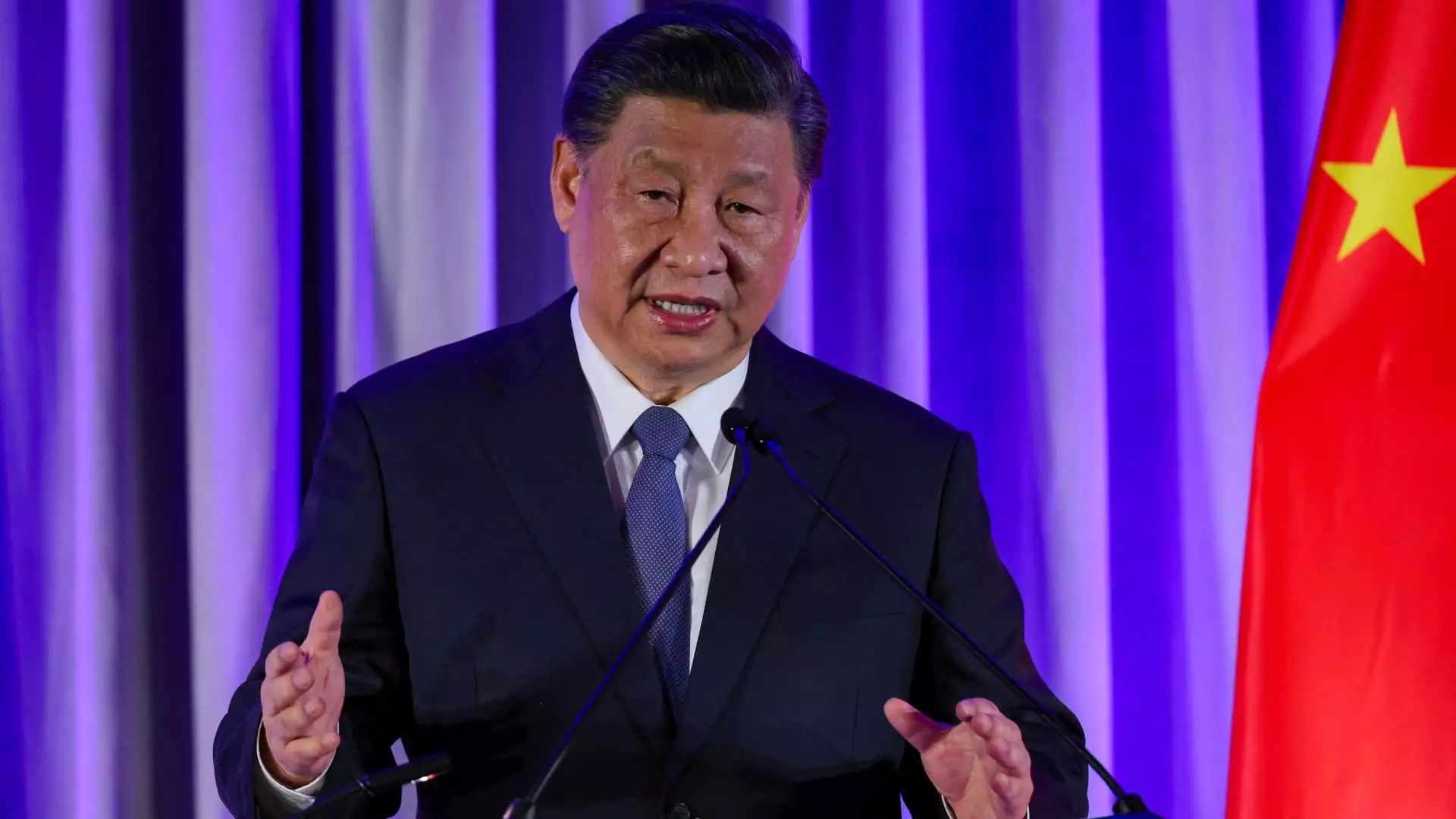

In recent years, China has faced substantial economic turbulence, particularly within its real estate sector. This downturn has not only impacted the developers’ financial stability but also seeped into the fabric of local economies, diminishing government revenues and household wealth. The unprecedented pressures on the property market trace back to government measures targeting debts among developers, initiated in 2020. As China’s economy struggles to rebound, recent high-level meetings among top leaders, including President Xi Jinping, signal a desire to halt the decline and initiate a recovery phase.

During a recent Politburo meeting, the Chinese Communist Party’s elite decision-makers emphasized the urgent need to stabilize the real estate market. A readout from the meeting conveyed that authorities “must work to halt the real estate market decline and spur a stable recovery.” However, the specific details—such as the timeline and scale of supportive measures—remain undefined. Analysts view this meeting as an important step toward constructing a comprehensive economic strategy. Zhiwei Zhang, president and chief economist at Pinpoint Asset Management, expressed optimism, indicating that formulating a robust fiscal package is a complex process that takes time.

The immediate impact of the meeting was felt across financial markets, with stocks in mainland China and Hong Kong experiencing substantial gains. An index tracking Chinese property stocks surged dramatically, demonstrating heightened investor confidence. This uptick suggests that market participants are reacting positively to the leadership’s commitment to restore stability.

The Economic Landscape: Challenges and Opportunities

The real estate sector, previously accounting for over one-quarter of China’s economy, has undoubtedly been a key driver of growth. However, as the government’s crackdown on excessive borrowing by property developers takes its toll, the sector has spiraled into decline. In recent months, statistics reveal a modest stabilization in the trend. For example, the decline in the value of new homes sold has marginally improved, suggesting that the worst may be waning.

Nonetheless, the broader economic outlook remains precarious. China’s total economic growth has slowed, raising questions about the government’s ability to meet its annual GDP targets. Analysts speculate that the growth rate for 2024 may hover around 4.7%, a drop from the previously anticipated levels. Consequently, the Chinese authorities are keen on implementing policies to rejuvenate economic activity and consumer confidence.

The recent meeting delineated various policy priorities aimed at invigorating the housing market while also addressing the broader economic challenges facing the nation. Notably, there is a focus on limiting new housing supply, enhancing loan access for approved projects, and reducing interest rates on existing mortgages. The People’s Bank of China has announced forthcoming cuts that are projected to lower the annual mortgage payment burden by a staggering 150 billion yuan.

Moreover, experts have noted a shift in the policy approach, suggesting that the government may be willing to tolerate slower economic growth in favor of a more sustainable development model. This pivot addresses longstanding structural issues while attempting to foster stabilization in consumer behavior, especially in the housing market. The directive appears to prioritize encouraging home purchases over merely inflating property prices.

As analysts dissect the implications of the Politburo meeting, reactions have varied widely. Some financial houses, like HSBC, are bullish, believing that a tide of proactive policies is on the horizon. Others, such as Capital Economics, express skepticism, cautioning that any hinted stimulus does not guarantee large-scale fiscal support. Throughout the summer, officials underscored the necessity for the economy to undergo a transitional phase, characterized by “pain,” toward a more refined growth model centered on innovation and high-tech industries.

This uncertainty reflects the broader sentiment in the market—a complex dance between optimism and realism as stakeholders await the government’s next moves. With the focus shifting from aggressive growth to more sustainable strategies, the policies laid out during this crucial meeting could very well dictate China’s pathway to economic recovery.

China finds itself at a crossroads, necessitating careful navigation to spur economic recovery, particularly within the beleaguered real estate sector. The outcomes of the Politburo meeting might hint at a cautious yet hopeful approach towards stabilizing growth while addressing the repercussions of previous policies. Going forward, the efficacy of these measures will be paramount in determining whether China can restore momentum in its economy or face prolonged challenges. The coming months will reveal whether the leadership’s resolve will translate into actionable change, and ultimately, a revitalized economic landscape.