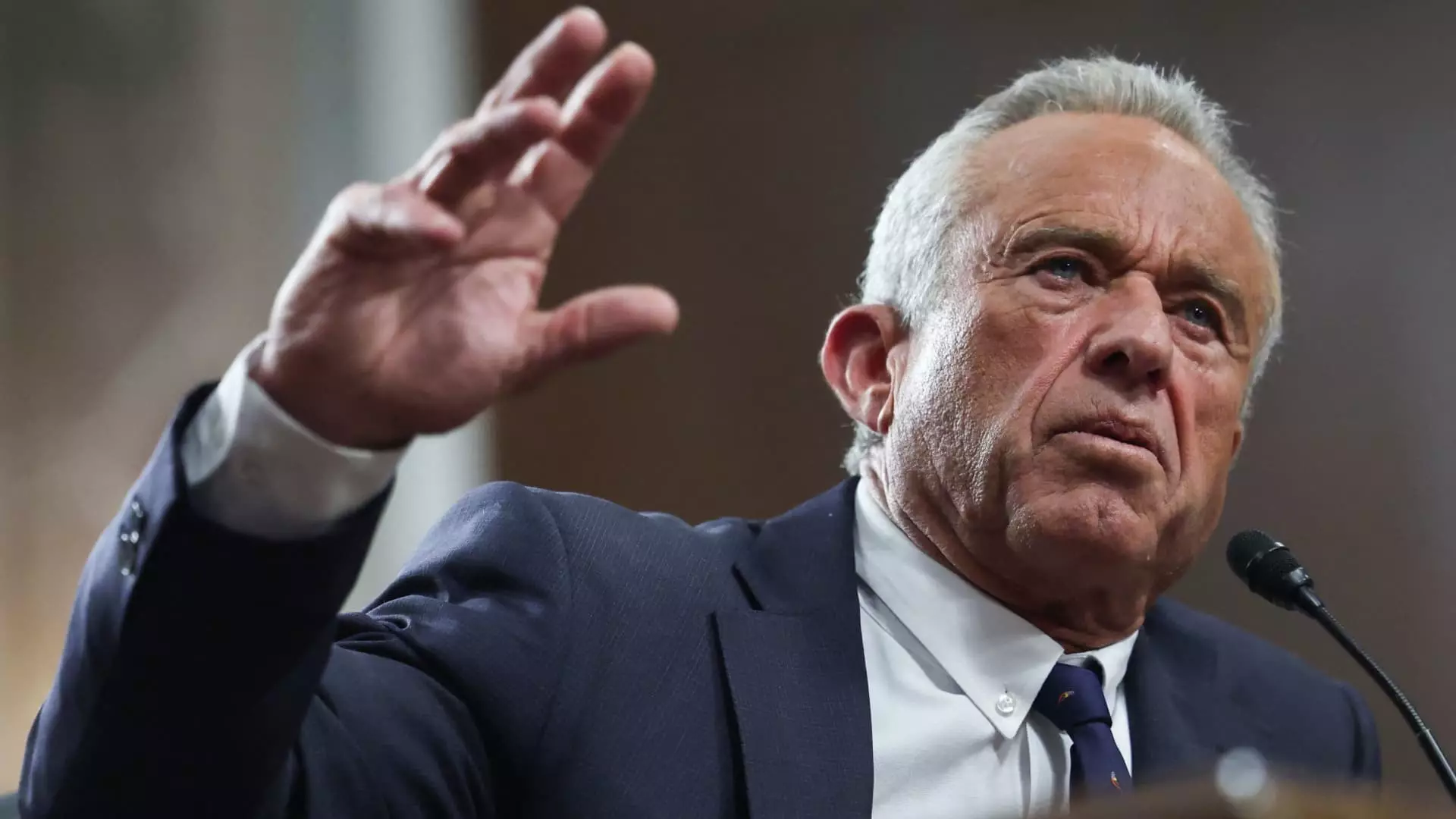

In an alarming trend, credit card balances in the United States have reached a staggering $1.17 trillion in 2024. This statistic is particularly concerning as it reflects a broader pattern that spans across income levels, affecting even the wealthiest individuals. A notable example is Robert F. Kennedy, Jr., who recently disclosed debts of up to $1.2 million on his credit cards. Such a figure raises critical questions about financial management, debt strategy, and the implications of high-interest credit lines in today’s economic climate.

Kennedy, who has been nominated by former President Donald Trump for the role of health and human services secretary, showcases an extraordinary case where personal finance becomes a public spectacle. His reported credit card debt, with interest rates hovering between 23.24% and 23.49%, is not merely a reflection of his spending habits but also offers insights into the broader economic pressures affecting consumers. Financial analysts note that such high balances are exceedingly rare and indicative of systemic issues that require deeper examination.

The pressures exerted by inflation present a unique challenge for both high-income and low-income households. Analysts highlight that persistent inflation has drastically minimized financial flexibility, forcing many to rely on credit as a makeshift emergency fund. Matt Schulz, chief credit analyst at LendingTree, emphasizes this point by stating that significant price increases over recent years have compelled many Americans to lean on credit cards more heavily than in the past.

While it might be easy for some to regard credit cards as tools for convenience or emergency, the reality is that they can spiral into a burden. Experts caution against viewing credit cards as savings, as their functions inherently differ. The rising debt figures serve as a stark reminder that reliance on credit cards can be detrimental to financial health, particularly when high-interest rates remain a constant.

The financial implications of carrying such hefty credit card balances are far-reaching. If Kennedy were to tackle his lower estimated balance of $610,000 by paying $50,000 monthly, it would take approximately 15 months to eliminate the debt, accruing around $93,000 in interest. In contrast, if he were to pay down a total debt of $1.2 million at the same monthly rate, he would remain in debt for 33 months, incurring nearly $434,000 in interest over time. These figures illustrate the eye-watering costs associated with prolonged credit card debt, necessitating a strategic approach to debt elimination.

Financial experts universally advise that prioritizing debt repayment over other financial goals—such as investments or savings—is crucial, especially with soaring interest rates. Ted Rossman, a senior analyst at Bankrate, asserts that paying down credit card debt could yield a “guaranteed risk-free, tax-free return,” an opportunity not readily found in many investment avenues today.

Interestingly, higher-income individuals demonstrate a propensity for long-term credit card debt more than their lower-income counterparts. Statistics reveal that a staggering 59% of borrowers earning over $100,000 have maintained credit card debt for more than a year, with 24% having carried such debt for five years or more. This troubling trend suggests that high credit limits, while enticing, can lead to financial overreach.

Charlie Douglas, a financial planner working with ultra-high-net-worth families, notes that wealthy borrowers often exploit credit card rewards and perks, such as those associated with the exclusive American Express Centurion Card. However, he argues that leveraging credit responsibly is vital. Establishing lines of credit without ongoing costs or maintaining a liquidity buffer of cash equivalent to one year’s expenses can serve as a more effective fiscal strategy for the affluent.

As the economy fluctuates and the average debt per credit card borrower hovers around $6,380 as of the third quarter of 2024, it is imperative for consumers to reevaluate their financial strategies. With the average credit card interest rate at an alarming 20.13%, individuals must make educated decisions to mitigate debt accumulation.

The case of Robert F. Kennedy, Jr. serves as a reminder that regardless of income level, individuals must engage in strategic financial planning to avoid the pitfalls of excessive credit card debt. By prioritizing debt repayment and utilizing alternative financing options, consumers can safeguard their financial futures against the creeping effects of mounting interest and economic strain.