As the Biden administration approaches the conclusion of its term, it has made significant strides in addressing the student debt crisis, culminating in a recent announcement that marks the final wave of student loan forgiveness. With over $600 million in debt canceled for approximately 8,700 borrowers, this action reflects the administration’s efforts to right the wrongs of a flawed system. Specifically, the beneficiaries include 4,550 borrowers navigating the Income-Based Repayment (IBR) plan and 4,100 former students from DeVry University—an institution previously found guilty of misleading students regarding job placement rates.

The decision to forgive debt for DeVry University alumni is particularly notable. Actions taken by the U.S. Department of Education stem from a 2022 investigation that unveiled substantial misrepresentations by the for-profit institution regarding the success of its graduates. Such findings underscore a critical issue prevalent in the for-profit college sector, where educational outcomes are often overstated to attract prospective students. Despite the lack of immediate comment from DeVry University, this development raises questions about the accountability of educational institutions and their role in potentially harming students’ financial futures.

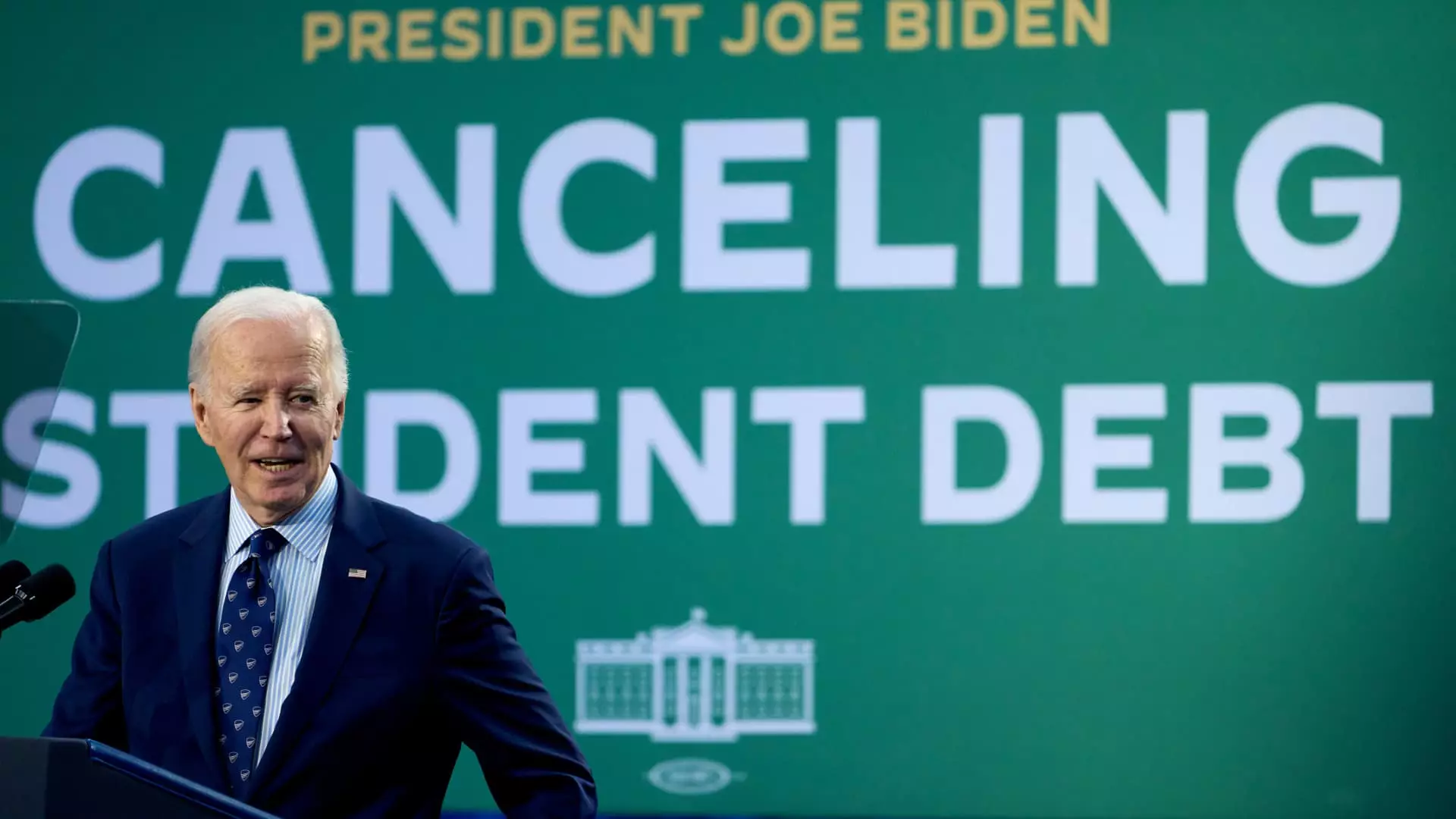

Notably, President Biden’s tenure will conclude with the forgiveness of approximately $188.8 billion in student debt affecting 5.3 million borrowers. Higher education expert Mark Kantrowitz hailed these measures as unprecedented, highlighting the sheer volume of relief granted in contrast to previous administrations. This achievement, however, comes amid challenges, especially after the Supreme Court’s decision to block Biden’s comprehensive plan aimed at a broader swath of borrower relief. The ongoing legal and political battles demonstrate the complexities surrounding student debt reform and the persistent hurdles the administration faced.

While the headlines focus on the dollar amounts forgiven, Secretary of Education Miguel Cardona emphasized the effort to address systemic failures within the student loan framework. The administration’s approach aimed to enhance existing relief programs and rectify past shortcomings. In particular, attention was paid to improving Income-Driven Repayment (IDR) plans, traditionally reliant on accurate payment tracking to ensure borrowers reach their forgiveness timelines.

Historically, borrowers have expressed frustration regarding their loan servicers’ inability to provide reliable information about their repayment progress. In response, the Department of Education has now taken measures to rectify these inconsistencies, allowing students enrolled in IDR plans to access an accurate payment count through the Studentaid.gov platform.

As the Biden administration closes this chapter, the implications for future student debt policy are substantial. The relief granted not only provides immediate financial relief for numerous borrowers but also sets a precedent regarding accountability in the education sector. Moving forward, the commitment to reforming outdated systems and providing transparency will be critical for maintaining momentum in addressing student debt.

The final wave of forgiveness is both a conclusion and a new beginning in the student loan narrative. The Biden administration leaves behind a legacy of significant debt relief and reforms, echoing the need for ongoing advocacy in ensuring educational institutions uphold their responsibilities to students. As the nation looks ahead, these actions invite a broader examination of the principles guiding higher education financing and access for future generations.