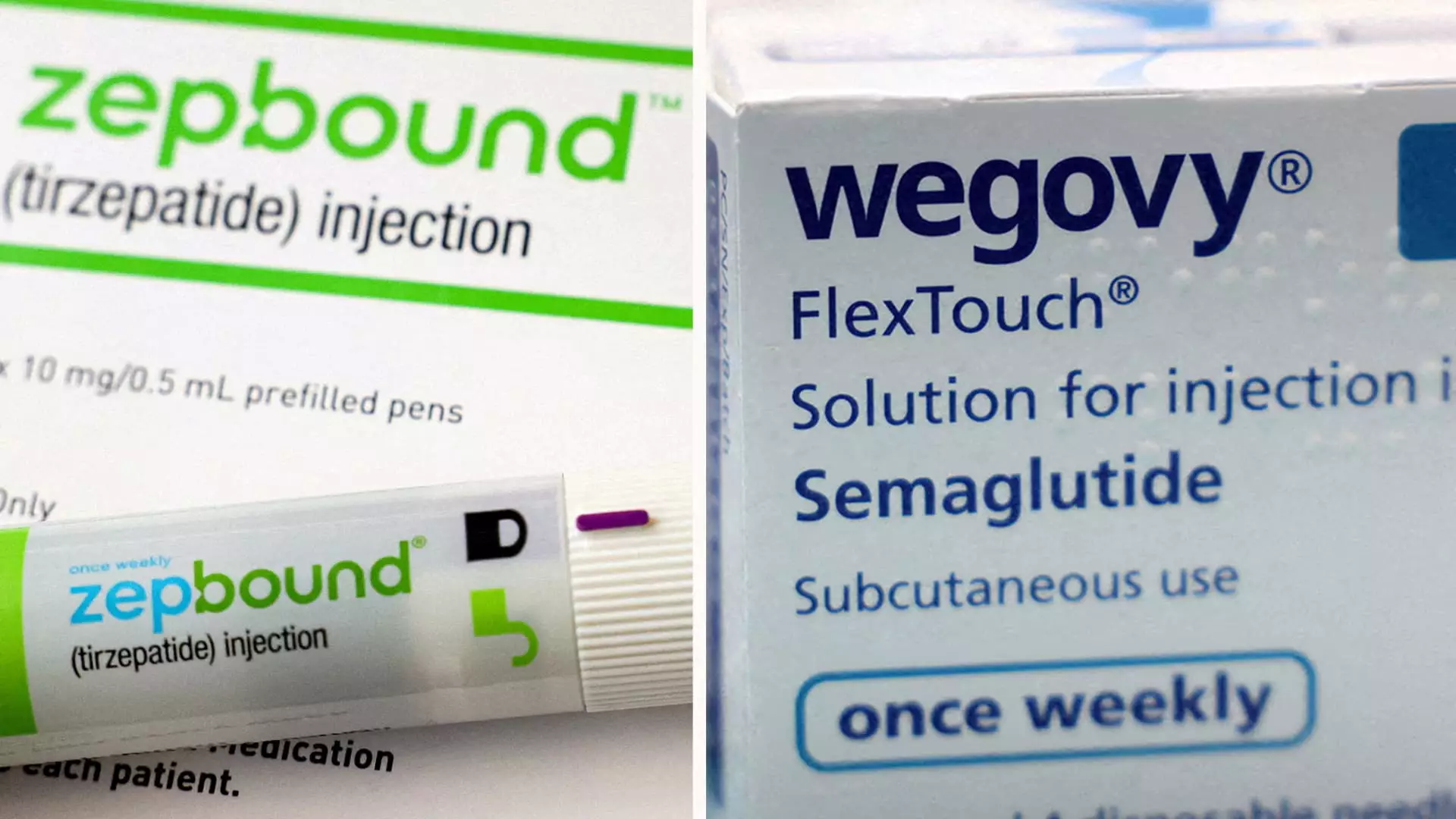

Eli Lilly has recently released promising data regarding its weight loss medication, Zepbound, indicating that it significantly outperforms its primary competitor, Novo Nordisk’s Wegovy, in a head-to-head clinical trial. This trial, which is considered a crucial milestone, showcased that Zepbound enables patients to achieve a remarkable average weight loss of 20.2%—approximately 50 pounds—over a 72-week period. In contrast, Wegovy led to a more modest average weight reduction of 13.7%, equivalent to roughly 33 pounds, during the same timeframe.

The trial’s design was robust and involved the random assignment of 751 patients diagnosed as obese or overweight, each having at least one related health issue, although diabetes was explicitly excluded from the study criteria. Notably, Zepbound demonstrated a 47% greater relative weight reduction compared to Wegovy. This pivotal finding makes Zepbound a compelling option for those seeking effective weight management solutions, especially in an era where obesity treatments are gaining increased attention.

Dr. Leonard Glass, senior vice president of global medical affairs at Eli Lilly Cardiometabolic Health, indicated that the motivation behind this extensive study was to support healthcare providers and patients in making informed decisions regarding weight loss treatment options. The significance of these findings cannot be overstated, particularly as the obesity epidemic continues to escalate globally.

Moreover, the study revealed that over 31% of Zepbound users achieved a weight loss of at least 25% of their body weight, compared to only 16% of those administered Wegovy. Such statistics suggest that Zepbound could be a transformative option for patients struggling with obesity, posing itself as a superior alternative in the existing market landscape.

The weight loss drug market is on the precipice of a significant boom, with estimates suggesting its potential worth could exceed $150 billion annually by the early 2030s. If Eli Lilly can capitalize on Zepbound’s efficacy, it might secure a considerable share in this lucrative market, positioning the drug as the best-selling treatment of its kind in history. Analyst predictions support this view: GlobalData anticipates Zepbound could generate an astounding $27.2 billion in annual sales by 2030, while Wegovy is projected to bring in $18.7 billion.

The intense competitive dynamics are further underscored by the historic delay of Zepbound’s market entry, having gained U.S. approval only in late 2023, two years after Wegovy. However, analysts still express optimism about Zepbound’s potential to disrupt the market, particularly given this trial’s results.

Despite the promising outlook surrounding these medications, both Eli Lilly and Novo Nordisk are grappling with the challenge of ensuring reliable access to these therapies. The past year has seen substantial demand outweighing supply for Zepbound and Wegovy, prompting the two companies to invest billions into expanding their manufacturing capabilities. Thankfully, the Food and Drug Administration (FDA) has recently recorded all doses of these drugs as available in its drug shortage database, which is a positive development for potentially affected patients.

Nevertheless, obstacles remain regarding insurance coverage for these treatments, which often limits patients’ access. In absence of insurance, the financial burden of these drugs remains significant, with both Zepbound and Wegovy costing around $1,000 each month. Such high costs can be prohibitive for many, underscoring the need for better insurance coverage and healthcare policies to support weight management initiatives.

It is vital to recognize that Zepbound and Wegovy, while serving similar purposes, operate through different mechanisms. Zepbound works by suppressing appetite and facilitating blood sugar regulation through the activation of two gut hormones, GIP and GLP-1. On the other hand, Wegovy exclusively focuses on activating GLP-1, which may limit its effectiveness in managing blood sugar and fat breakdown. This distinction could be pivotal for healthcare providers when recommending treatments based on individual patient needs.

The promising results of Zepbound present the potential for a significant shift in obesity treatment paradigms, particularly as more data emerge and patient access improves. As Eli Lilly continues to evaluate its findings for publication in peer-reviewed journals and medical conferences, the excitement surrounding Zepbound is likely to grow exponentially in the coming months.