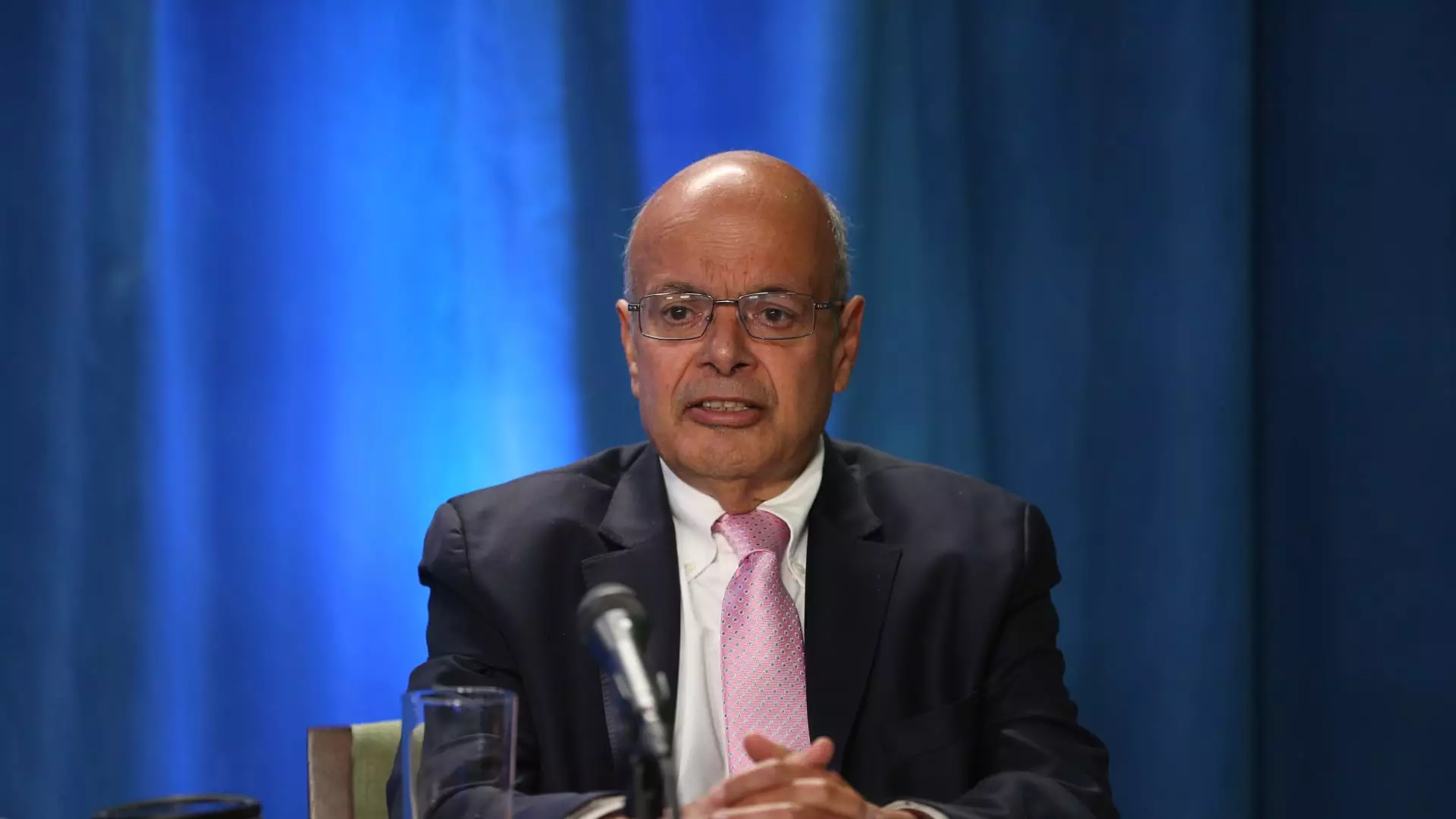

In a surprising move that has raised eyebrows in investment circles, Ajit Jain, the esteemed vice chairman of insurance operations at Berkshire Hathaway, has divested over half of his stake in the company. A recent regulatory filing revealed that Jain sold 200 shares of Berkshire Class A stock for an impressive average price of $695,418 per share, totaling around $139 million. This strategic realignment has left him with merely 61 shares, while family trusts and his nonprofit foundation continue to hold a collective stake of 105 shares. Notably, this decision marks the most considerable reduction in Jain’s holdings since his long tenure at Berkshire began in 1986, positioning it as a potentially pivotal moment for the company and its investors.

Although the precise reasons for Jain’s decision remain unclear, one hypothesis is that he capitalized on Berkshire’s recent surge in stock price, which has fluctuated around $700,000 per share, contributing to the company’s remarkable $1 trillion market capitalization by the end of August. According to David Kass, a finance professor at the University of Maryland, the sale potentially signals Jain’s perception of Berkshire being at a valuation peak. The diminishing pace of share repurchases by Berkshire further underscores this sentiment; reports show that the company bought back merely $345 million of its equity in the second quarter—a stark contrast to the staggering $2 billion repurchased in each of the preceding quarters. These trends may indicate that Jain considers Berkshire’s stock overvalued, leading to strategic reevaluations in both personal and corporate financial frameworks.

The timing of Jain’s share reduction undeniably evokes discussions among shareholders and analysts regarding Berkshire Hathaway’s future stock performance. Bill Stone, Chief Investment Officer at Glenview Trust Co., resonates with the notion that the stock is fundamentally constrained in its growth potential, where it currently trades at over 1.6 times its book value. Stone suggests that investors should not anticipate any substantial stock repurchases from Berkshire given the prevailing price levels, reinforcing the idea that Jain’s actions reflect broader market conditions and internal company assessments of value.

Ajit Jain’s legacy at Berkshire Hathaway is significant; he has been instrumental in steering the conglomerate into profitable avenues, including a strategic emphasis on the reinsurance sector and revitalizing Geico’s operations. Warren Buffett, the company’s revered CEO, has lauded Jain’s contributions, stating in his 2017 letter that Jain has delivered tens of billions in value to shareholders. This track record of success adds weight to the scrutiny of his current decisions, as shareholders contemplate the implications of his reduced stake.

With whispers of succession plans that place Greg Abel as the potential successor to Buffett, understanding Jain’s motivations becomes all the more critical. While speculation has historically centered around a competition between Jain and Abel for the future leadership of Berkshire, Buffett has publicly clarified that Jain has no desire to lead the company. This affirmation helps dispel doubts but simultaneously invites scrutiny into what Jain’s substantial stake reduction means within the broader context of leadership transitions.

As Berkshire Hathaway navigates a new chapter of its existence, the decisions made by its key executives, especially stalwarts like Jain, are vital to understanding how the corporation will perform and adapt. Stakeholder confidence may hinge upon interpreting these actions not only as reactions to market conditions but as reflections of an evolving corporate strategy influenced by lasting leadership values.

Ajit Jain’s recent share sale encapsulates a critical moment for Berkshire Hathaway, both from an individual perspective and a broader corporate standpoint. As stakeholders digest the implications, questions arise regarding market valuation and internal strategy at the conglomerate. Ultimately, as Berkshire enters an era ahead of Buffett’s eventual retirement, the consequences of Jain’s decisions will resound through the ranks of shareholders, who simultaneously balance the legacy of past successes against a landscape that is continuously reshaped by market movements, leadership shifts, and valuation challenges. The unfolding narrative at Berkshire represents not just a financial transaction, but a pivotal moment that could signal shifts in strategy, confidence, and direction for one of the world’s most renowned conglomerates.