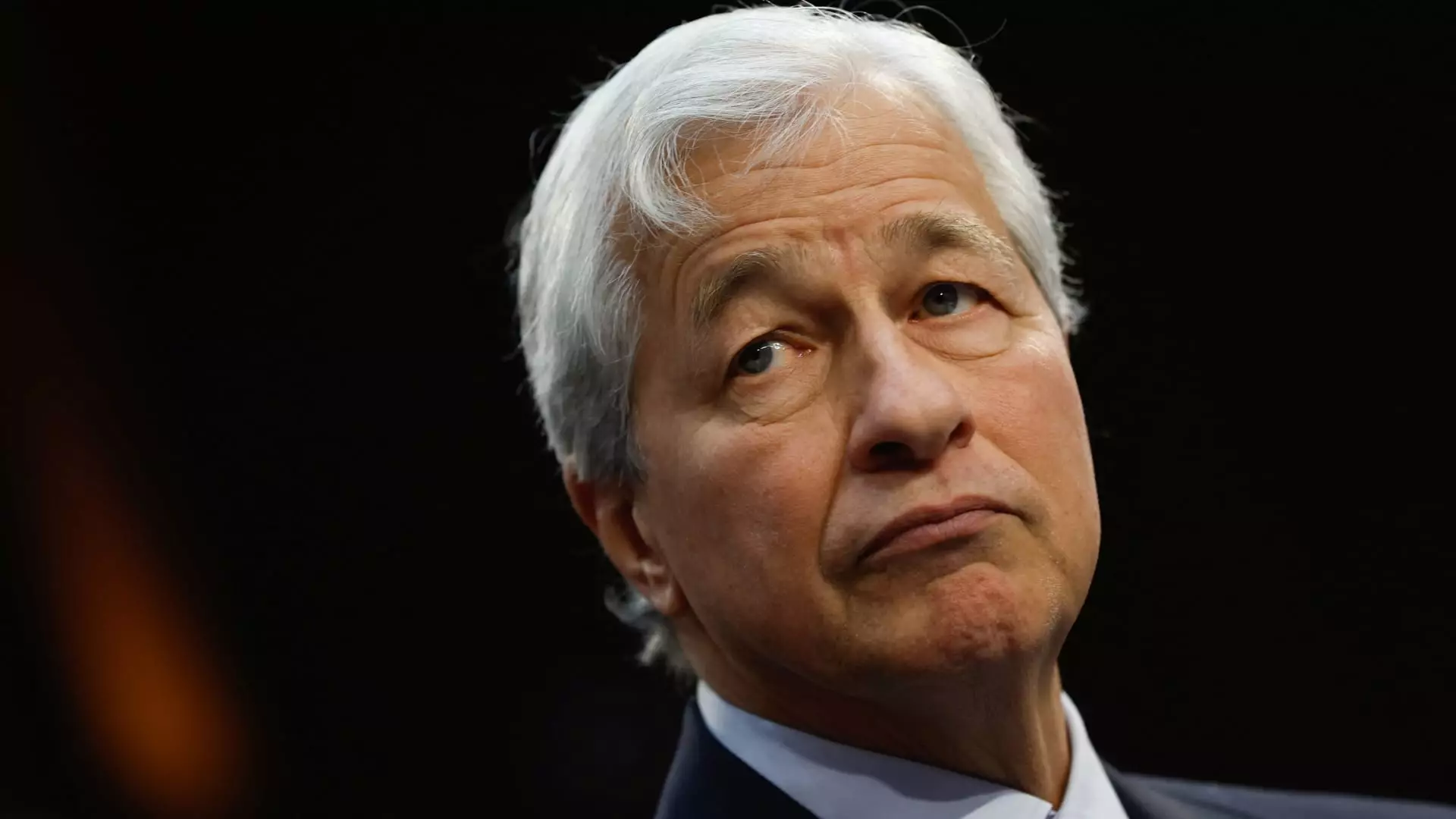

In an era marked by escalating geopolitical tensions, global business leaders are increasingly voicing alarms over the potential ramifications of international conflicts. Jamie Dimon, CEO of JPMorgan Chase, exemplifies this sentiment with pointed observations about the precarious state of the world during the bank’s recent earnings announcement. His perspective underscores the urgency for robust global leadership to address rapidly deteriorating conditions stemming from prolonged conflicts in the Middle East and the ongoing war in Ukraine.

Dimon’s comments reflect a profound concern for human welfare amidst these turbulent events. The conflicts not only inflict significant human suffering but also threaten to reshape global economic landscapes. His assertion that “the outcome of these situations could have far-reaching effects” serves as a grim reminder that the implications extend far beyond the immediate tragedies; they could alter the fabric of global economic relations and future geopolitics. Economies worldwide may be forced to reckon with disruptions borne from these conflicts, impacting trade, investment, and overall economic stability.

One of Dimon’s most striking points is his perspective on the unraveling international order established after World War II. The tensions resulting from the Middle Eastern conflicts, coupled with the precarious dynamics between the U.S. and China, signal a potential shift towards a new era of geopolitical relations—one characterized by unpredictability and confrontation. Dimon notes the concerning notion of “nuclear blackmail” as emerging from countries like Iran and North Korea, heightening fears over global security and stability. This troubling trend calls for decisive action and sharper diplomatic engagement by Western nations.

As highlighted by the one-year mark of the conflict between Israel and Hamas following the horrific attack on October 7, 2022, violence in the region shows little sign of abating. The scale of human casualties and widespread violence impacts not just local populations but also creates ripple effects across regional and global economies. The involvement of international actors like Hezbollah and Iran complicates the situation further, with fears that escalated military responses might provoke broader conflicts. Dimon’s accurate assessment of this situation directly relates to potential implications for global markets, as investors worry about stability in oil supplies and regional resources.

Despite acknowledging some positive signs in the U.S. economy, such as lower inflation rates, Dimon remains cautious about the broader economic horizon. He emphasizes challenges such as large fiscal deficits, infrastructure needs, and a shifting landscape in international trade dynamics, framing them as looming obstacles that could derail any optimistic projections. The specter of global remilitarization presents additional hurdles, demanding a calibrated response from policymakers as they navigate increasingly complex geopolitical realities.

In light of these discussions, it is clear that the world is entering a turbulent phase demanding strong leadership. Dimon’s insights underline a pressing need for collaboration among nations, especially among Western leaders, to address these multifaceted challenges. The convergence of conflict and economic uncertainty poses significant risks, yet it also presents a compelling case for proactive engagement and strategic planning to safeguard future prosperity in a rapidly changing world. The stakes are high, and the necessity for concerted action could not be more critical.