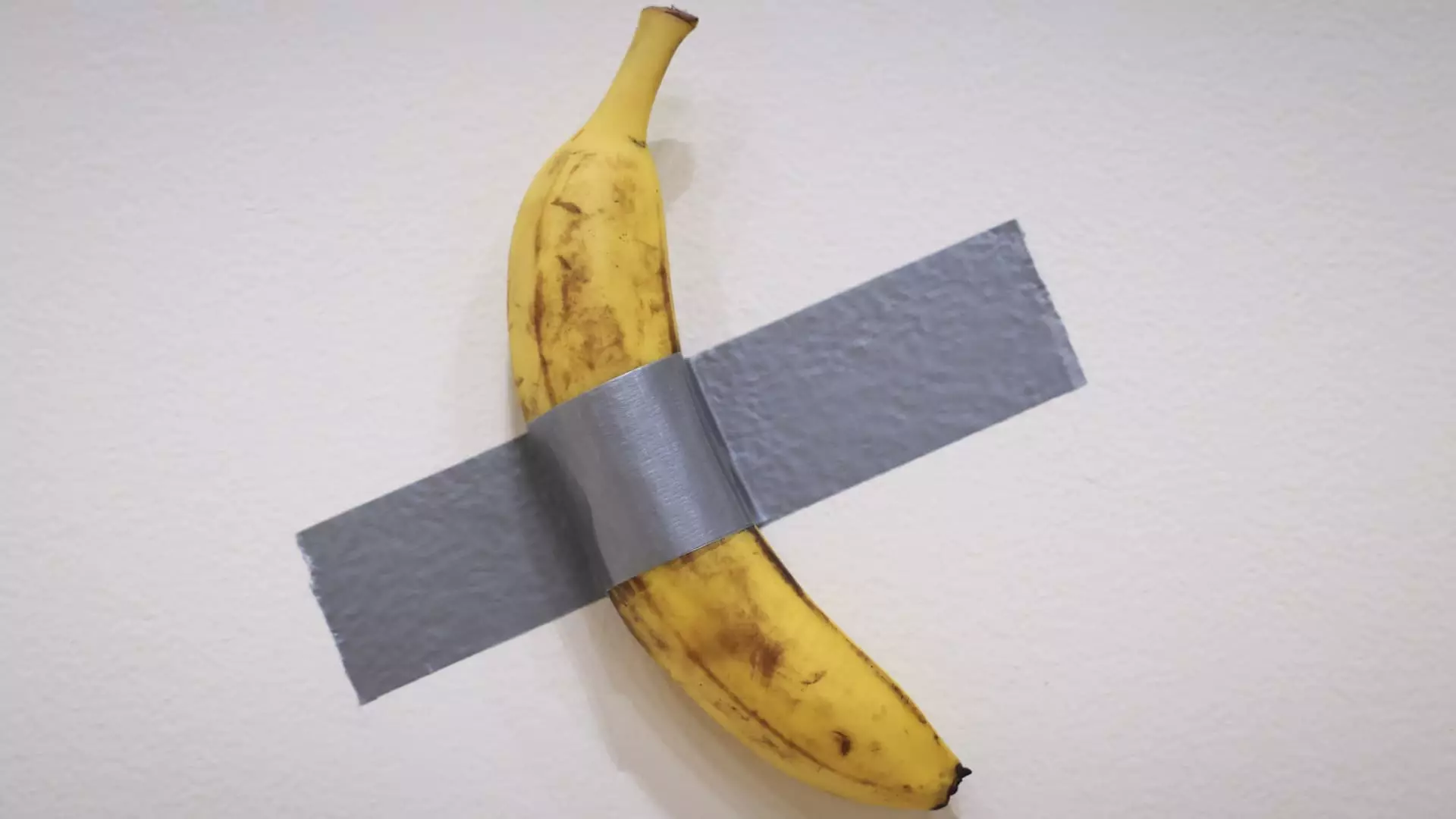

The recent auction of Maurizio Cattelan’s provocative piece, “Comedian,” has brought the worlds of contemporary art and cryptocurrency to the forefront of public discourse. The sale, which saw crypto investor Justin Sun paying a staggering $6.2 million for a banana duct-taped to a wall, exemplifies the modern marriage of art, culture, and digital currency. This transaction not only highlights the appreciation for unconventional art forms but also showcases how cultural phenomena can dramatically inflate the perceived value of such artworks.

The banana artwork first captured the public’s imagination at Art Basel Miami Beach in 2019, where it made waves for its humorous yet pointed commentary on consumerism and the nature of art itself. Originally priced at $120,000, it struck a chord among collectors and critics alike, leading to its viral status across social media platforms. Its success is emblematic of how art can transcend its physical form, sparking dialogue and intrigue that extends far beyond the gallery walls.

Cattelan’s intent seems to involve a cheeky critique of the art market and the commodification of art. The absurdity of paying a hefty sum for a piece that could disintegrate at any moment poses essential questions regarding the value of art. In an era where memes and digital representation often interface with tangible artistic expressions, “Comedian” represents a shift in how we perceive authenticity, ownership, and artistic value.

Justin Sun, founder of the cryptocurrency platform Tron, has long been a figure linked with high-stakes investments in the digital space. His willingness to pay $6.2 million in cryptocurrency further cements the growing trend of using digital assets in traditional marketplaces. For Sun, acquiring “Comedian” transcended mere ownership; it became a statement on the intersectionality of art and cryptocurrencies.

His rationale behind the purchase, as he noted, was the potential for the piece to serve as a cultural artifact that bridges the gap between memes, art, and digital currencies. In this context, the piece is more than just a banana; it transforms into a cipher through which discussions of value, authenticity, and the evolving nature of art can be explored. His intention to eat the banana further provokes questions about preservation, consumption, and what it means to truly encounter a work of art.

The auction, part of Sotheby’s broader collection featuring over $1 billion worth of artwork, serves as an indicator of a noteworthily strong rebound in the art market. After experiencing declines over the past two years, auction results signal renewed enthusiasm among wealthy collectors, likely spurred by a recovering stock market and the unpredictable economic climate that follows major elections.

Significantly, the infusion of cryptocurrency into such transactions seems to invigorate an already dynamic market. Other noteworthy sales—such as a Monet water lilies painting going for $65.5 million and a Rene Magritte piece fetching $121 million—reinforce the notion that the appetite for art remains insatiable among high-net-worth individuals.

As the lines continue to blur between traditional and digital expressions in the art world, the implications for collectors and investors are profound. Assets like NFTs have already begun to shift how value is perceived, and Sun’s purchase of Cattelan’s banana underscores a budding movement wherein provenance and cultural relevance may supersede the tangible aspect of the artworks themselves.

The fusion of art, culture, and cryptocurrency invites a broader, ever-evolving discussion regarding the constructs of ownership in a rapidly digitalized world. As collectors experiment with alternative forms of currency and unconventional artworks, we may be witnessing the dawn of an era where what constitutes “art” is continually redefined—provoking ongoing dialogue and potentially inspiring a new generation of artists and collectors alike.

Justin Sun’s purchase of the banana art piece encapsulates more than just an extravagant expenditure; it reflects a cultural moment that merges the absurd with investment and prompts essential conversations regarding value, ownership, and authenticity in the digital age.