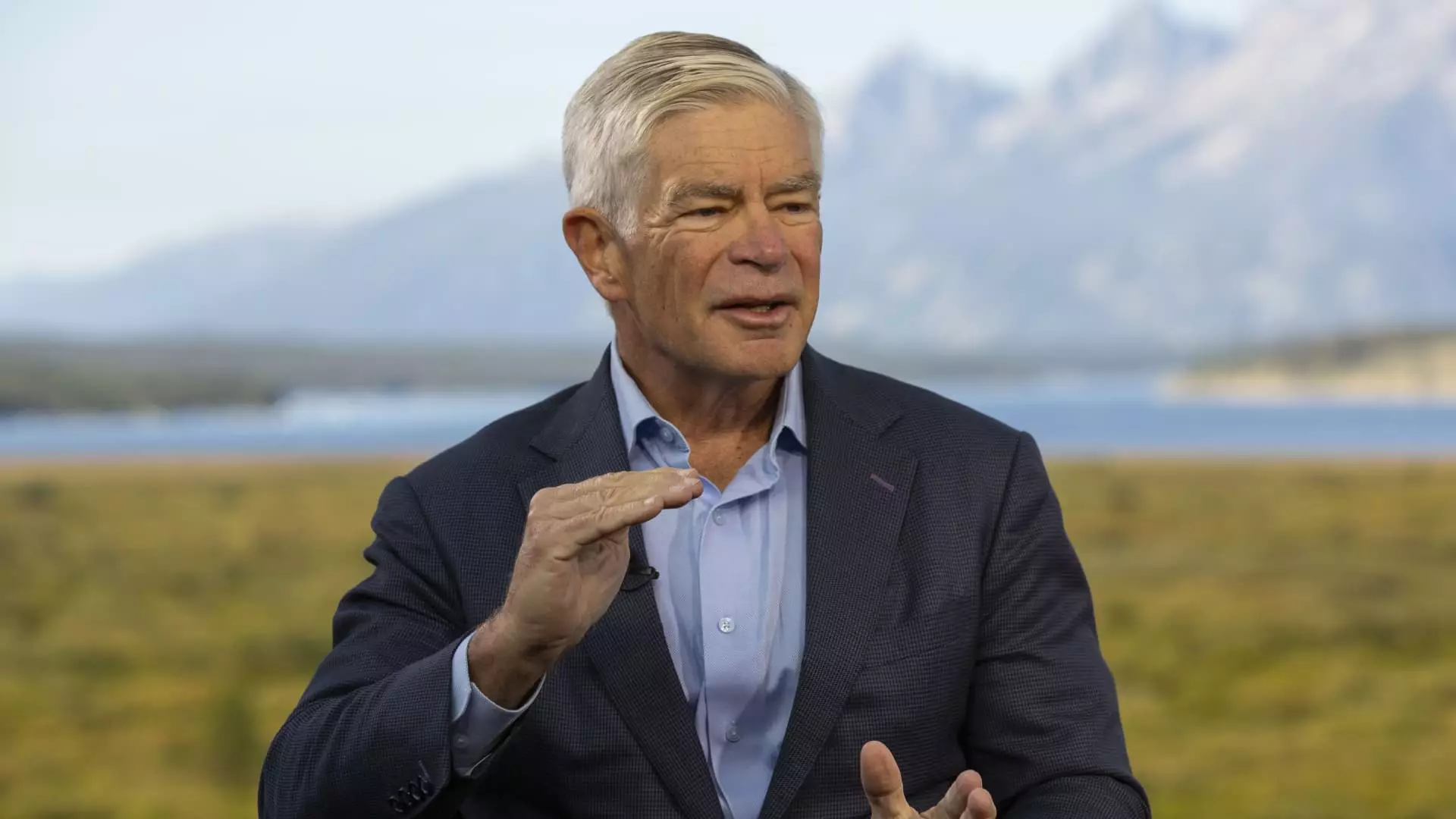

Federal Reserve President Patrick Harker recently made a bold statement supporting an interest rate cut in September. During an interview with CNBC at the Fed’s annual retreat in Jackson Hole, Wyoming, Harker emphasized the need for monetary policy easing in the near future. This stance aligns with the sentiment expressed in minutes from the last Fed policy meeting, indicating a high probability of a cut to address concerns about inflation and potential weaknesses in the labor market.

Harker emphasized the importance of beginning the process of moving rates down in September. He suggested that the Fed should approach easing methodically and provide clear signals well in advance. While market expectations currently lean towards a 25 basis point cut, with some uncertainty about a potential 50 basis point reduction, Harker expressed the need for more data before making a final decision. The Fed has maintained its benchmark borrowing rate for some time as it grapples with persistent inflation challenges.

Amidst growing concerns about the upcoming presidential election, Harker emphasized the Fed’s commitment to making policy decisions based on data rather than political considerations. He highlighted the role of Fed officials as proud technocrats tasked with responding appropriately to economic indicators. Harker’s position reflects a commitment to maintaining the independence and integrity of the Federal Reserve in the face of external pressures.

In a separate interview, Kansas City Fed President Jeffrey Schmid shared his perspective on the potential for a rate cut. While offering a more nuanced view than Harker, Schmid indicated a leaning towards easing policies in the near future. He cited the rising unemployment rate as a key factor influencing the direction of monetary policy. The labor market dynamics, which previously contributed to inflation pressures, have shown signs of cooling in recent months.

Schmid acknowledged the challenges facing the labor market but expressed confidence in the resilience of banks under the current high-rate environment. He dismissed concerns about monetary policy being overly restrictive, suggesting that there is room for adjustments to support economic growth. While not directly involved in the rate-setting committee this year, Schmid’s insights provide valuable perspectives on the evolving economic landscape.

Looking ahead, both Harker and Schmid’s comments offer insights into the potential trajectory of Fed policies. While short-term considerations such as interest rate cuts dominate the current discussions, the broader economic context and labor market dynamics will continue to inform future decisions. As the Fed navigates the complex interplay of economic indicators and external pressures, maintaining a data-driven approach remains crucial in ensuring stability and growth in the economy.