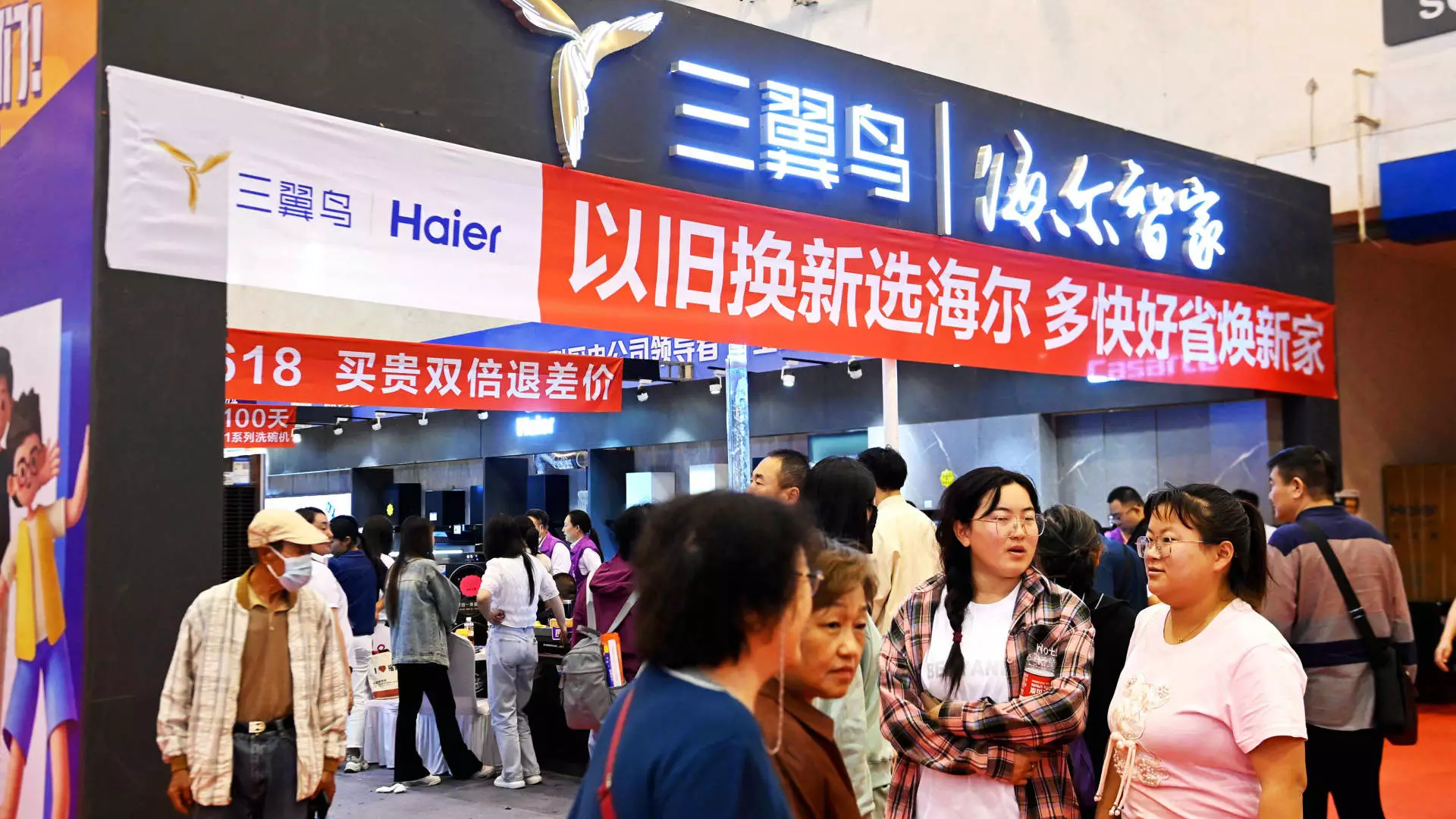

In a bid to invigorate domestic consumer spending, China has recently allotted a staggering 300 billion yuan (approximately $41.5 billion) towards a trade-in and equipment upgrade initiative. Announced in July, this policy is aimed at stimulating consumption by subsidizing the exchange of old products for newer versions. However, industry experts have voiced skepticism regarding the effectiveness of this approach. With only half of the funds designated for consumer goods such as vehicles and home appliances, the remainder supports larger equipment upgrades, including elevators. The ambitious goal has yet to translate into tangible outcomes on the ground, raising concerns about its overall viability.

While the plan appears robust on paper, real-world execution poses a critical challenge. Consumers, often reticent in the face of economic uncertainties, are required not only to contribute financially but also to possess devices worthy of trade-in, complicating widespread participation. Jens Eskelund, the president of the European Union Chamber of Commerce in China, highlighted the staggering expectation placed on consumers given the upfront costs involved. He pointed out the necessity for local execution of these funds, emphasizing that a mere announcement won’t yield results without concrete support for consumers.

An underlying issue in the implementation of this trade-in initiative is distribution equity. Reports suggest that on average, the scheme will generate around 210 yuan ($29.50) per capita across the population, but the actual benefit to consumers may be severely diluted. The EU Chamber of Commerce’s research indicates that only a fraction of these allocations will directly reach consumers, making substantial boosts to overall consumption unlikely. If the program fails to engage a significant number of consumers, it risks becoming a significant expenditure without the corresponding economic stimulation.

Analysts remain cautious about the impact that the trade-in scheme will have on retail sales, predicting a meager contribution of approximately 0.3% to overall figures in 2023, as per UBS’s Chief China Economist, Tao Wang. Retail sales growth has already shown signs of stagnation—reported at just 2% in June—the slowest pace since the onset of the COVID-19 pandemic, followed by a slight increase to 2.7% in July. New energy vehicles are the one notable exception, witnessing a remarkable surge of nearly 37% in sales during the same period, suggesting that consumer interest may be shifting more favorably towards environmentally friendly options rather than traditional products eligible for trade-in.

The program’s potential for supporting equipment upgrades also faces significant hurdles. Officials have indicated that a large share of the current elevator infrastructure is aging, yet companies specializing in this sector, like Otis and Kone, reported a lack of new orders specific to the governmental initiatives, indicating that the industry is yet to see the positive influences of these measures. Otis has documented a drop in its new equipment sales by double digits during the second quarter, underscoring the challenges ahead.

For firms such as ATRenew, which deal in secondhand products, the immediate effects of the trade-in policy may not be evident. Despite the slow start, the CFO Rex Chen emphasized a more optimistic long-term outlook, particularly concerning the evolution of the secondhand goods market. Certain e-commerce platforms are registering a surge in trade-in activities, demonstrating localized success even as broader implementation remains sluggish.

China’s ambitious attempt to enhance consumer spending through a trade-in program reveals the complexities associated with stimulating an economic rebound. While the initiative presents intriguing possibilities for urban modernization and shifts toward sustainable consumption, significant challenges linger. Consumer hesitance, accessibility issues, and slow government execution may thwart immediate goals. Looking forward, it is crucial for policymakers and businesses to navigate these obstacles methodically to unlock the full potential of this strategy, ensuring that both economic recovery and consumer confidence are revitalized. Ultimately, the success of this initiative will hinge not only on the allocation of funds but also on fostering an environment where consumer engagement is encouraged and facilitated effectively.