The Consumer Financial Protection Bureau (CFPB) has been a cornerstone of financial regulation since its establishment in the aftermath of the 2008 financial crisis. Tasked with safeguarding consumer interests, the agency has faced continuous opposition, especially from banking trade groups that perceive it as overly aggressive. However, recent developments have raised serious doubts about the agency’s future sustainability and operational capabilities. Following an internal memo indicating a move to remote work due to the headquarters being closed until mid-February, employees are left grappling with potential layoffs and administrative uncertainties.

Leadership Shake-Up and Immediate Consequences

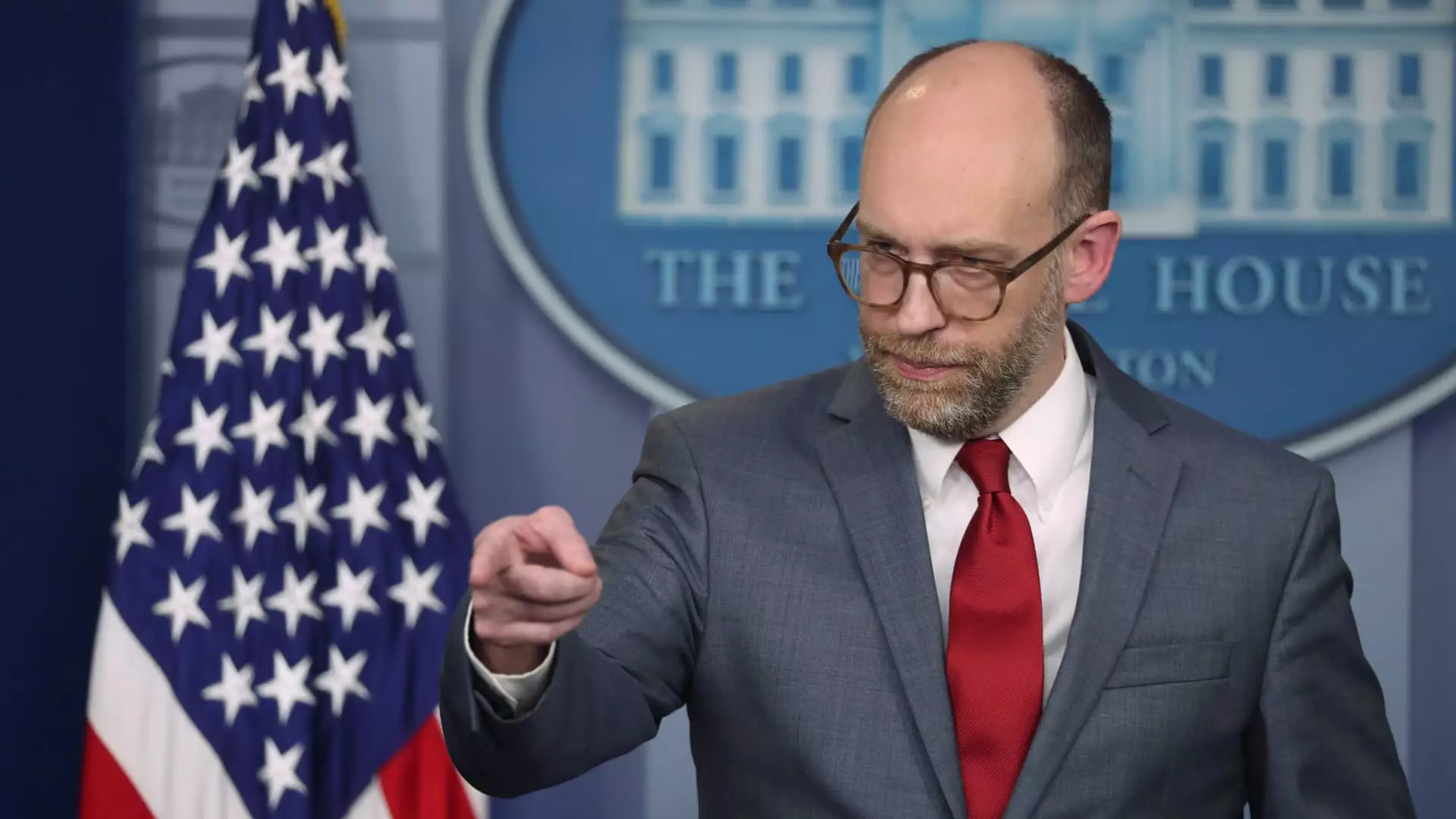

The abrupt transition in leadership—highlighted by Russell Vought assuming the role of acting director—has sent tremors throughout the CFPB. In his first official communication, Vought initiated a freeze on nearly all regulatory activities, including the oversight of financial institutions. This decision mirrors a broader strategy, reminiscent of approaches taken by previous administrations, aimed at diminishing federal agencies’ influence. For CFPB employees, this suspension stirs anxieties about job security, especially considering Vought’s alignment with Project 2025, a conservative initiative focused on dismantling and restructuring federal administrative functions.

The activation of personnel from Elon Musk’s crew—nicknamed the “DOGE team”—has heightened concerns about the dynamic at the CFPB. Reportedly granted access to sensitive information, including performance reviews, these operatives raise questions about the motives behind such access. Musk’s historical antagonism towards the CFPB, recently underscored by his social media post proclaiming “CFPB RIP,” indicates a hostile takeover attempt rather than a constructive shift in policy. The infusion of external operatives adds a layer of complexity that could impair the agency’s mission to protect consumers.

As uncertainty mounts, CFPB employees brace themselves for potential layoffs, echoing strategies previously employed by Trump administration officials aimed at destabilizing federal entities. While the agency employs approximately 1,700 personnel, a minimal subset of these positions is mandatorily required, raising fears of mass layoffs that could undermine the CFPB’s consumer protection objectives. It’s crucial to understand that the CFPB was established to prevent financial institutions from exploiting consumers—a mission that cannot be effectively executed with diminished staff resources.

The implications of staffing cuts extend beyond job loss; they threaten the very fabric of consumer protection initiatives. Several efforts currently on the table have the potential to save Americans billions of dollars—from capping credit card fees to alleviating the burden of medical debt on credit reports. Thus, the risks associated with the agency’s operational breakdown spotlight the delicate balance between maintaining rigorous consumer protections and appeasing financial institutions through regulatory rollbacks.

The tumultuous relationship between the CFPB and financial sectors has been contentious since its inception. Trade groups have historically railed against the agency’s regulations, often advocating for rule overturns through litigation, some even challenging its constitutionality. The current moment seems to represent a confluence of anti-regulatory sentiment aligning with concentrated efforts to diminish or eliminate the CFPB’s influence entirely. If successful, this movement could reverse significant gains made in consumer protections over the past decade.

Historically, initiatives targeting consumer safeguards—such as limiting unjust fees imposed on credit card users—have faced fierce litigation and political opposition, yet they represent critical advancements in consumer rights. In this light, the potential fiscal and regulatory implications of an incapacitated CFPB cannot be underestimated, especially as families reel under the weight of excessive fees and unmanageable debts.

The fate of the CFPB lies at a precarious crossroads. The agency’s future appears increasingly dependent on political maneuvering and shifting power dynamics within the federal government. As employees prepare for a turbulent new chapter marked by layoffs, the question remains: who will advocate for the millions of consumers relying on the CFPB’s protective measures? Advocacy for a stable and robust regulatory framework is essential to prevent a regression in consumer rights. Resolute vigilance from both the public and legislators is necessary to ensure that the benefits earned from stringent consumer protections are not swiftly undone in the face of aggressive political opposition. The agency’s survival is critical, not only for its employees but for the American consumers who depend on its oversight.