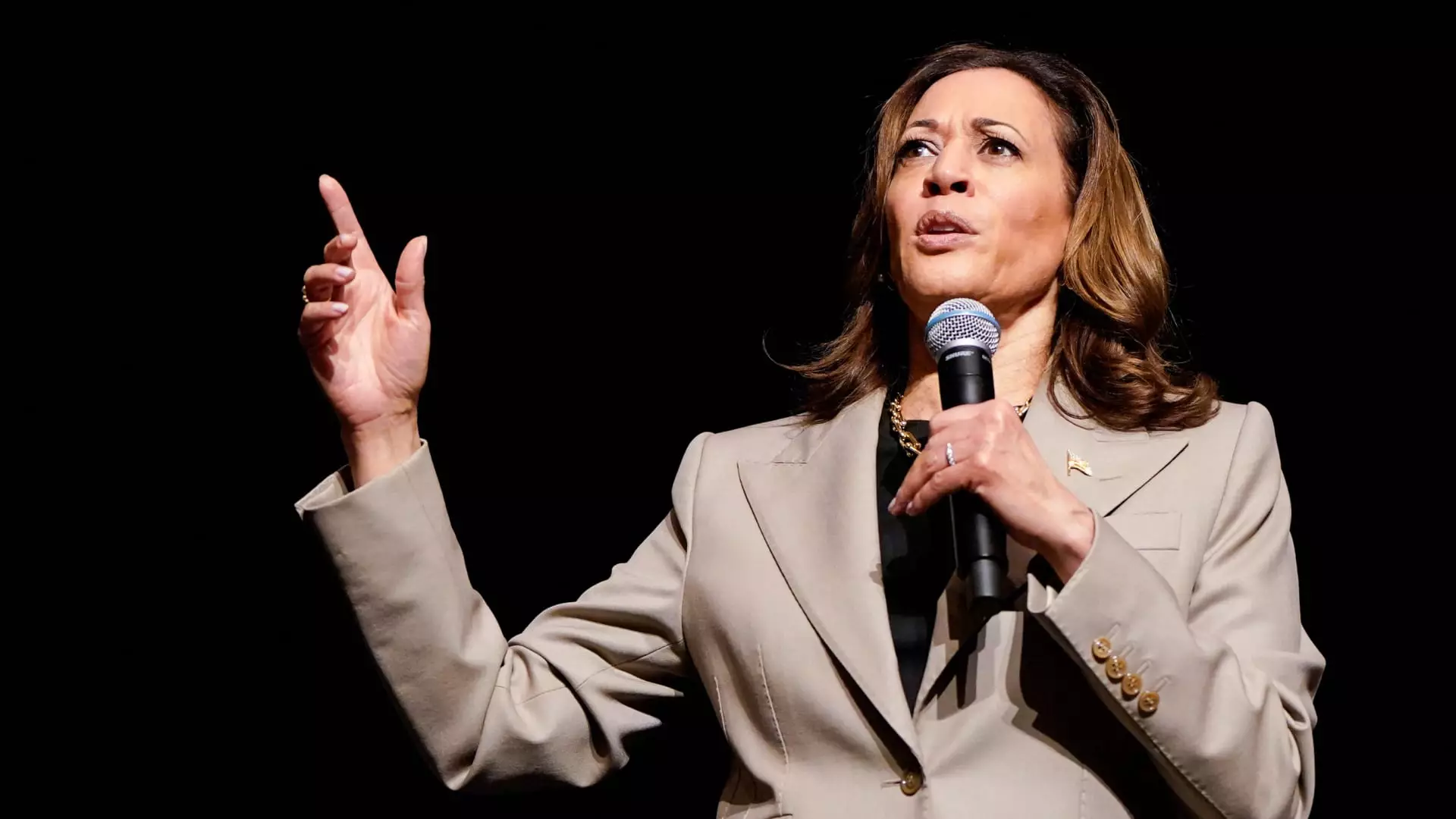

Vice President Kamala Harris recently unveiled an economic plan that includes an expanded child tax credit worth up to $6,000 in total tax relief for families with newborn children. This proposal aims to restore the higher child tax credit that was enacted through the American Rescue Plan in 2021, providing significant financial support to families in need.

The proposed tax break by Harris would offer increased benefits to middle- to lower-income families for the first year after a child is born. With a focus on providing $6,000 in tax relief during the initial year of a child’s life, this plan aims to alleviate financial burdens for new parents and support them during a critical time.

Comparison to JD Vance’s Proposal

This proposed child tax credit expansion follows in the footsteps of other politicians, such as Sen. JD Vance, who suggested a $5,000 child tax credit. The inclusion of a $2,400 bonus for newborns is seen as a unique and somewhat surprising addition, possibly in response to Vance’s proposal. This demonstrates a trend towards increasing support for families through tax credits.

While Senate Republicans previously blocked an expanded child tax credit, there is growing bipartisan momentum behind the idea of increasing support for families. The size and design of future tax credits will likely depend on which party controls the White House and Congress, but there is potential for collaboration on this issue.

Expanding the child tax credit, whether to $3,000 or $6,000, comes with significant financial implications. Lawmakers are already facing challenges with trillions in expiring tax cuts, making it crucial to weigh the costs and benefits of such proposals. The estimated costs of these expansions highlight the need for careful consideration and fiscal responsibility.

Kamala Harris’ proposed child tax credit expansion has the potential to provide crucial support to families in need, particularly during the early years of a child’s life. With a focus on fiscal responsibility and balancing financial considerations, this plan represents a step towards alleviating economic challenges faced by many American families. It will be interesting to see how this proposal progresses and whether it garners bipartisan support in the future.