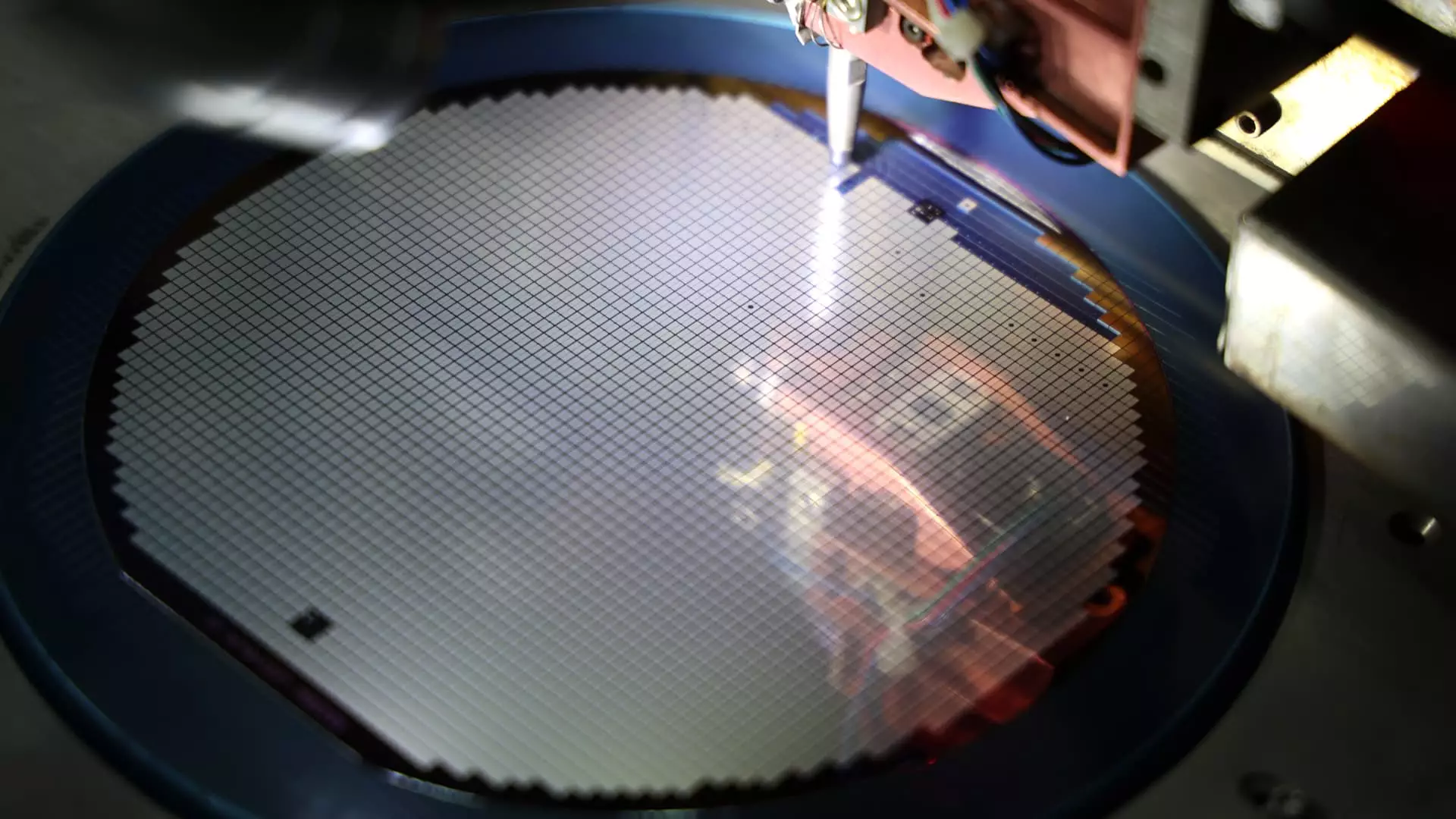

In a recent report by Bank of America analysts, it was revealed that four of the world’s largest semiconductor equipment manufacturers, such as ASML, have experienced a significant increase in their China revenue since late 2022. The report highlighted that China has ramped up its purchases of semiconductor manufacturing equipment in response to tighter export restrictions imposed by the U.S. in October 2022. This surge in purchasing is part of China’s strategy to boost its own semiconductor manufacturing capabilities.

According to the analysis conducted by BofA, companies like Lam Research, KLA Corp., and Applied Materials have witnessed a substantial growth in their China revenue. The share of China revenue for these companies more than doubled from 17% in the fourth quarter of 2022 to 41% in the first quarter of 2024. This sharp increase underscores the growing importance of the Chinese market for global semiconductor equipment manufacturers.

Trade Tensions and Market Risk

The report also emphasized the pivotal role of technology, particularly the semiconductor industry, in the ongoing trade tensions between the U.S. and China. The escalating tensions pose a significant risk to tech companies, especially if export restrictions become even tighter in the future. With recognized this risk when it began imposing export controls on advanced semiconductors and related equipment sales to China in October 2022. The potential for even broader restrictions on semiconductor equipment exports to China under the Biden administration further underscores the precarious nature of the current market environment.

While the U.S. is tightening export controls, China is actively working to enhance its tech self-sufficiency. Chinese leaders have reiterated this goal in recent policy meetings, signaling their commitment to reducing back domestic technology capabilities. This drive for self-sufficiency aligns with China’s broader strategic objectives to reduce reliance on foreign technology and bolster its own innovation ecosystem.

Despite the uncertainties stemming from trade tensions and export restrictions, the overall market performance of semiconductor companies remains positive. The VanEck Semiconductor ETF (SMH), which tracks U.S.-listed chip companies, has shown resilience in the face of recent challenges. While the ETF has experienced a slight decline in the past week, it still maintains significant gains of nearly 46% for the year so far. This performance reflects the underlying strength and growth potential of the semiconductor industry, even in the midst of geopolitical uncertainties.

China’s increasing semiconductor equipment revenue has significant implications for the global market. As China asserts its position as a key player in the technologies and semiconductor industries, companies and investors must navigate through the changing landscape of trade tensions and market dynamics to capitalize on emerging opportunities and mitigate potential risks.