Recent years have shown a significant dominance of a few large companies in the U.S. stock market. The concentration of the market raises concerns among experts about whether this trend exposes investors to higher risks. This is evident in the S&P 500, the key benchmark for U.S. stocks, where the top 10 companies by market capitalization accounted for 27% of the index’s value by the end of 2023. This marked a substantial increase from the 14% share they held a decade earlier. The rapid rate of concentration growth, the most significant since 1950, has raised alarms among analysts.

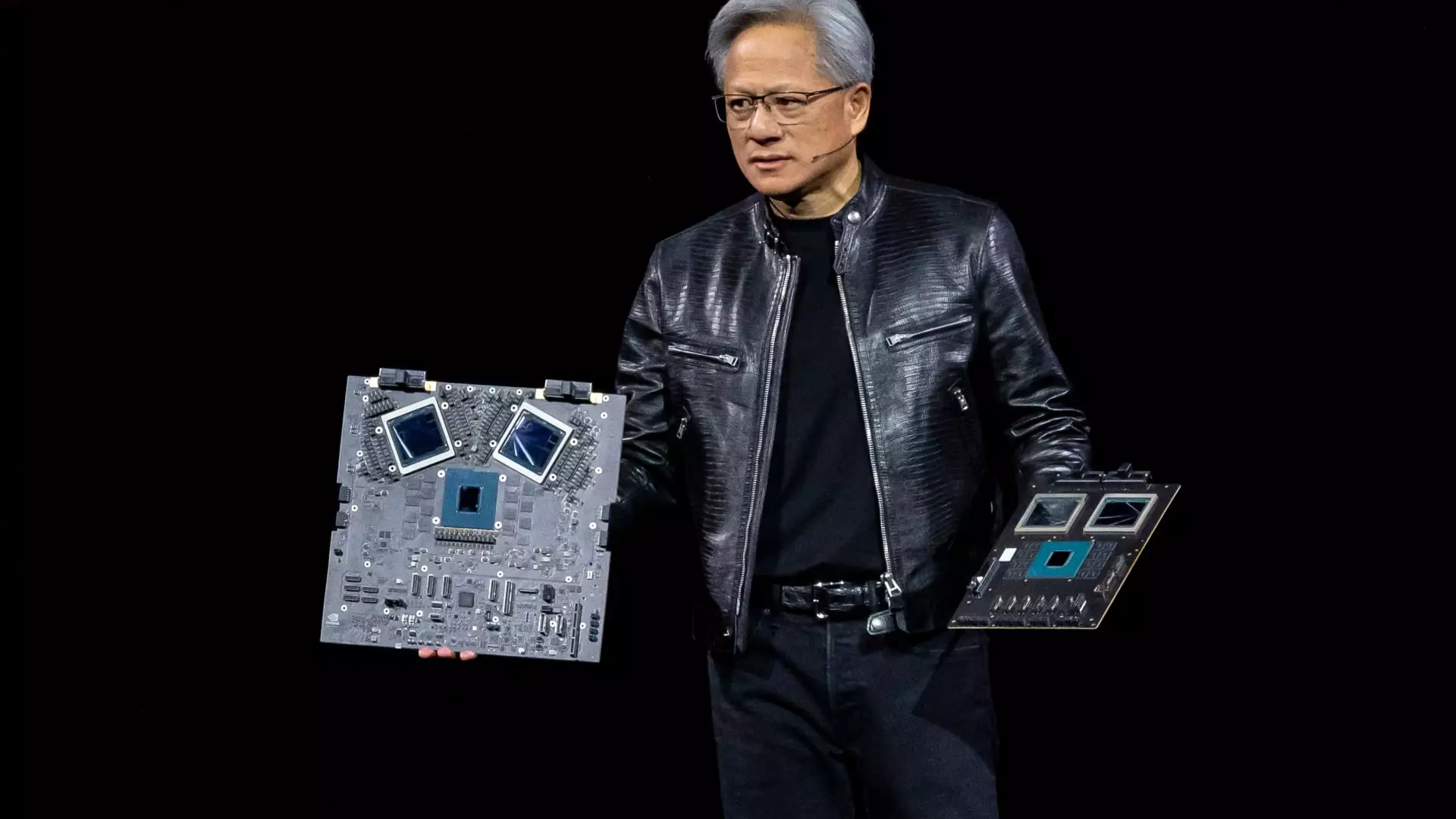

Seven tech giants, including Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla, made up approximately 31% of the S&P 500’s value, further highlighting the concentration at the top. The outsized influence of these companies on the overall market performance has caused unease among investors. For instance, in 2023, the Magnificent Seven stocks were responsible for more than half of the S&P 500’s gains. However, the downside is equally stark, as seen when Nvidia’s stock plummeted, affecting the entire index and sending ripples through the market.

Financial experts like Charlie Fitzgerald III caution against the risks associated with market concentration. With nearly a third of the S&P 500’s value tied up in just seven stocks, diversification becomes a key concern. A lack of diversification could expose investors to significant vulnerabilities, especially if a market downturn affects these large companies simultaneously. The S&P 500’s structure, based on market capitalization, exacerbates the concentration, particularly with the surge in tech stocks’ prices.

While the concerns around stock market concentration are valid, some market experts believe the fears may be exaggerated. Data indicating that the U.S. market is more diversified compared to historical and global standards offer a contrasting view. The lessons from past market crashes, where stock concentration did not necessarily cause the downturns, provide a sense of reassurance. Moreover, the profitability of the current market leaders and the quality of their earnings suggest that the elevated valuations are sustainable in the present economic landscape.

Strategies for Mitigating Risks

Diversification remains a crucial strategy for investors looking to navigate the challenges of a concentrated market. By including a mix of large, mid-sized, and small U.S. companies, as well as foreign equities and real estate, investors can spread their risk across different asset classes. Target-date funds, which automatically adjust the asset allocation based on the investor’s age, offer a simple and effective way to achieve diversification. Incorporating such funds into a well-balanced portfolio can help mitigate the risks associated with market concentration.

The increasing concentration of the U.S. stock market poses both risks and opportunities for investors. While the dominance of a few large companies raises concerns about overexposure and lack of diversification, historical data and expert opinions provide a nuanced perspective on the situation. By adopting smart investment strategies, staying informed about market trends, and maintaining a well-diversified portfolio, investors can navigate the challenges presented by a concentrated market and position themselves for long-term financial success.