The investment landscape for startups is experiencing a notable transformation, particularly through the involvement of family offices—the private investment entities controlled by wealthy families. An analysis conducted by CNBC in collaboration with Fintrx, a private wealth intelligence platform, has brought to light the top family offices that actively participated in startup investments in 2024. This investigation is unprecedented, revealing an impressive collective engagement of over 150 investments spanning various sectors, such as biotechnology, energy, cryptocurrencies, and artificial intelligence.

Family offices, which serve as investment vehicles for individual families, are shrouded in a certain degree of secrecy. This makes it all the more significant to identify those that are not just renowned in private wealth circles, but are also emerging as pivotal players within venture capital. Names like Aglaé Ventures, Emerson Collective, and Thiel Capital are now synonymous with innovative finance, drawing attention not only for their wealth but also for their strategic investment choices.

At the forefront of this surge is Maelstrom, the Hong Kong-based family office led by Arthur Hayes, notably one of the co-founders of the cryptocurrency exchange BitMEX. This family office has made headlines by backing a record 22 startups in 2024, with a substantial focus on blockchain technology, including investments in companies such as Cytonic and Magma. This aligns with the broader trend observed whereby significant funding has poured into the blockchain space, signifying the robust interest of family offices in the digital economy.

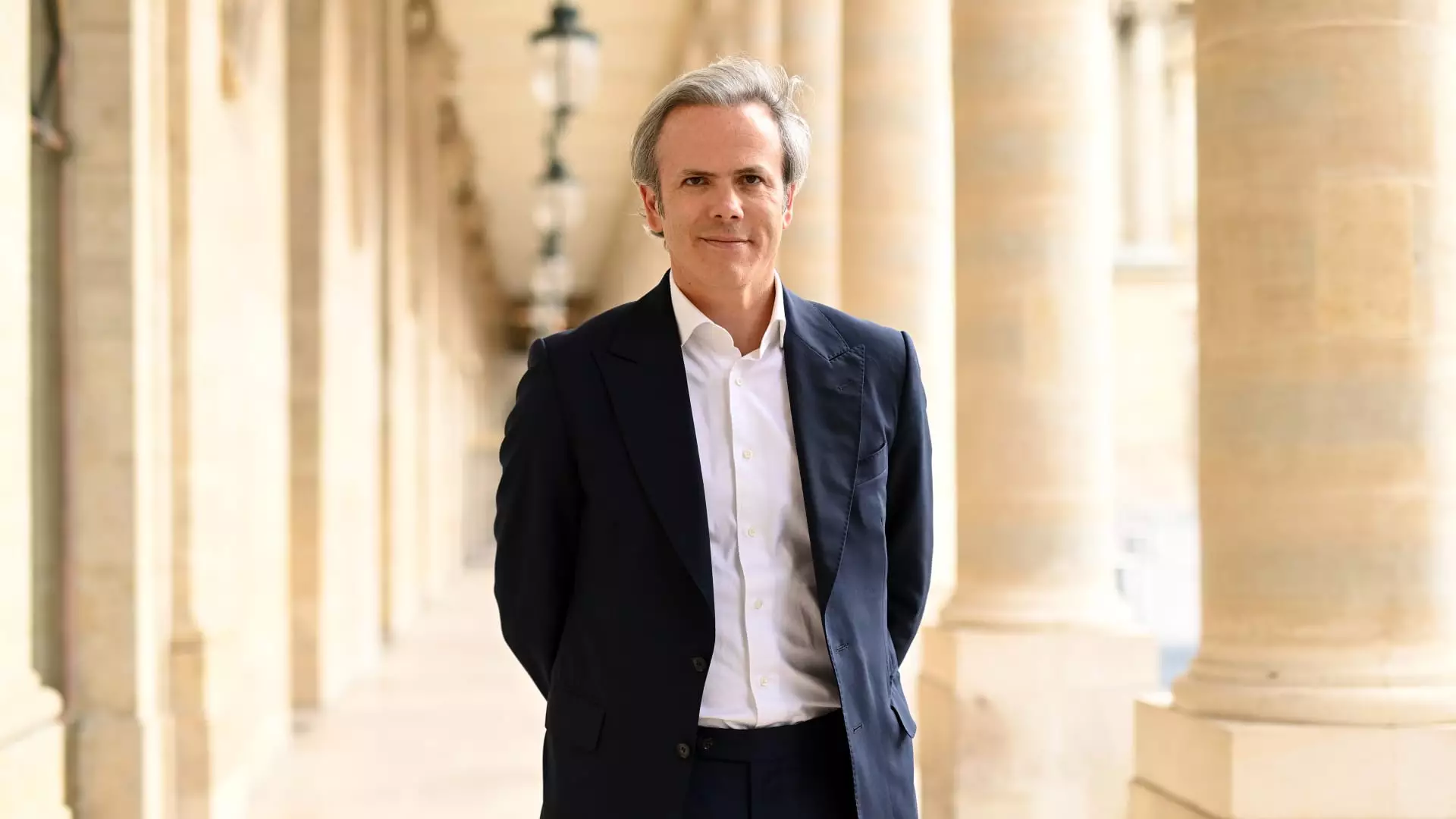

Following closely behind is Motier Ventures, helmed by Guillaume Houzé, which has initiated backing for 21 startups this year. While its focus is primarily on technology, especially artificial intelligence and blockchain, it spans diverse industries, reflecting a comprehensive investment strategy. Noteworthy highlights from Motier’s portfolio include Vibe.co and Holistic AI, underscoring the growing congruence between digital marketing and artificial intelligence technologies.

The participation of family offices in startups is more than just a trend; it signals a significant shift in the investment paradigm. The latest report highlights that nearly one-third of the startup capital in 2022 originated from family offices, which showcases their growing weight in venture financing. According to the UBS Global Family Office Report, there’s an overwhelming inclination among family offices toward artificial intelligence, with 78% planning to invest further in this domain. This positions AI as the leading sector among family office investments, illustrating a keen interest in the technology’s potential for transformative impact.

Family offices are increasingly viewed not just as vehicles for wealth preservation but as active players in shaping the future of various sectors. They leverage their resources to experiment with startups, acting as laboratories that provide insights into emerging markets and technologies. This learning approach is manifested in their inclination to invest in early-stage companies, granting them not only a financial stake but also strategic insights that can inform larger-scale investments in the market.

Despite the promising outlook, the landscape isn’t devoid of challenges. The volatility present in the technology sector, exacerbated by the stock market fluctuations of 2022 and early 2023, has led to significant paper losses for many family offices engaging directly with startups. Missing out on public exits such as IPOs and mergers can lock up capital for these investment entities, causing concerns about funding liquidity.

Industry experts like Nico Mizrahi emphasize the importance of disciplined investing, warning that some family offices may have become overly enthusiastic, chasing after trends without a sound strategy. This serves as a cautionary tale for smaller family offices, underscoring the need to collaborate with experienced managers in niche sectors like technology to mitigate risks.

As the environment for startup funding evolves, the role of family offices is becoming increasingly pronounced. Their ability to provide capital while also serving as strategic partners can lead to innovative breakthroughs across a variety of industries. Moving forward, successful family offices may be distinguished not just by the capital they wield, but by their capacity to adapt to changing market dynamics and forge productive partnerships within the startup ecosystem. This is an exciting time for family offices as they carve out their role in the burgeoning world of startup investments, balancing risks with the potential for substantial rewards in an ever-changing economic landscape.