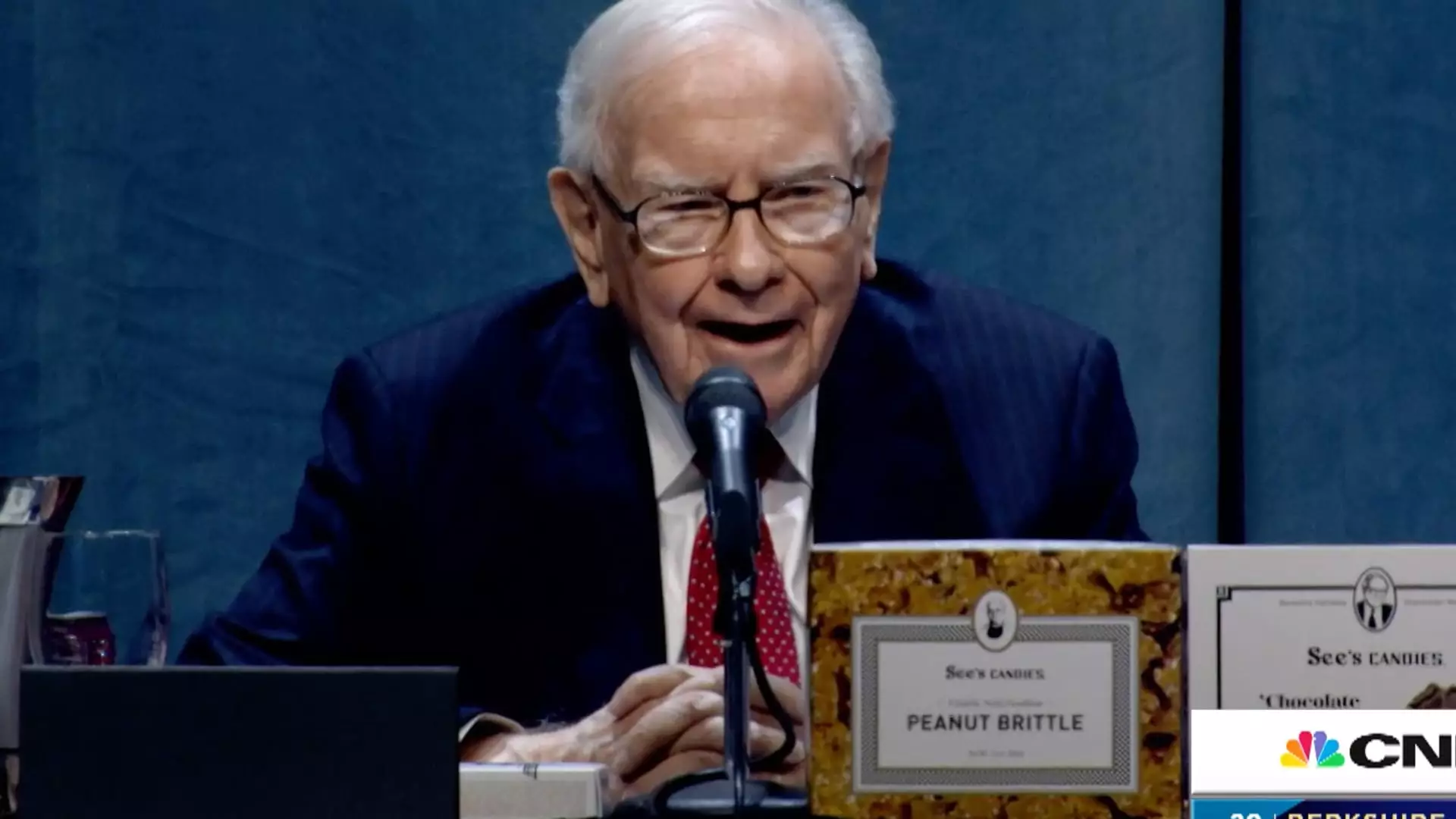

In a rare reveal of his views on the subject of tariffs, legendary investor Warren Buffett illuminated the potential economic repercussions instigated by punitive trade measures. During an interview with CBS, Buffalo addressed the tariffs imposed by President Donald Trump, suggesting that they may lead to inflationary pressures and negatively impact consumers. The insights he provided—drawing on extensive experience through his conglomerate, Berkshire Hathaway—underscore a critical concern regarding the interconnectedness of global trade and local economies.

Buffett’s metaphorical framing of tariffs as “an act of war” highlights the severity with which he perceives trade barriers. His remarks are not merely casual commentary; they reflect a deeper understanding of economic implications that such policies can engender. “Over time, they are a tax on goods. I mean, the Tooth Fairy doesn’t pay ‘em!” Buffett remarked humorously, emphasizing that ultimately, the burden of tariffs falls on consumers who pay higher prices for goods. This notion of tariffs as indirect taxes reminds us of the need to equip ourselves with an understanding of economic fundamentals.

The Current Economic Landscape

During the interview, Buffett’s reluctance to express direct opinions regarding the current economic state is telling. While he recognizes the intricacies of economic dynamics, his caution reflects a broader uncertainty that investors are currently grappling with. Economic models are fraught with unpredictability, especially amid rapid shifts in policy and market sentiment. Buffett’s comment encapsulated this uncertainty, “I think that’s the most interesting subject in the world, but I won’t talk, I can’t talk about it, though.”

Since the onset of tariffs, market fluctuations have intensified. Investors have observed Buffett’s own transition toward a more conservative strategy—marked by the divestiture of stocks and a significant accumulation of cash reserves. This pivot is indicative of a cautious outlook not just from Buffett, but evidently across the investment community. While some analysts view these moves as a bearish signal, others interpret this as a strategic positioning by Buffett for his eventual successor, preparing the company for future challenges rather than signaling despair.

Market Reactions and Investor Sentiment

The repercussions of Trump’s trade policies extend beyond Buffett’s thoughts; they reverberate throughout financial markets, affecting stock valuations and investor sentiment. The recent uptick in market volatility can largely be attributed to a combination of trade tensions, changes in policy, and the current socioeconomic environment. Presently, the S&P 500 indexes have shown minimal gains, reflecting hesitance among investors and concerns regarding sustained economic growth.

The complexities of trade and tariffs necessitate serious attention as their effects unravel across different sectors of the economy. As investors look ahead, the uncertainty surrounding tariffs and trade policy calls for vigilance and thoughtful strategy. Buffett’s insights serve as a reminder of the need for informed decision-making in the face of fluctuating economic conditions, especially as consumers and investors alike bear the weight of these decisions. The future remains uncertain, but discussions led by seasoned investors like Buffett will continue to shape our understanding of these critical economic dialogues.