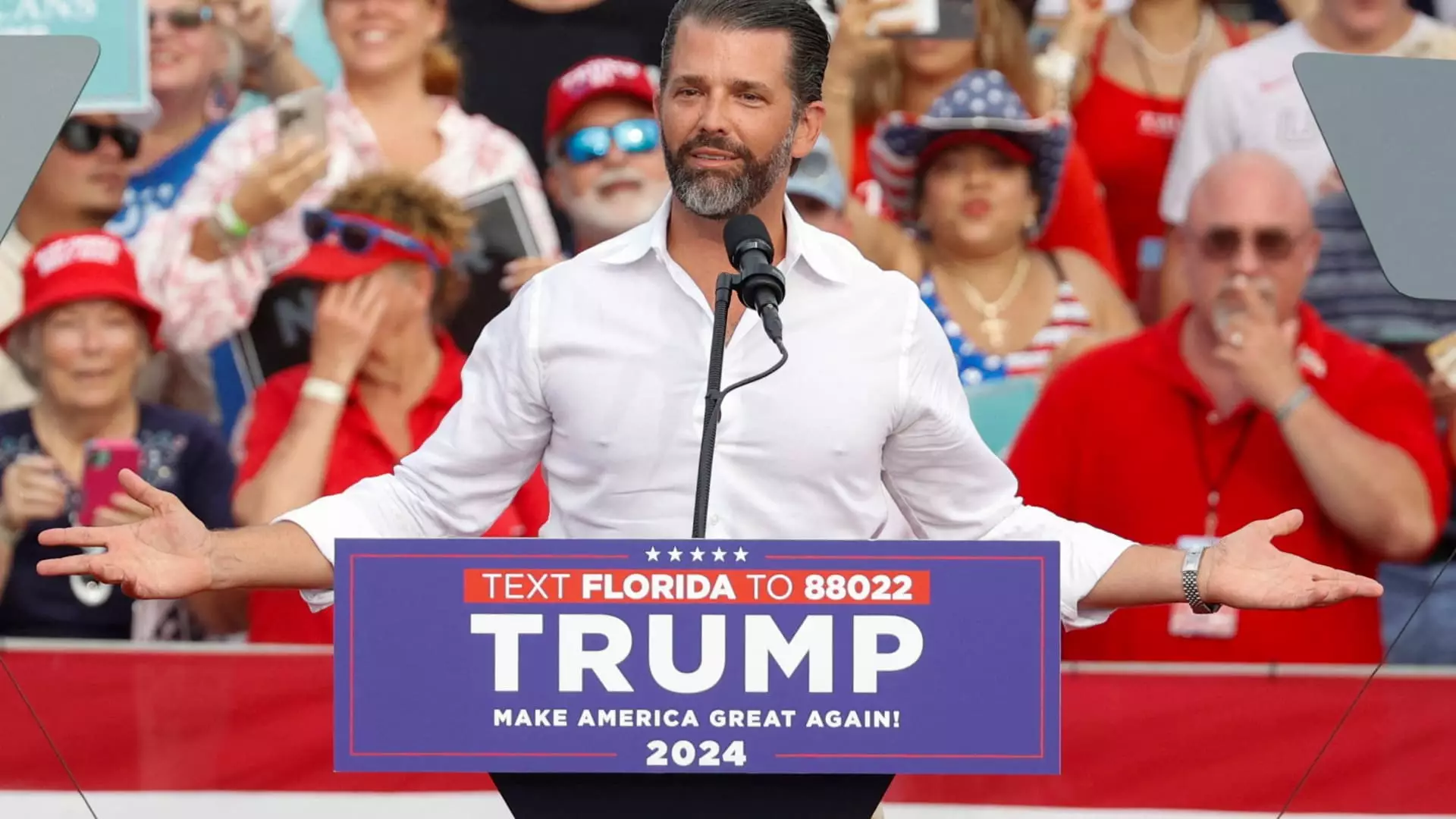

The recent appointment of Donald Trump Jr. to the board of PSQ Holdings, the company behind the online marketplace PublicSquare, has sent shockwaves through the financial markets. On Tuesday, shares of PSQ skyrocketed, experiencing a staggering surge of 185% during afternoon trading hours. This remarkable increase underscores not just the immediate market reaction but also the broader implications of Trump’s involvement in a company that champions “life, family, and liberty.”

Leadership transitions often serve as pivotal moments for organizations, reflecting their strategic direction and future ambitions. Michael Seifert, the CEO and chairman of PSQ, stated that Trump Jr. has been invested in the company before its initial public offering (IPO). His commitment to creating a so-called “cancel-proof” economy is indicative of a growing trend among businesses seeking to align themselves with conservative values. Trump Jr.’s robust background, particularly in the business realm, is anticipated to bolster the board’s strategic oversight, aligning it with values that resonate with a specific consumer demographic.

Financial Overview and Market Positioning

Although PSQ Holdings is classified as a microcap stock with a modest market capitalization of $72 million, its recent financial performance highlights challenges that the company faces. During the third quarter, PSQ recorded only $6.5 million in net revenue and incurred over $14 million in operational losses. These figures suggest that while the excitement surrounding Trump’s appointment might stimulate share prices in the short term, lasting growth will require addressing underlying financial issues. The firm’s ambitious goals, such as developing a robust marketplace and a payments ecosystem, may well be necessary for sustainable progress.

Trump Jr.’s entry into PSQ Holdings is particularly noteworthy in light of his recent ventures, including a partnership with venture capital firm 1789 Capital, which invests in conservative-aligned products. This trend highlights a growing network of political and business symbiosis aimed at nurturing platforms that resonate with specific ideological groups. As he engages with organizations historically associated with conservative values, Trump Jr.’s influence can potentially redefine the business landscape, particularly the way companies interact with their audiences.

Donald Trump Jr.’s board position at PSQ Holdings marks a significant intersection of politics and business, with the potential to affect not only the company’s trajectory but also its investors’ confidence. While the immediate market reaction has been overwhelmingly positive, stakeholders should remain cognizant of the financial realities facing the company. The rise of a “cancel-proof” economy, as advocated by Trump Jr., embodies a growing movement that could shape consumer behavior and investment strategies profoundly. For those watching the market, PSQ Holdings is a company to keep an eye on, as it navigates the complex terrain of aligning conservative values with financial growth.