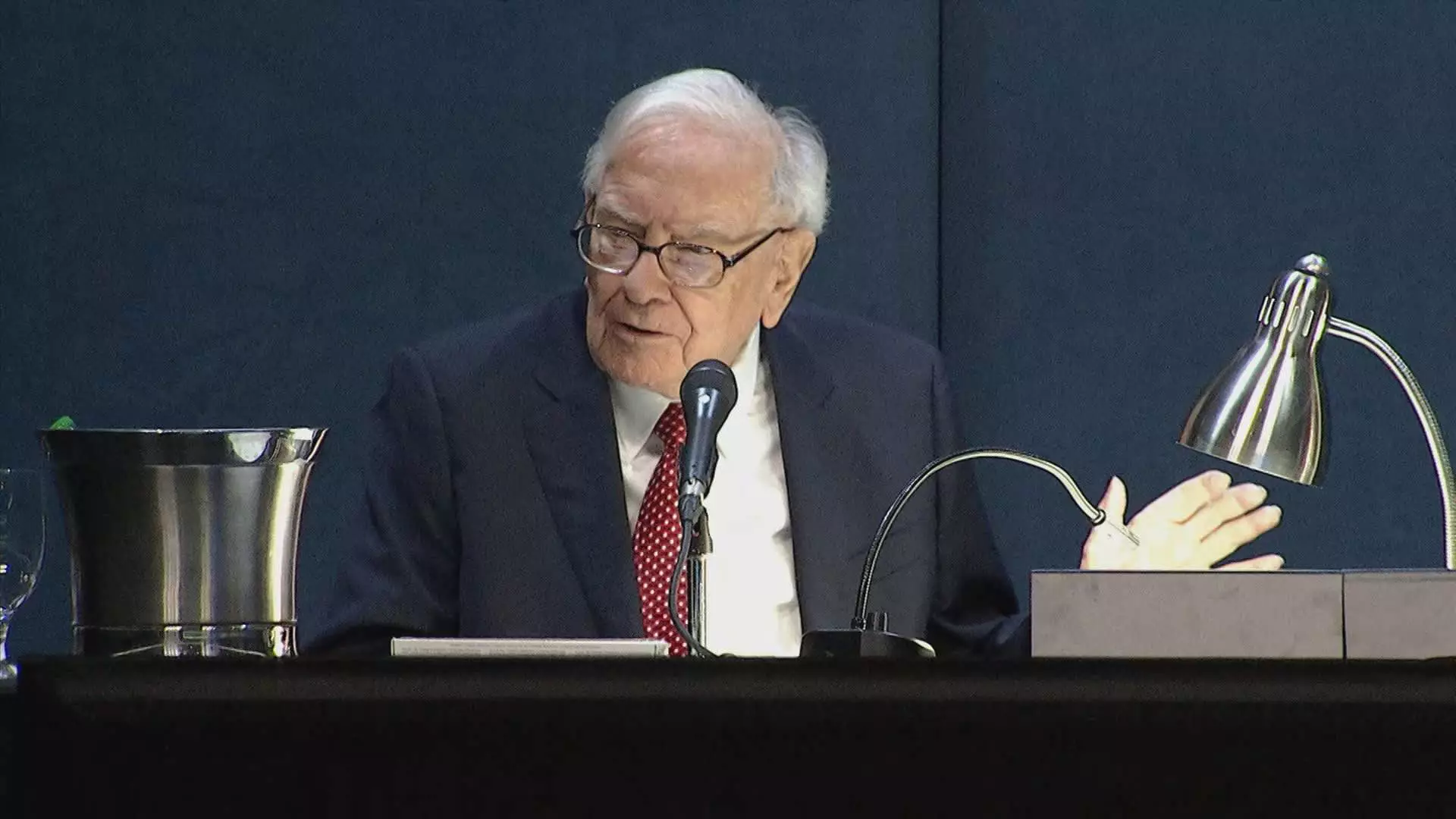

Warren Buffett, also known as the “Oracle of Omaha,” recently made headlines for owning the exact same number of shares of Apple as he does Coca-Cola. This intriguing observation came to light after a regulatory filing revealed that both Apple and Coca-Cola holdings stand at 400 million shares each in Berkshire Hathaway’s equity portfolio. It has sparked speculation among Buffett followers about the rationale behind this balance and if it signifies that Buffett is halting further sales of Apple shares. David Kass, a finance professor, pointed out that Buffett’s affinity for round numbers might indicate a strategic move to maintain his position in Apple, similar to his long-standing commitment to Coca-Cola.

Buffett’s relationship with Coca-Cola dates back to 1988 when he first purchased shares of the company. Over the years, he steadily increased his stake in Coca-Cola to reach 100 million shares by 1994. Since then, Buffett has maintained a consistent share count, emphasizing his belief in the company’s enduring value. Notably, Berkshire’s Coca-Cola holding was adjusted to 400 million shares following stock splits in 2006 and 2012. Buffett’s early introduction to Coca-Cola at a young age played a significant role in shaping his investment philosophy and long-term commitment to the brand.

While Buffett is often associated with value investing, his foray into tech giants like Apple may seem uncharacteristic. However, Buffett views Apple as a consumer products company rather than a pure technology play, akin to Coca-Cola’s consumer appeal. He has praised Apple’s loyal customer base and product offerings, positioning it as a key business within Berkshire’s diverse portfolio. Despite Berkshire’s recent reduction in Apple shares by over 49%, Buffett’s comparison of Apple to Coca-Cola at the annual meeting suggests a strategic alignment between the two holdings. The deliberate balancing of Apple shares at 400 million may reflect Buffett’s underlying confidence in the company’s long-term prospects.

The equal share numbers in Apple and Coca-Cola raise questions about the meticulous planning behind Buffett’s investment decisions. While some view it as a coincidence, others speculate that Buffett’s strategic vision guides his portfolio allocation. The recent shift in Apple’s weighting in Berkshire’s portfolio, alongside Buffett’s emphasis on unlimited holding periods for both companies, underscores his unique approach to long-term investing. As Berkshire’s most cherished equities, Apple and Coca-Cola occupy a special place in Buffett’s investment philosophy, showcasing his unwavering commitment to enduring businesses.

Warren Buffett’s equal share ownership in Apple and Coca-Cola unveils a nuanced strategy that combines historical precedent with forward-looking insights. Whether a coincidence or a master plan, Buffett’s deliberate actions underscore his distinctive investment style and unwavering confidence in the companies he chooses to hold. As investors continue to decode Buffett’s market moves, one thing remains clear – his investment decisions are driven by a blend of intuition, experience, and a long-term perspective that sets him apart in the world of finance.