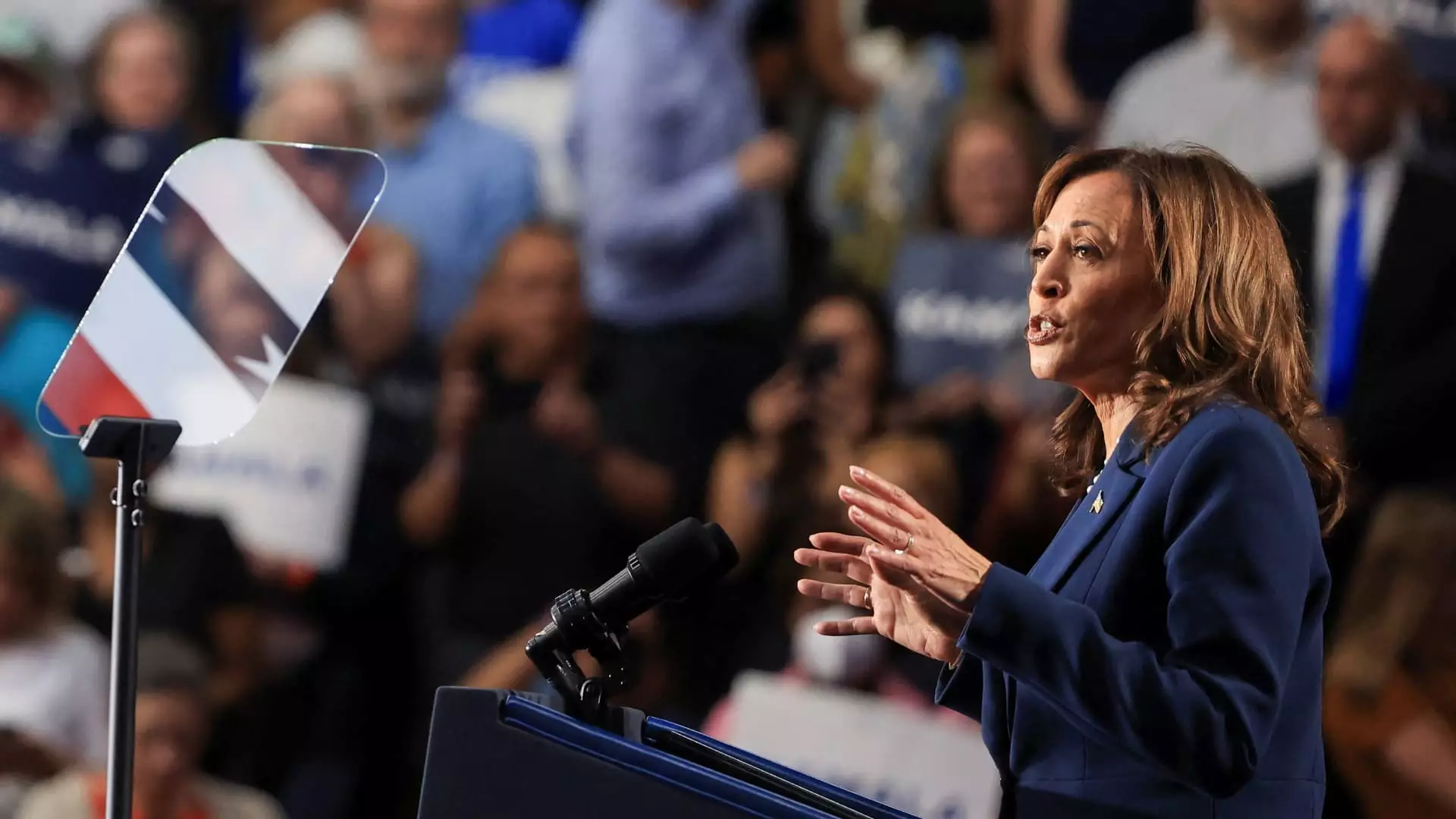

In a decisive moment for her political career, Vice President Kamala Harris has made it clear that strengthening the middle class will be a cornerstone of her campaign to succeed President Joe Biden as the Democratic presidential candidate. Speaking at a recent event in West Allis, Wisconsin, Harris emphasized that “when our middle class is strong, America is strong,” a rhetoric that echoes previous positions she has championed. This focus on the middle class is a strategic response to economic realities that many Americans face today, particularly as wealth inequality widens.

Harris’ approach to revitalizing the middle class inherently involves addressing the wealth gap. Recent analyses spotlight the widening discrepancies between income levels in the United States and highlight an urgent need for effective policy measures. A robust middle class serves not just as a backbone of the economy but also as a barometer of societal health. Therefore, Harris’ keen focus on middle-class restoration is not only timely but crucial for the broader socio-economic landscape.

One of the pivotal measures Harris previously endorsed during her tenure as a senator was the LIFT the Middle Class Act. This proposed legislation aimed to deliver significant tax credits—up to $3,000 for individuals and $6,000 for couples—to lower- and middle-income families. Advocates argue that such measures would serve as substantial financial relief in a climate marked by rising costs and stagnant wages for working-class Americans.

Contrary to other proposals, such as President Biden’s rent cap initiative, experts like Georgetown finance professor Francesco D’Acunto suggest that the LIFT Act might offer more immediate support to consumers. The rent cap restricts landlords from increasing rents beyond 5%, ostensibly shielding consumers from escalating housing costs. However, critics warn that such a cap might create unintended consequences, including landlords withdrawing their properties from the rental market or still hiking rents while sacrificing federal tax benefits.

The LIFT Act, on the other hand, focuses directly on assisting renters, addressing their financial burdens without imposing potentially dangerous market restrictions. D’Acunto argues that a targeted tax credit could thus alleviate the pressures stemming from rent inflation.

The inflating cost of living amid broader economic challenges has left many working-class Americans feeling financially vulnerable. According to experts like Tomas Philipson, former chair of the White House Council of Economic Advisers, this financial anxiety has only deepened due to inflation, which has eroded real wages for many households. With the rise of artificial intelligence, concerns about long-term job security have escalated, underscoring an urgent need for updated fiscal measures tailored to contemporary challenges.

In such an environment, the rationale for introducing the LIFT tax credit may gain even more importance. Laura Veldkamp from Columbia University contends that the growing anxiety surrounding AI-induced job displacement paints a compelling case for social safety nets like tax credits, which can alleviate the burden of unpredictability on workers. However, this initiative faces its own set of challenges, particularly with regard to long-term fiscal sustainability.

Implementing a generous tax credit system like LIFT would be financially ambitious. The Tax Policy Center’s estimates from recent years suggest the proposal could incur considerable costs, prompting Harris to advocate for repealing specific provisions of the Tax Cuts and Jobs Act for high earners to fund such endeavors. However, with growing concerns about national debt and potential fiscal constraints, her campaign will need a clear financial strategy to mitigate the challenges of funding these programs.

It’s worth noting that the political climate has shifted considerably since the LIFT Act was first introduced. The Child Tax Credit, expanded under the American Rescue Plan, successfully reduced child poverty rates, demonstrating how effective fiscal measures can mobilize support among working families. With a history of success in temporarily boosting financial security among vulnerable demographics, it stands to be a top priority for legislators and an area that resonates deeply with voters.

As Harris continues to establish her platform, the intersection between her revived interest in the LIFT Act and the ongoing discussions around the Child Tax Credit will be critical. Experts predict that she may need to prioritize these initiatives for effective implementation, given the differing designs yet similar goals they embody.

Navigating political landscapes can be challenging, particularly in the face of partisan disagreements in Congress. Harris’ challenge will be to unify these various agendas under a coherent vision for middle-class support. Whether she will revitalize older proposals or rather adapt to newly-found circumstances may define her campaign trajectory.

The revival of American middle-class prosperity appears to rest on Kamala Harris’ shoulders, fostering hope and posing significant strategic challenges. The essential role of bold economic policy—including targeted tax relief—could define not only her candidacy but also the fate of millions looking for support in challenging economic times.