The excitement around Nvidia has reached dizzying heights over the past two years, primarily driven by its pivotal role in the booming artificial intelligence (AI) sector. Just when it seemed like the company would continue on a meteoric rise, it encountered significant turbulence, creating a precarious balance for investors. While this chip-making giant has seen its market capitalization swell dramatically, challenges loom on the horizon, prompting both analysts and investors to carefully scrutinize its upcoming quarterly report.

From skyrocketing valuations to sudden drops, the market journey for Nvidia has been nothing short of a roller coaster. The company experienced an extraordinary increase in market cap—around ninefold since late 2022—culminating in its brief tenure as the world’s most valuable public company. However, this euphoria was quickly countered by a stark decline of nearly 30% within just seven weeks, wiping out about $800 billion in market cap. As the tides turned yet again, Nvidia found itself riding a rally that brought its stock perilously close to previous highs. This spontaneous fluctuation underscores the volatility inherent in the tech sector, especially for companies at the forefront of revolutionary technologies.

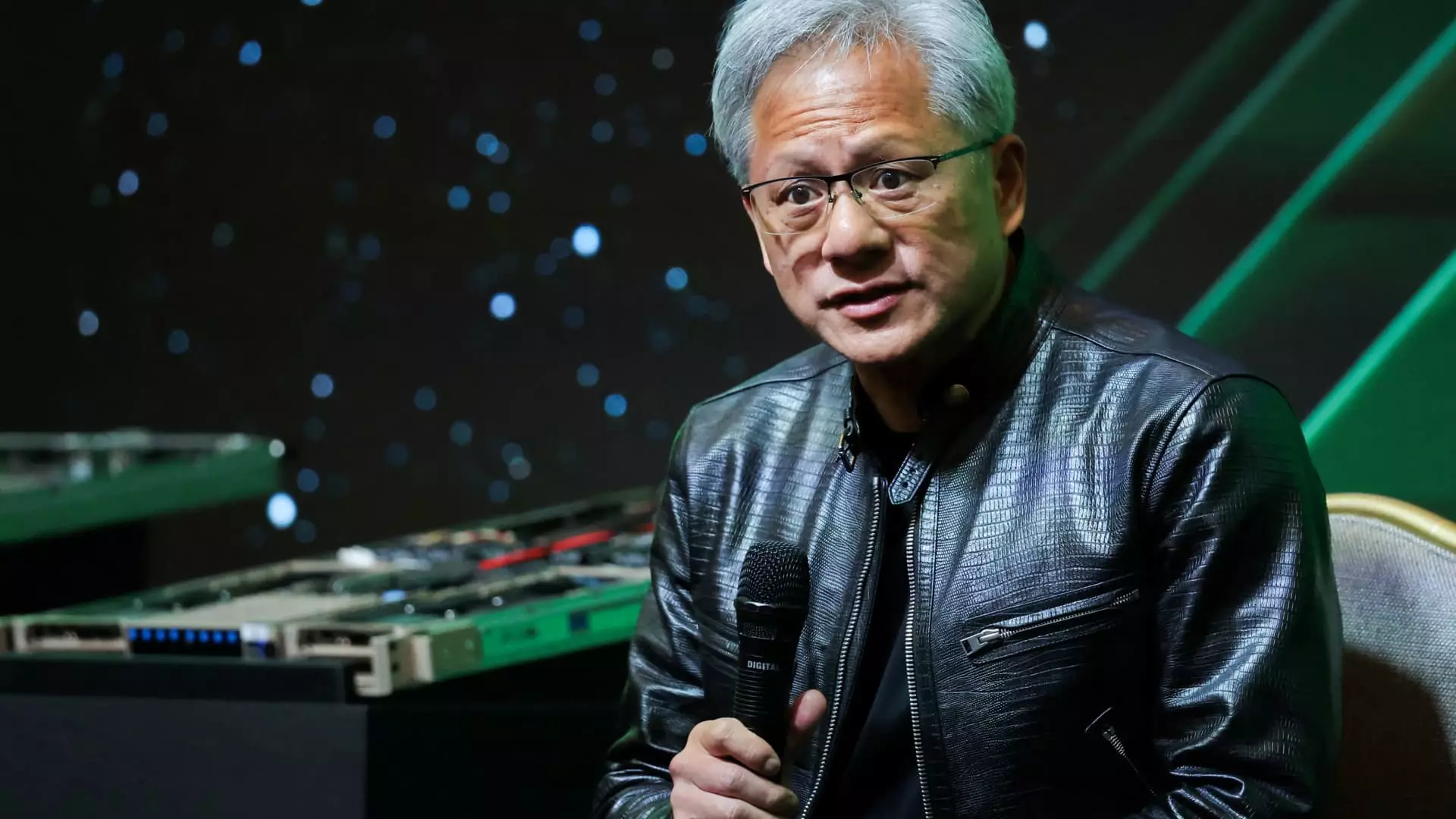

With expectation mounting ahead of Nvidia’s quarterly earnings report, investors are gripped by a complex interplay of hope and caution. The implications of the report echo beyond mere numbers; any hint that AI demand is plateauing or that a major cloud customer is scaling back could lead to far-reaching repercussions across markets. Eric Jackson, a notable figure in investment circles, has aptly described Nvidia as “the most important stock in the world right now,” hinting at its significant position in steering market sentiment. This volatility makes investors acutely aware that disappointing results could catalyze broader market disruptions.

In the prior three quarters, Nvidia’s revenue has more than tripled year-on-year, predominantly fueled by robust performance in the data center division. Analysts predict a continuation of this trend with anticipated growth reaching approximately 112% for the current quarter. Still, the road ahead proves challenging, as growth comparisons become increasingly daunting. The anticipated revenue for the forthcoming quarter stands at $31.7 billion, spurred by the hope that clients are still willing to expend resources for AI infrastructure. Positive forecasts from industry leaders bolster this optimism, yet the specter of slumping infrastructure spending looms large.

Goldman Sachs’ analysts have voiced concerns about the sustainability of hyperscale capital expenditures, sparking debate over whether the current investment trajectory is simply a bubble waiting to burst. The market’s ebullience in August—with an 8% rise—was notably fueled by statements from major clients, who indicated their commitment to investing in Nvidia-powered infrastructure regardless of potential overspending risks. Yet, the tension remains palpable; investors are left to weigh the optimistic tone against the backdrop of potential budgetary constraints.

With Nvidia’s burgeoning profit margins, the crucial question of long-term returns for clients persists. The staggering price tags attached to these advanced processors, each costing tens of thousands of dollars, incentivize scrutiny about their economic viability. During a recent earnings call, CFO Colette Kress reassured stakeholders with claims that cloud providers could expect to generate $5 for every $1 spent on Nvidia’s chips over a span of four years. This form of delineation is crucial, as clients and investors seek steadfast metrics that could affirm their massive investments.

Analysts also speculate about the upcoming Blackwell chips, Nvidia’s next-generation offering that may have encountered production delays. The anticipated rollout—a crucial milestone for maintaining Nvidia’s competitive edge—is now muddled with uncertainty. Even as the current Hopper chips continue to dominate the market, facing down competition from emerging entities, the timing of the Blackwell release remains under intense examination.

The race to scale AI capabilities has positioned Nvidia as an industry titan, but this recognition comes with a caveat: the path forward is riddled with competitive and operational challenges. Although production hurdles may push back revenue expectations associated with the Blackwell chips, the resilience of the current H200 chips positions Nvidia favorably for continued success, provided demand remains robust.

As the tech sector stands on the precipice of innovation and investment, Nvidia’s quarterly report emerges as a critical juncture. The outcome will likely ripple across the market, affecting not only Nvidia but the larger tech giants who rely on its products to fuel AI advancements. Investors will be watching closely, hoping Nvidia emerges not just as a leader in AI but as a stable contribution to their portfolios amid the chaotic landscape of technological evolution.