Penn Entertainment has recently announced plans to lay off approximately 100 employees in order to focus on growth for ESPN Bet. This decision was communicated by CEO Jay Snowden in an internal email to staff members. The move is aimed at enhancing operational efficiencies following the company’s acquisition of theScore, a Canadian media and gaming powerhouse, in 2021. With a workforce of around 20,000 employees, Penn Entertainment is looking to streamline its operations and pave the way for future growth.

Snowden highlighted in the memo that the acquisition of theScore prompted the company to prioritize the build-out of its proprietary tech stack and the migration of its sportsbook to theScore’s platform. This phase of transition resulted in a temporary delay in implementing organizational changes that typically accompany a major acquisition. However, Penn Entertainment is now gearing up for a new phase of growth, particularly in its interactive business segment, which includes the ESPN Bet brand.

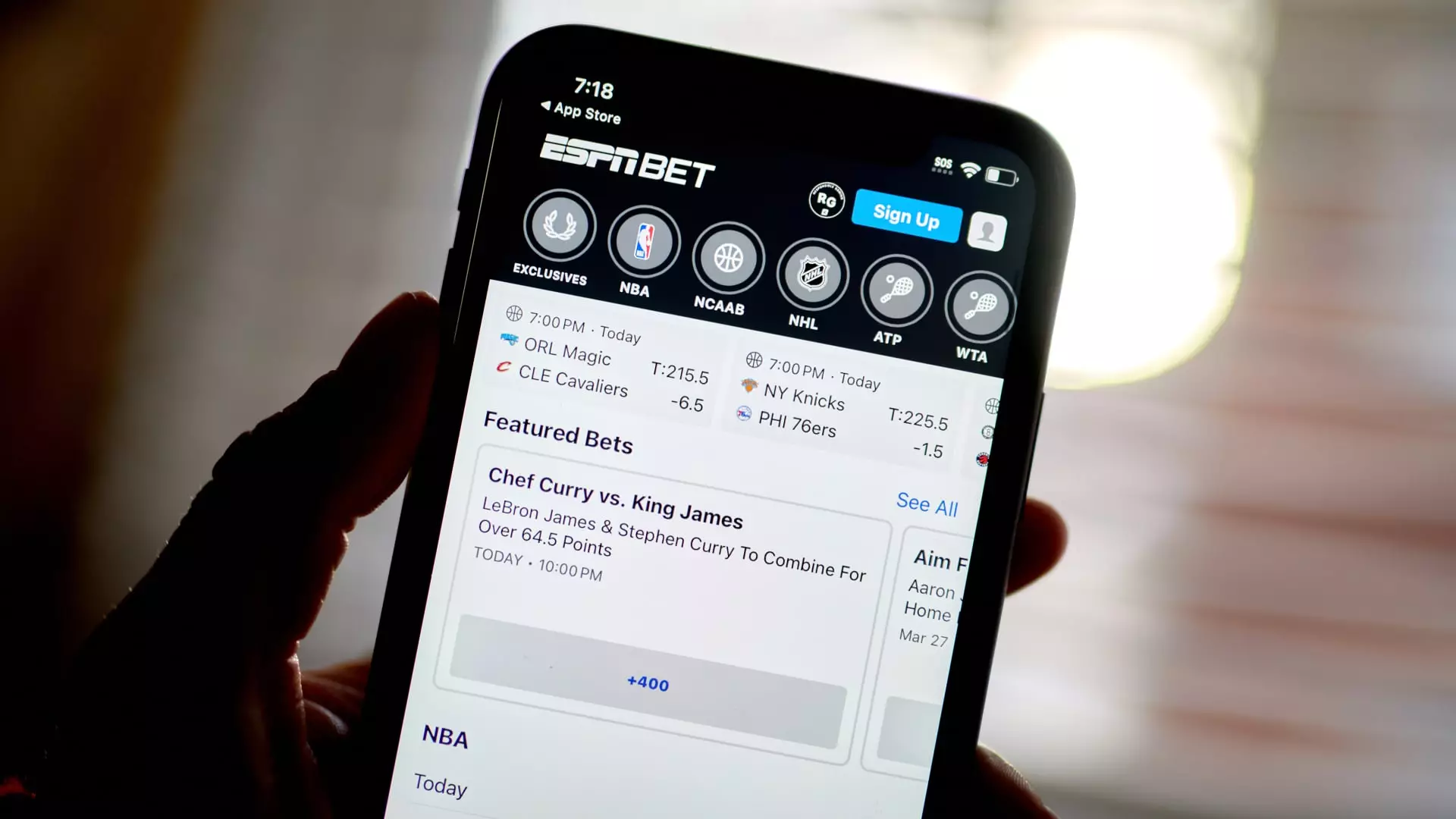

The company’s initiatives moving forward will focus on product enhancements and deeper integration into ESPN’s ecosystem. The $2 billion branding partnership with Disney’s ESPN is a key component of Penn Entertainment’s growth strategy. Despite pressure from investors to demonstrate the potential of the rebranded sportsbook, the company remains committed to its vision. Speculation about potential interest from other gaming and casino companies remains in the air, but Truist gaming analyst Barry Jonas believes that a sale in the near term is unlikely due to the complexities involved in such a transaction.

Penn Entertainment faces challenges in meeting investor expectations, as evidenced by a 25% decline in share value year to date. The company has failed to meet earnings projections in the last two quarters and has revised its guidance downward. There is a sense of anticipation among investors regarding the success of ESPN Bet and the additional investments required to achieve desired results. Despite the uncertainties, Truist maintains a buy rating on Penn Entertainment with a price target of $25.

The layoffs at Penn Entertainment signal a strategic shift in focus towards growth and operational efficiency. As the company navigates through challenges and implements new initiatives, the road ahead may not be smooth, but there is optimism surrounding the potential of ESPN Bet and the opportunities it presents for the company’s future.