On a notably difficult trading day, Micron Technology’s stock experienced a dramatic decline of 16%, marking what could be the company’s severest drop since the onset of the COVID-19 pandemic in March 2020. As the dust settled on its financial disclosures, the share price settled at approximately $86.78, a staggering 45% decrease from its peak value reached in June. Such a sharp decline indicates not only immediate investor discontent but also underlying concerns about the company’s ability to navigate turbulent market conditions effectively.

The crux of the issue appears to stem from an earnings report that painted a less favorable picture for the upcoming fiscal second quarter. Micron projected revenues to be around $7.9 billion, with an uncertainty margin of $200 million, along with anticipated adjusted earnings per share (EPS) of $1.43, offering a range of uncertainty around 10 cents. Discrepancies were immediately evident as market analysts had forecasted a more optimistic revenue figure of $8.98 billion alongside an EPS of $1.91. This disconnect between the company’s projections and analysts’ expectations has raised red flags that could forewarn a challenging few quarters ahead for the chipmaker.

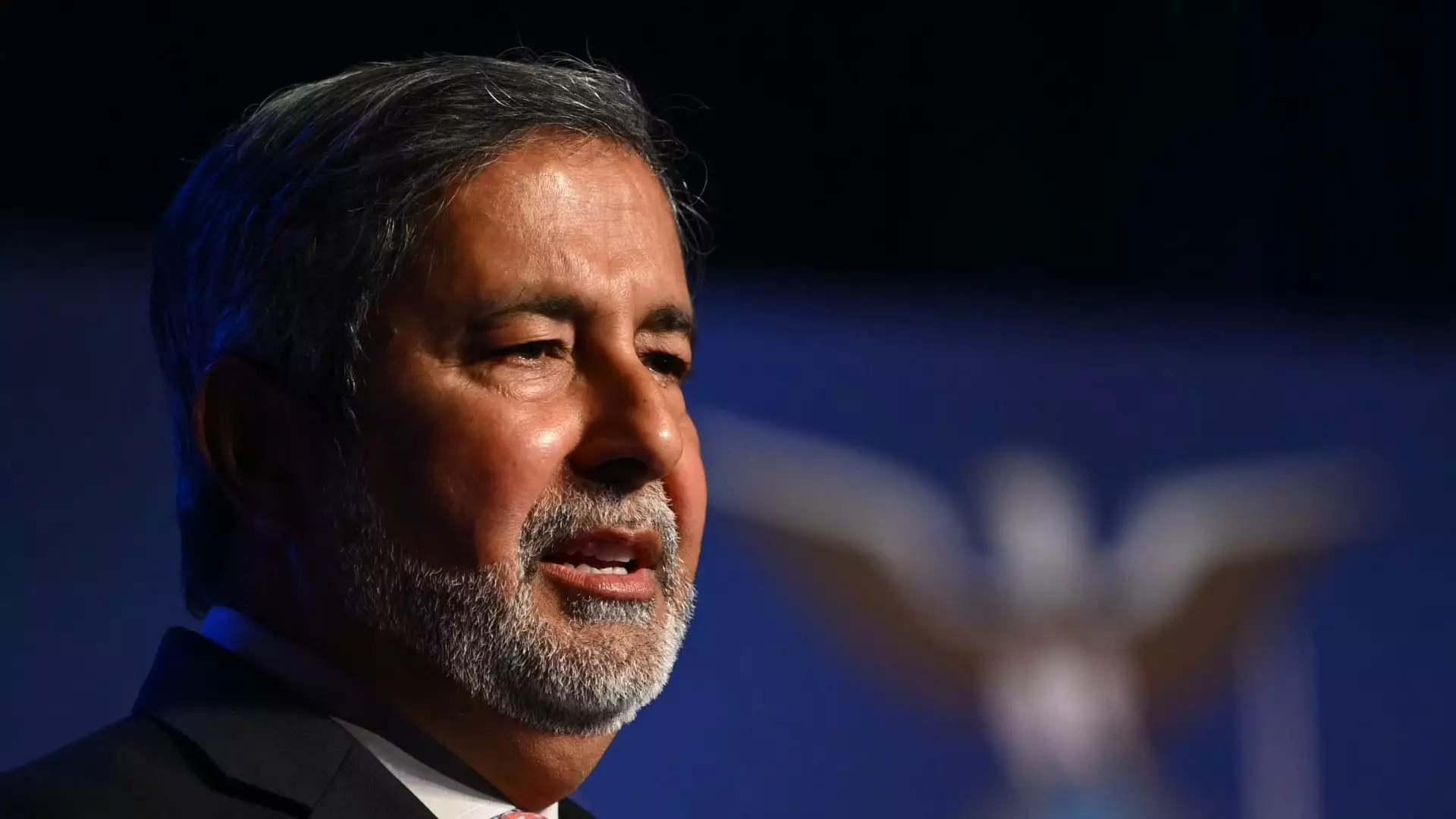

In a bid to contextualize these figures, Micron’s CEO, Sanjay Mehrotra, acknowledged the deceleration of growth in consumer device segments along with significant “inventory adjustments.” Such insights possess substantial weight, suggesting that even as segments like data centers report increased demand—especially due to the artificial intelligence boom—the broader consumer market may be facing a slowdown, thereby inhibiting overall revenue growth. Industry experts, including those from Stifel, echoed this sentiment in their commentary, specifically pointing to a protracted PC refresh cycle and excess inventory in the smartphone sector.

Despite the dismal forecast, analysts have retained a cautiously optimistic stance on Micron’s stock. Stifel, for instance, maintained a ‘buy’ rating, albeit with a slightly revised price target, reducing it from $135 to $130. While the company has reported strong earnings figures for the preceding quarter—cast in a favorable light by an 84% increase in revenue year-on-year—investor confidence may take longer to recover. The impressive 400% surge in data center revenue highlights niches of robust demand, signaling areas where growth is still attainable even amidst broader market challenges.

Micron Technology finds itself in a precarious position as it attempts to weather increasingly tumultuous economic conditions while appeasing stakeholder expectations. With lower earnings guidance, coupled with insights from executive leadership, Micron must now strategize carefully to not only reassure investors but also capitalize on emerging opportunities in the tech landscape. The next few quarters will be critical as analysts and investors alike watch closely for signs of recovery or further decline in this dynamic sector.