As we embark on 2025, the financial landscape reveals a vivid tableau of market excitement and speculation. The first trading session of the year witnessed a remarkable upturn, echoing sentiments reminiscent of past market booms. A remarkable resurgence in both cryptocurrency and traditional stocks indicates that investor enthusiasm is palpable, even if the underlying catalysts are invisible. With 2024 having closed on an optimistic note, marked by the S&P 500’s outstanding performance, the stage is set for a gripping year ahead.

One of the most striking elements in recent market movements is the remarkable rebound of cryptocurrencies. Bitcoin, the bellwether of the crypto market, has eclipsed the $96,000 milestone, causing ripples across related stocks. Companies like MicroStrategy, Coinbase, and Robinhood experienced significant increases, highlighting how tightly intertwined cryptocurrencies have become with the broader financial ecosystem. This crypto renaissance is underscored by unconventional tokens like “fartcoin,” which made headlines with an astonishing 45% rise in value, culminating in a market capitalization of $1.38 billion. The juxtaposition of serious investments alongside whimsical tokens reflects a volatile yet vibrant market atmosphere, where speculative bets can yield surprising returns.

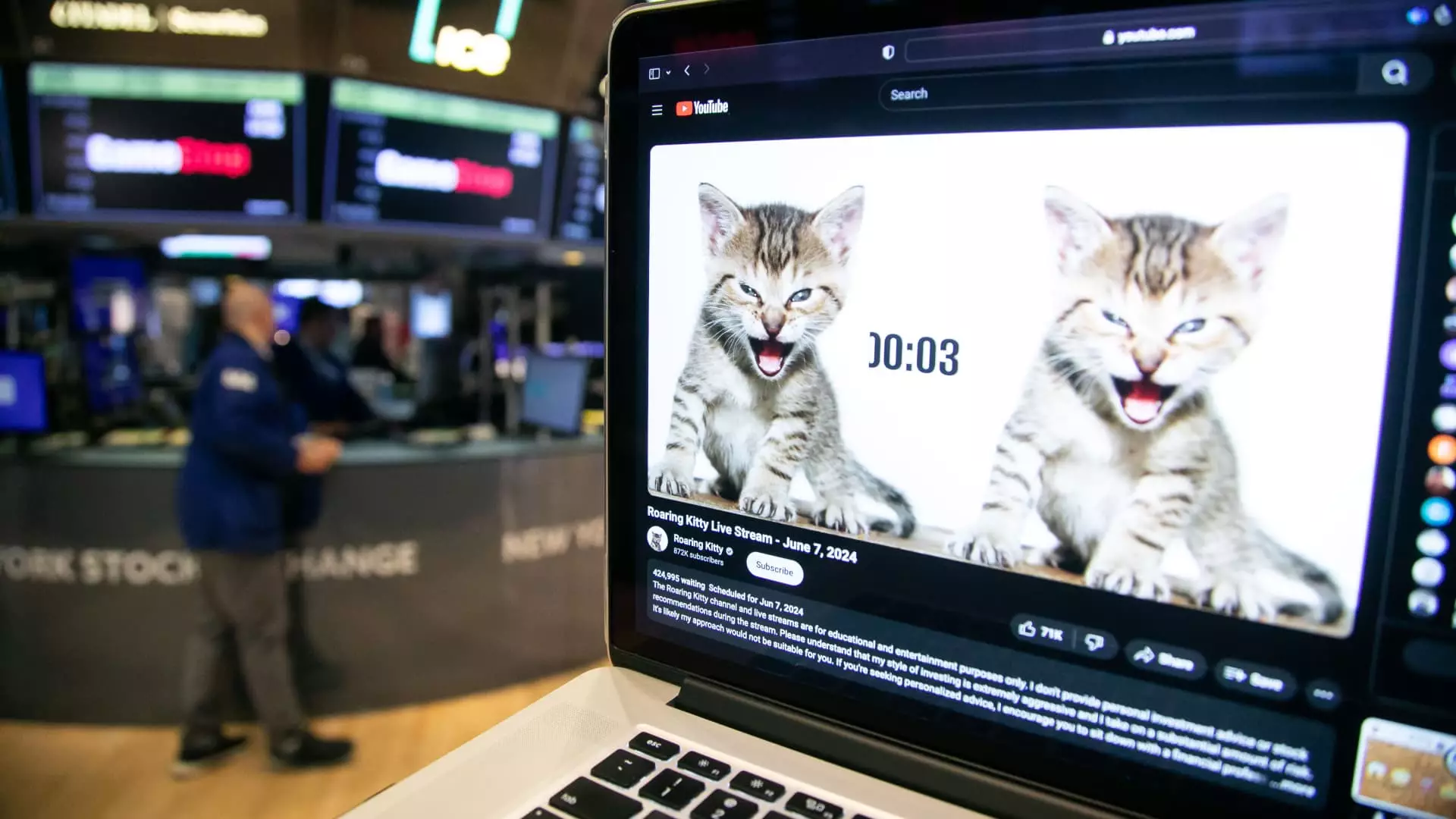

In addition to cryptocurrency, the meme stock phenomenon continues to captivate investors. Led by social media personality Keith Gill, also known as Roaring Kitty, retail traders embarked on a frenzied search for cues that could signal the next big play. The enigmatic nature of Gill’s recent posts, including references to pop culture figures, has sparked speculation about potential price movements in stocks like Unity Software and GameStop. Unity Software enjoyed an 11% increase in its stock price, demonstrating how the rapid dissemination of information on social platforms influences trading behavior. The synergy between social media and investment decisions emphasizes an evolving dynamic where community sentiment can drive market outcomes.

While crypto and meme stocks captured headlines, other sectors, particularly semiconductors, have been quietly making their mark. The semiconductor industry was among the star performers in 2024 and continues to rally with companies like Broadcom and Nvidia reporting solid gains. The momentum in this sector suggests that while some trading patterns may be driven by speculation or whimsy, there’s also a strong foundation in technological advancement and consumer demand. The waning enthusiasm for artificial intelligence stocks doesn’t detract from the prevailing optimism, as investors remain focused on the essential role that semiconductors play in driving technological innovation.

The latest trading patterns evoke memories of the various ebbs and flows witnessed in financial markets, where broad indices oscillate in response to public sentiment and policy anticipations. Initial spikes reminiscent of the post-Trump election euphoria illustrate how quickly emotions can translate into market movements. However, as we have seen, investor confidence may soon be tempered by broader economic realities. Concerns about inflation, supply chain disturbances, and the Fed’s potential interest rate strategies are crucial factors that could dampen the exuberance seen at the year’s outset.

The first trading day of 2025 serves as a microcosm of broader market dynamics where speculation, nostalgia, and analysis converge. While some sectors are buoyed by sound fundamentals, others thrive on the unpredictable winds of social media frenzy. The ensuing months will likely reveal whether this rollercoaster ride of investor sentiment can sustain itself or if it will lead to a more sober assessment of market value in light of external pressures. As investors navigate this landscape, understanding the intricate interplay of emotions, speculation, and market realities will be paramount in charting a path forward amidst volatility.