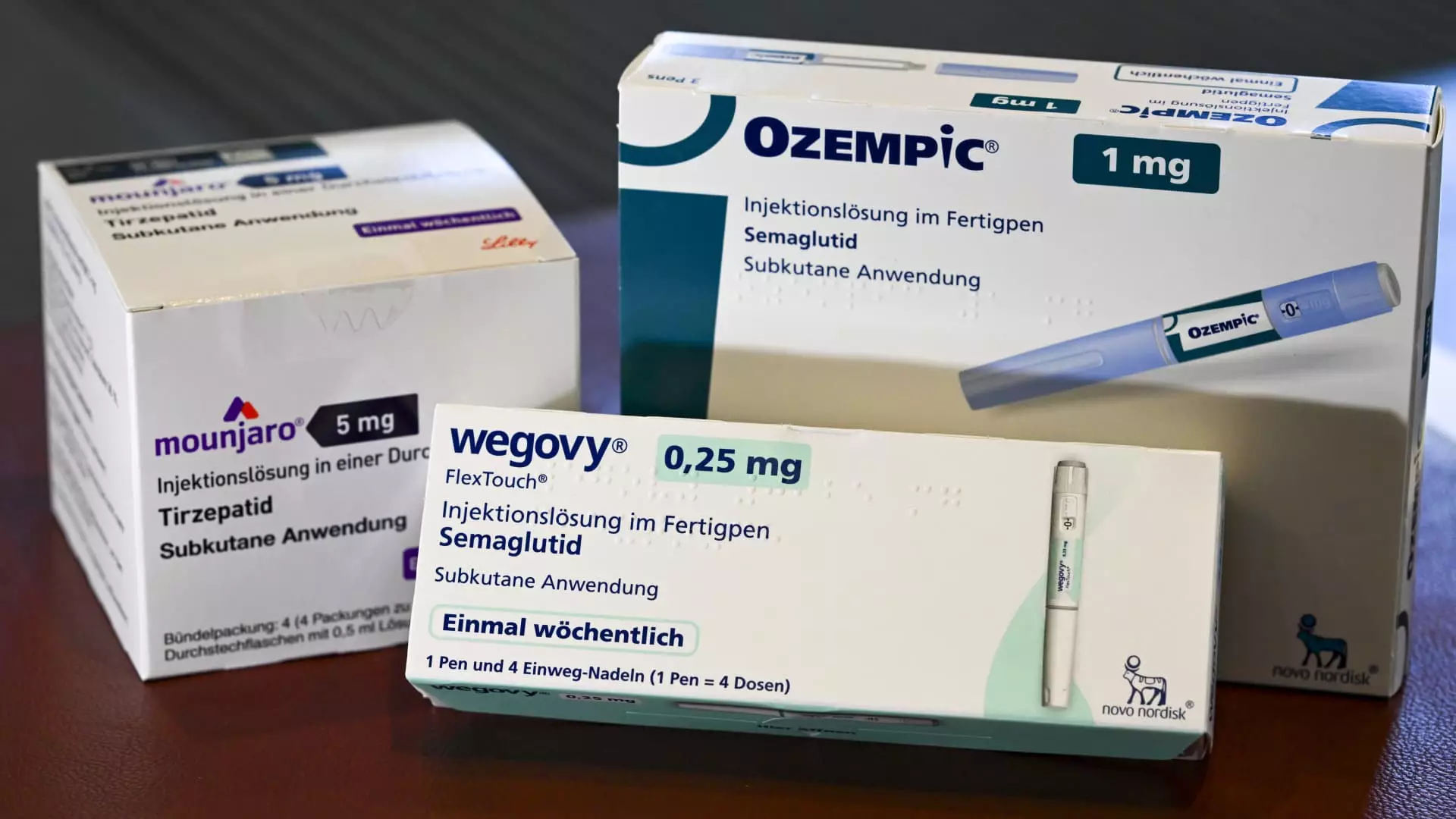

In recent years, the pharmaceutical landscape has witnessed a seismic shift with the rise of GLP-1 medications such as Mounjaro, Ozempic, and Wegovy. These drugs are not only marketed for diabetes management but also promise significant weight loss benefits. However, the increasing demand for these pricey treatments is raising eyebrows among corporate employers grappling with rising health care costs. As the market explodes, a pressing question looms: Are these medicines truly worth the financial burden they impose on businesses and ultimately on employees?

The Costs: Unpacking Upfront Investment

The introduction of GLP-1 medications has come with astonishing sticker prices, often exceeding $1,000 per dose. This hefty price tag is not just a minor inconvenience; it’s a seismic disruption for large employers who are now faced with crushing drug costs. While long-term projections suggest that these medications could lead to improved health outcomes and lower overall medical expenses, the short-term reality is a financial quagmire. Employers are cornered into foot the bill for these medications before any tangible health benefits materialize, leading to skepticism surrounding the feasibility of such investments.

A study by Aon analyzed data from 139,000 U.S. workers between 2022 and 2024, revealing that while initial medical costs may surge due to frequent doctor visits—prompted by underlying health issues related to obesity—the silver lining comes during the deeper treatment timeline. In the first 12 to 15 months, increased healthcare engagement might feel like a punch to the gut for employers. Yet, those who stick with the regimen reportedly see a 7% decrease in overall healthcare expenses by the end of two years, and the most dedicated participants enjoy savings of up to 13%.

The Potential Returns: An Economic Argument

For businesses, the promise of a return on investment (ROI) becomes particularly tantalizing when considering documented health benefits. According to Aon, the reduction in serious cardiac events such as heart attacks and strokes is extraordinary—over 40%. Additionally, a notable decrease in diabetes onset is encouraging news for companies supporting their employees’ health journeys. With the staggering costs associated with cardiovascular events and diabetes management, the financial implications of preventative measures become glaringly clear.

However, it’s not just about the numbers; there’s a moral layer to the narrative. The ethical consideration of investing in employees’ health cannot be overlooked. The notion that companies might benefit financially from subsidizing medications that effectively combat chronic health issues is compelling. Arguments can easily be made for both sides. On the one hand, companies should take proactive measures for employee wellness; on the other, the focus on profitability may lead to a more transactional view of healthcare, emphasizing cost savings over individual wellbeing.

The Long Game: Navigating the Terrain

For companies willing to embrace these innovative treatments, a strategic rollout is critical. Aon has taken proactive steps by implementing a subsidized GLP-1 weight management program for its workforce, complete with virtual wellness visits and home blood tests. This comprehensive approach highlights a burgeoning trend—employers transitioning from a passive role to becoming active participants in their employee’s health journey. Yet, this raises another set of ethical questions: Should employee health increasingly depend on corporate resources?

The conclusion drawn from Aon’s data illustrates a societal shift toward proactive health engagement. However, the reality remains that not all employers can shoulder these costs, leading to a disparity in health equity. When healthcare becomes a privilege of those who work for larger firms offering innovative benefits, what does that mean for small businesses or underprivileged workers? The advent of GLP-1 medications could exacerbate income inequality unless regulations and support systems are implemented to ensure equitable access.

The emergence of GLP-1 drugs has forced a reevaluation of corporate responsibility in healthcare, raising pivotal questions about the intersection of business and wellbeing. While initial costs may seem disheartening, the emerging potential for long-term health improvements and economic returns invites a deeper conversation on the role of employer-sponsored health initiatives. As we stand on the precipice of a healthcare revolution, it’s crucial to tread carefully, ensuring that the focus on profit does not overshadow the genuine necessity for holistic human care.