Oracle Corporation’s recent surge in stock price, which saw a remarkable 6% increase during after-hours trading on Thursday, underscores the company’s bullish outlook for its future. This upswing followed the announcement of raised revenue guidance for fiscal year 2026, with Oracle projecting at least $66 billion—surpassing analyst expectations of $64.5 billion. This trajectory signals not just a successful quarter, but a sustainable growth model that positions Oracle favorably within the competitive tech landscape. Over the past three trading days, Oracle shares have experienced a staggering 15% increase, marking a significant moment for investors and stakeholders alike as the stock reaches unprecedented heights.

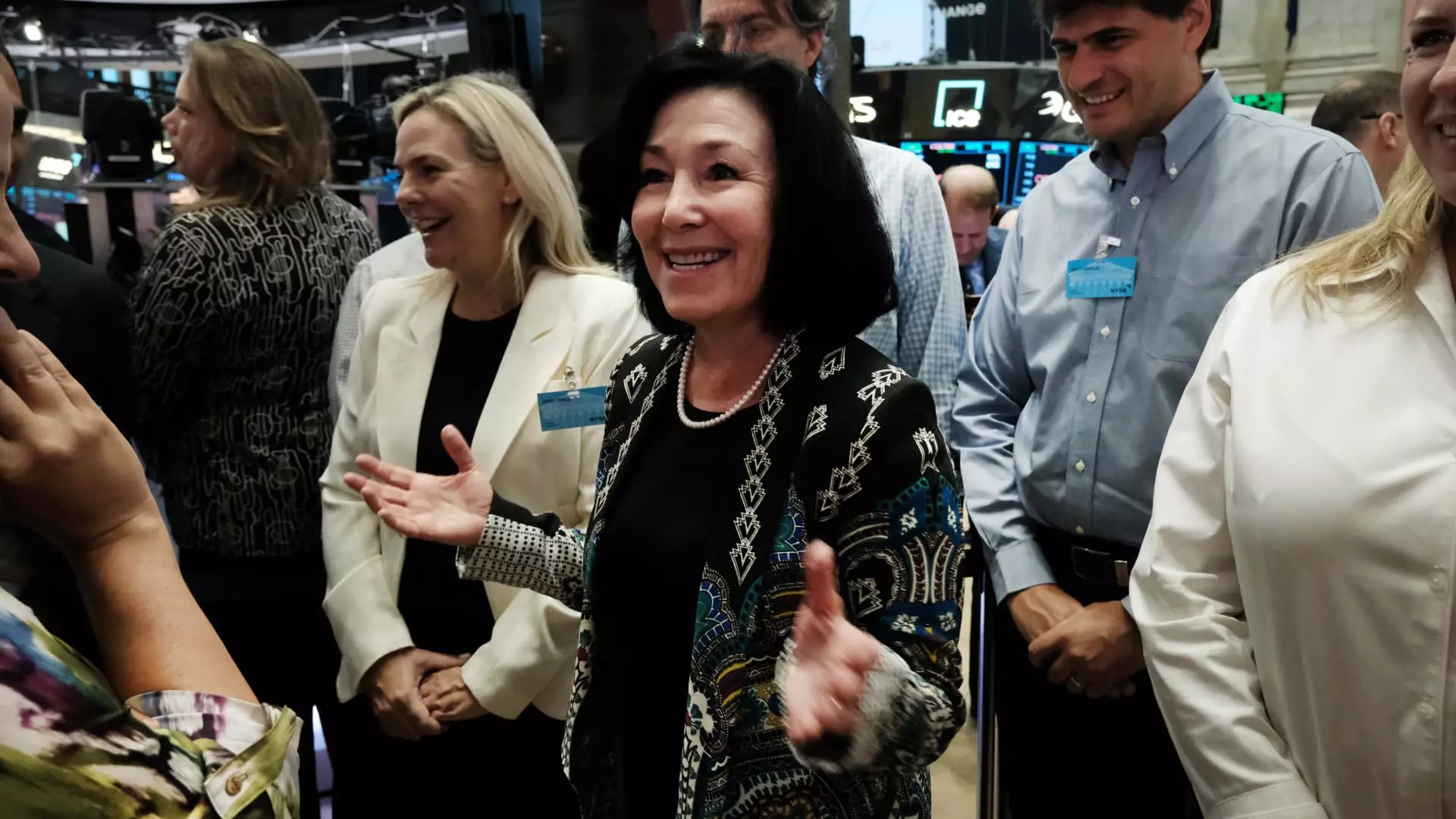

At an analyst meeting coinciding with the highly anticipated Oracle CloudWorld conference held in Las Vegas, CEO Safra Catz provided insight into the company’s long-term goals. Looking ahead to fiscal year 2029, Oracle projects revenues to exceed $104 billion, with an ambitious expectation of 20% year-over-year growth in earnings per share. Such optimistic outlooks typically inspire confidence not only among analysts but also within the investment community, as the company clearly communicates its intent to remain a leader in the crowded database software market.

A major factor contributing to this positive outlook is Oracle’s strategic partnerships with top-tier cloud providers, namely Amazon, Google, and Microsoft. These alliances were bolstered by recently announced collaborations, enabling users to access Oracle database software seamlessly through established cloud platforms. Such accessibility is critical as businesses increasingly shift their operations to the cloud, a transition that has already accelerated Oracle’s cloud infrastructure revenue by an impressive 45% in the latest quarter. This growth rate outpaces many of its competitors, positioning Oracle favorably as cloud adoption continues to soar.

Beyond traditional cloud services, Oracle is also poised to leverage opportunities in the rapidly evolving field of artificial intelligence. The company has begun accepting orders for an extensive array of next-generation “Blackwell” graphics processing units from Nvidia, indicating its commitment to maintaining competitiveness in AI technology. The integration of such advanced infrastructure not only enhances Oracle’s cloud computing capabilities but also signifies its readiness to capture a share of the burgeoning AI market, which is expected to play a critical role in the future of tech.

Catz did not shy away from discussing future capital expenditures, indicating that these investments are projected to double in the current fiscal year 2025. This commitment to reinvesting in infrastructure and technology further reinforces Oracle’s strategic growth plan and demonstrates a long-term vision that seeks to innovate and expand. Oracle’s robust revenue forecasts coupled with its focused investments in key partnerships and emerging technologies reveal a company that is not just riding the current wave of cloud adoption, but actively shaping the future of IT solutions. As Oracle continues to gain momentum, it remains a critical player to watch in the ever-evolving tech industry.