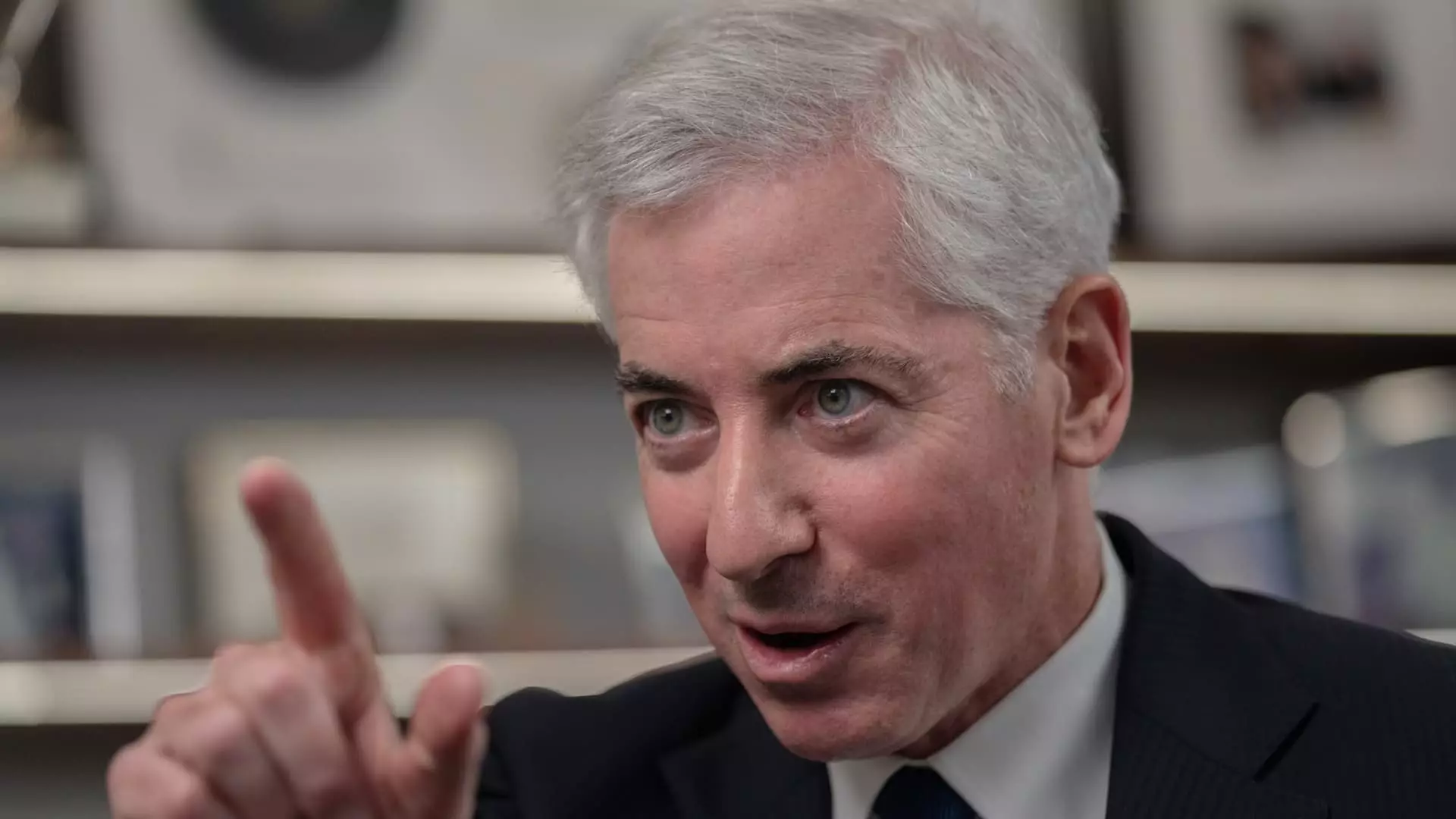

Bill Ackman’s Pershing Square USA recently made headlines by withdrawing plans for an initial public offering (IPO) after apparent lackluster investor demand. Originally, Ackman had ambitious plans to model his fund after Berkshire Hathaway, but those plans were put on hold due to the unmet expectations of potential investors.

Despite the setback, Ackman remains determined to come back with a revised plan for the IPO. It was reported that the fund intended to raise $2 billion, a far cry from the $25 billion figure that had been previously speculated. This sudden change in direction has left many wondering about the future of Pershing Square and Ackman’s strategy moving forward.

The decision to withdraw the IPO came on the heels of a notice on the New York Stock Exchange’s website, indicating a delay in the planned offering. The market’s reaction to this news has been mixed, with some viewing it as a missed opportunity for Ackman to capitalize on his growing popularity among retail investors. Despite having over one million followers on social media, the failed IPO has raised questions about Ackman’s ability to rally support for his fund.

Further complicating matters, it was revealed that Baupost Group, a prominent investment firm, chose not to participate in the offering after initially expressing interest. This decision was reportedly influenced by Ackman’s earlier claims that Seth Klarman’s hedge fund would be involved. The subsequent fallout from these missteps has cast a shadow over Pershing Square’s reputation in the investment community.

As Pershing Square navigates this challenging period, there are lingering uncertainties about the fund’s future prospects. With $18.7 billion in assets under management, the fund remains a significant player in the financial markets. However, Ackman’s handling of the failed IPO and the subsequent investor backlash have raised doubts about his ability to steer the fund in the right direction.

The withdrawal of Bill Ackman’s Pershing Square USA IPO has highlighted the challenges of navigating the complex world of finance. Despite setbacks, Ackman’s determination to regroup and come back with a revised plan underscores his resilience as an investor. Only time will tell whether his efforts will pay off and restore confidence in Pershing Square’s future.