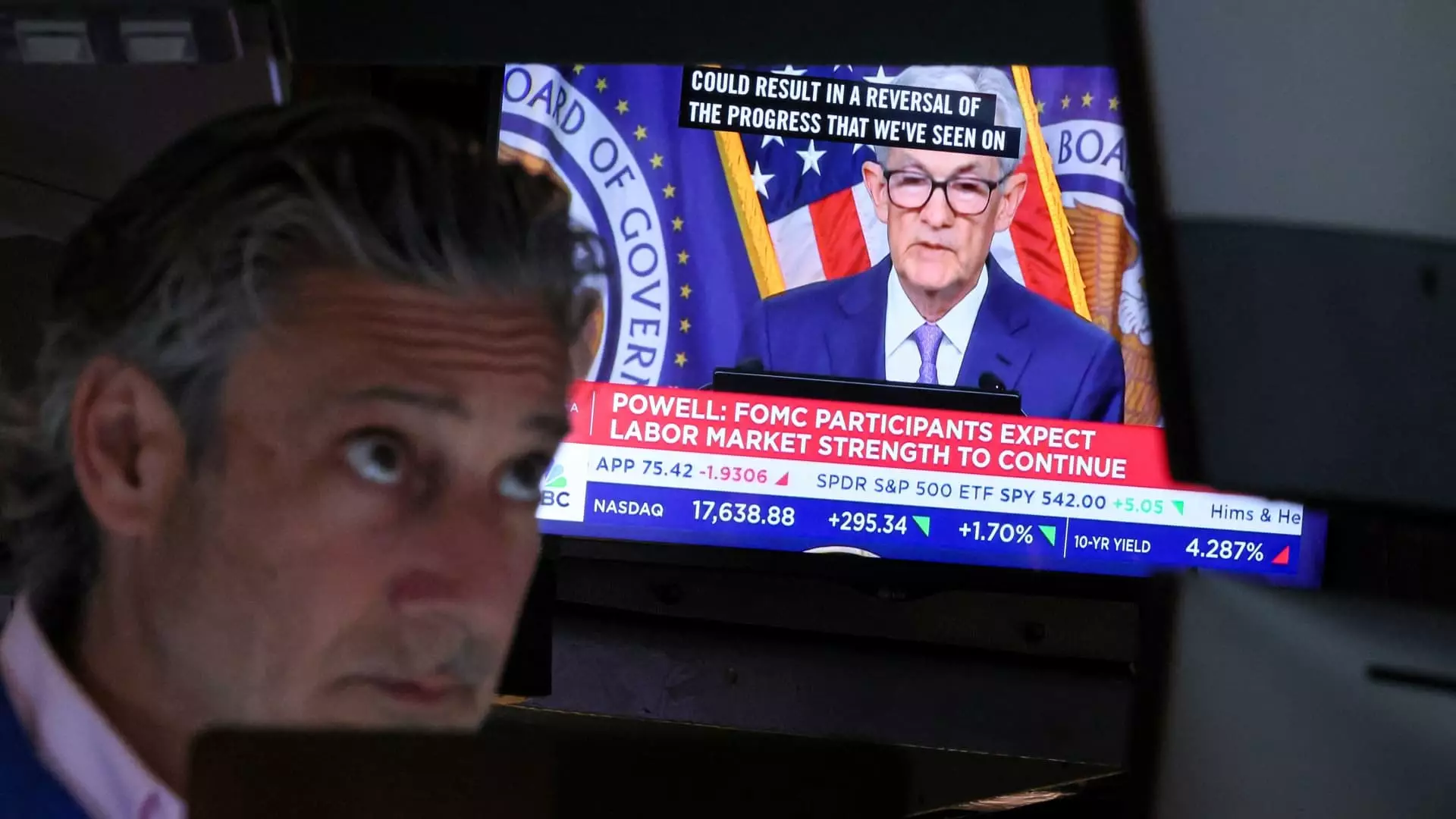

In recent weeks, the stock market has experienced significant growth in response to speculation surrounding the Federal Reserve’s potential interest rate cuts. With traders now estimating a 100% chance of a rate cut by September, stocks have soared to new heights. The Dow Jones Industrial Average, S & P 500, and Nasdaq Composite have all reached all-time highs, reflecting the optimism in the market. This positive sentiment has prompted investors to capitalize on the overbought market by executing a series of trades, including selling off shares of certain companies to raise additional cash.

One notable trend in the stock market is the increasing interest in sectors outside of Big Tech. Investors are diversifying their portfolios to include small-cap U.S. stocks, as reflected in the 11% jump in the Russell 2000 over the past five sessions. This shift away from mega-cap tech stocks has had implications for the performance of certain companies, with stocks like Amazon, Alphabet, Meta, and Microsoft posting losses since the last meeting. Additionally, stocks with heavy ties to China, such as Wynn Resorts, Starbucks, and Estee Lauder, have also faced declines.

Despite the overall market trends, certain stocks have outperformed expectations in recent months. The top five performing stocks include Ford Motor, Morgan Stanley, Stanley Black & Decker, Apple, and Dover. These companies have seen gains ranging from 7.3% to 17.7%, with each company driven by unique factors contributing to their success. For example, Ford Motor’s surge in performance can be attributed to increased sales of hybrid vehicles, while Morgan Stanley’s growth is linked to the anticipation of a potential second presidency for Donald Trump.

The recent market fluctuations have highlighted the importance of investor sentiment and the need for a diversified portfolio. By carefully monitoring market trends and seizing opportunities in emerging sectors, investors can navigate the changing landscape of the stock market. While short-term gains can be enticing, it is essential to consider the long-term outlook for each investment. Companies like Apple and Stanley Black & Decker, with promising developments in artificial intelligence and housing market activity, respectively, offer potential for sustained growth in the future.

The recent performance of the stock market reflects a combination of factors, including Federal Reserve speculation, market rotation, and individual company developments. By staying informed and adopting a cautious yet optimistic approach to investing, investors can capitalize on emerging trends and position themselves for long-term success in the stock market. It is essential to conduct thorough research, diversify portfolios, and remain vigilant in monitoring market conditions to make informed investment decisions.