As the new year approaches, the media industry finds itself at a pivotal crossroads, ripe for speculation about what the future holds. With the holiday spirit in the air, some of the most influential media executives have anonymously shared their predictions for 2025. This article synthesizes their insights, assessing the likely developments in a rapidly changing landscape marked by strategic mergers, technological shifts, and a rethinking of traditional broadcast models.

Before diving into future forecasts, it’s useful to evaluate the accuracy of last year’s predictions. The 2024 forecasts yielded mixed results. While some expectations, such as the collaboration between Warner Bros. Discovery’s Max and Disney, came to fruition, other high-profile guesses did not materialize. There was no significant streaming bundle formed among major players like Netflix and Disney, as speculated, and significant public shifts within Disney’s leadership structure failed to occur. Understanding these past predictions is crucial; they set the stage for current insights and provide context for the optimism and skepticism reigning among media moguls.

One of the most pronounced trends expected to continue into 2025 is consolidation within the media industry. Predictions suggest that Comcast may revisit previous aspirations of merging with other cable giants to strengthen its market position. This scenario emerges nearly a decade after its failed acquisition attempt for Time Warner Cable, marking a significant pivot for the company. Following its sale of vast entertainment assets to Disney, there’s speculation that Fox may strategically acquire Warner Bros. Discovery’s streaming and linear services to regain lost market share. Such actions would reverberate through a dwindling pool of heavyweights in a media landscape increasingly characterized by consolidation.

The streaming sector remains a focal point of anticipatory predictions. Consolidation efforts suggest a bundling strategy whereby Paramount Global, NBCUniversal, and Warner Bros. Discovery would adjust their approaches to compete against industry leaders. These executives are contemplating a hard bundle of services, offering discounted access to a suite of streaming platforms that could rival Netflix and Disney+. The flexible nature of these deals might allow for innovative offerings that cater to varying demographic needs, fostering a competitive environment.

Moreover, ESPN’s anticipated launch of its flagship streaming service by the fall of 2025 signals a significant shift in how sports content is distributed. As traditional sports broadcasting faces decline due to the cord-cutting trend, the adaptation of streaming models will become critical, setting the stage for potential partnerships and bigger broadcasting strategies.

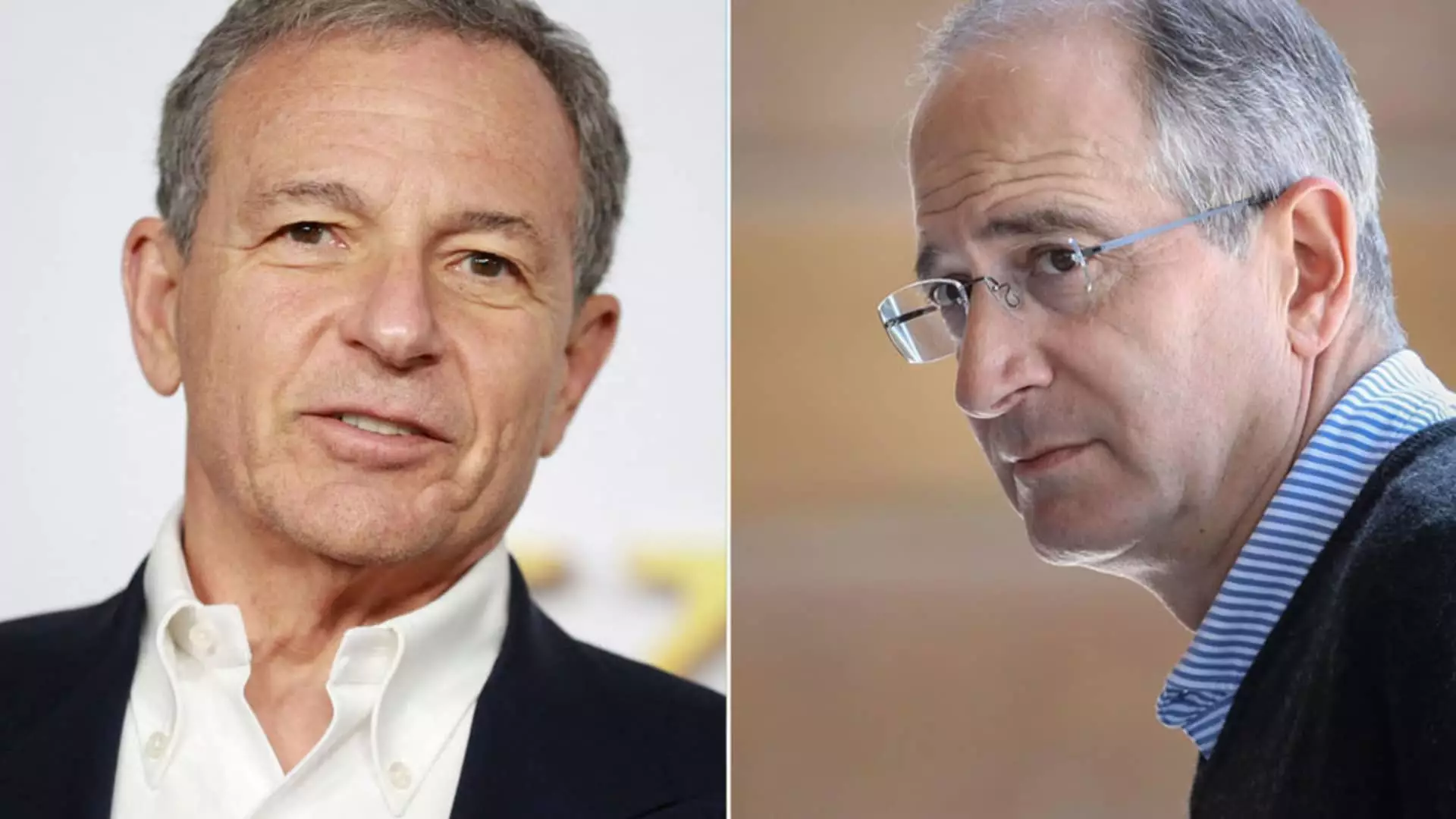

Amidst predictions of mergers and acquisitions, there is also speculation about leadership transitions within key corporations. Disney’s delay in naming a new CEO until 2026 has left observers curious, particularly in light of Bob Iger’s previously tumultuous internal changes. Many insiders are backing Dana Walden as a potential successor, hinting at an impending shift in strategic vision. Such changes in leadership could have far-reaching implications for the direction of major franchises, including revitalizing iconic series like “Star Wars,” which has seen its appeal waning with adverse responses from long-time fans.

Despite the optimism surrounding possible mergers and expansions, some executives question whether consolidation will genuinely rectify the industry’s current challenges. The complexities of digital transformation and evolving consumer preferences suggest that simply combining resources may not suffice. Executives like those at Paramount and NBCUniversal acknowledge the need for a more profound rethinking of content delivery and audience engagement. Without innovation, consolidation efforts might lead to superficial changes rather than effective solutions.

Additionally, the advent of antitrust lawsuits, as seen with Fubo’s challenges against Venu, demonstrates that the regulatory environment could complicate or even hinder ambitious consolidation plans. Creative and strategic foresight will be crucial for navigating these hurdles.

While the landscape of media and entertainment in 2025 will undoubtedly be marked by change, the opportunities for collaboration prove promising. Whether through strategic partnerships, innovative bundling strategies, or supportive regulatory environments, the industry must rely on creativity and adaptability to survive and thrive amidst the shifting tides. As we look ahead, media executives remain hopeful that 2025 will be a year of transformation, driving significant advancements in how content is created, distributed, and consumed. The lingering question, however, remains: can the industry embrace change effectively enough to navigate these tumultuous waters? Only time will tell.