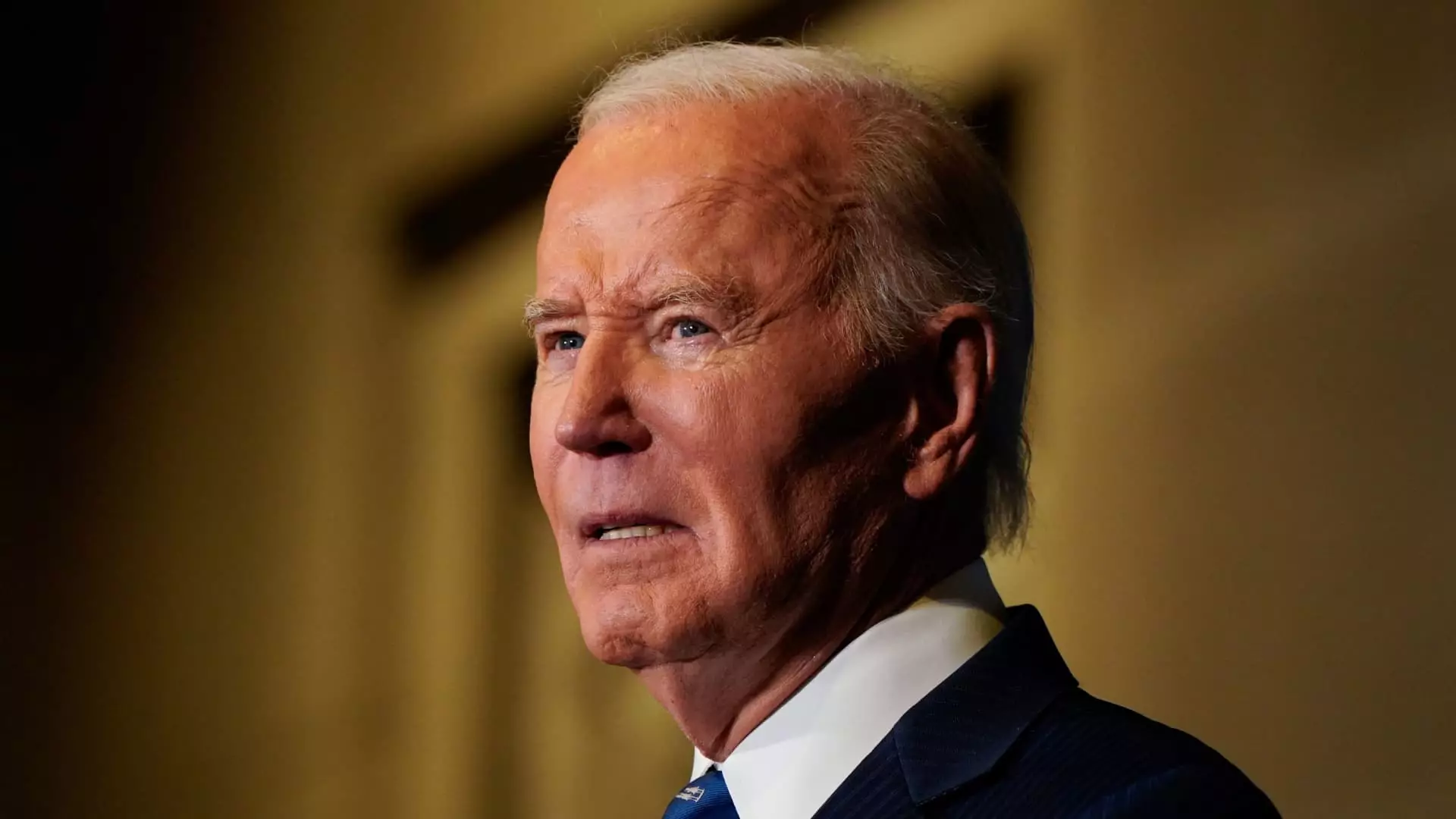

In a significant shift of policy, the Biden administration has recently announced the withdrawal of two prominent initiatives aimed at delivering student loan forgiveness. These proposals were designed to offer debt relief to various categories of borrowers, including those with long repayment histories and individuals grappling with financial difficulties. The cancellation of these plans comes just weeks before the inauguration of President-elect Donald Trump, raising concerns among consumer advocates and current borrowers alike.

The Education Department cited “operational challenges” in implementing the proposed loan cancellation measures as the primary justification for their withdrawal. In a statement released through the Federal Register, the Department indicated that it would redirect its limited operational resources to focus on helping distressed borrowers successfully transition back into repayment before the shift in administration. This decision is particularly disheartening given the administration’s previous efforts to provide meaningful relief to borrowers confronting the weighty burden of student debt.

The setbacks for the Biden administration began after the Supreme Court’s decision in June 2023, which struck down an earlier, more ambitious plan aimed at erasing substantial student loan balances. Higher education experts noted that the latest proposals were perceived as a contingency measure, or a “Plan B,” in response to that judicial blow. Critics of the prior administration, including Trump, had consistently labeled student loan forgiveness initiatives as problematic, asserting that they undermine economic discipline.

Thus, it is not surprising that experts like Mark Kantrowitz have voiced concerns regarding the administration’s awareness of the potential roadblocks posed by a subsequent Trump presidency. With Trump’s opposition to student loan forgiveness firmly established, the withdrawal of these plans has left many borrowers puzzled and anxious about their financial futures.

For many, the administration’s withdrawal is more than just a missed opportunity; it signals a dispiriting reality for millions still encumbered by student debt. Consumer advocates are expressing deep disappointment, emphasizing that comprehensive forgiveness would have drastically improved the financial situations of countless Americans. According to Persis Yu of the Student Borrower Protection Center, the proposals had the potential to “unlock economic mobility” for numerous borrowers and their families.

Moreover, the ongoing concern surrounding the stability of existing forgiveness programs emphasizes the precarious landscape for student loan borrowers. Well-established initiatives like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF) remain in operation; however, the future of these programs is uncertain. Many borrowers are left wondering whether their repayment plans will be affected by the shifting political tides.

While the withdrawal of the proposed regulations is a setback, the Education Department continues to provide other avenues for forgiveness. For eligible public service employees, PSLF promises loan cancellation following a decade of consistent payments. Similarly, teachers working in underprivileged schools may qualify for TLF, which offers substantial relief after a five-year commitment. Despite the staff reductions and transitional uncertainties looming on the horizon, borrowers can still explore various federal relief alternatives.

Resources such as Studentaid.gov offer vital information about remaining options for federal student loan relief, while organizations like the Institute of Student Loan Advisors maintain comprehensive databases of forgiveness programs available in individual states. In this precarious environment, it is crucial for borrowers to stay informed and proactive about their rights and the options available to them.

The withdrawal of the Biden administration’s plans for broad student loan forgiveness represents a significant moment in the ongoing dialogue concerning educational finance in the United States. As we look ahead to a potentially more conservative administration, borrowers must brace themselves for continued uncertainty. While existing programs may still offer some solace, the removal of promising initiatives leaves a lingering sense of disappointment and concern. As discussions about student debt reform continue, the plight and voices of borrowers will remain a pressing issue that policymakers must not overlook.