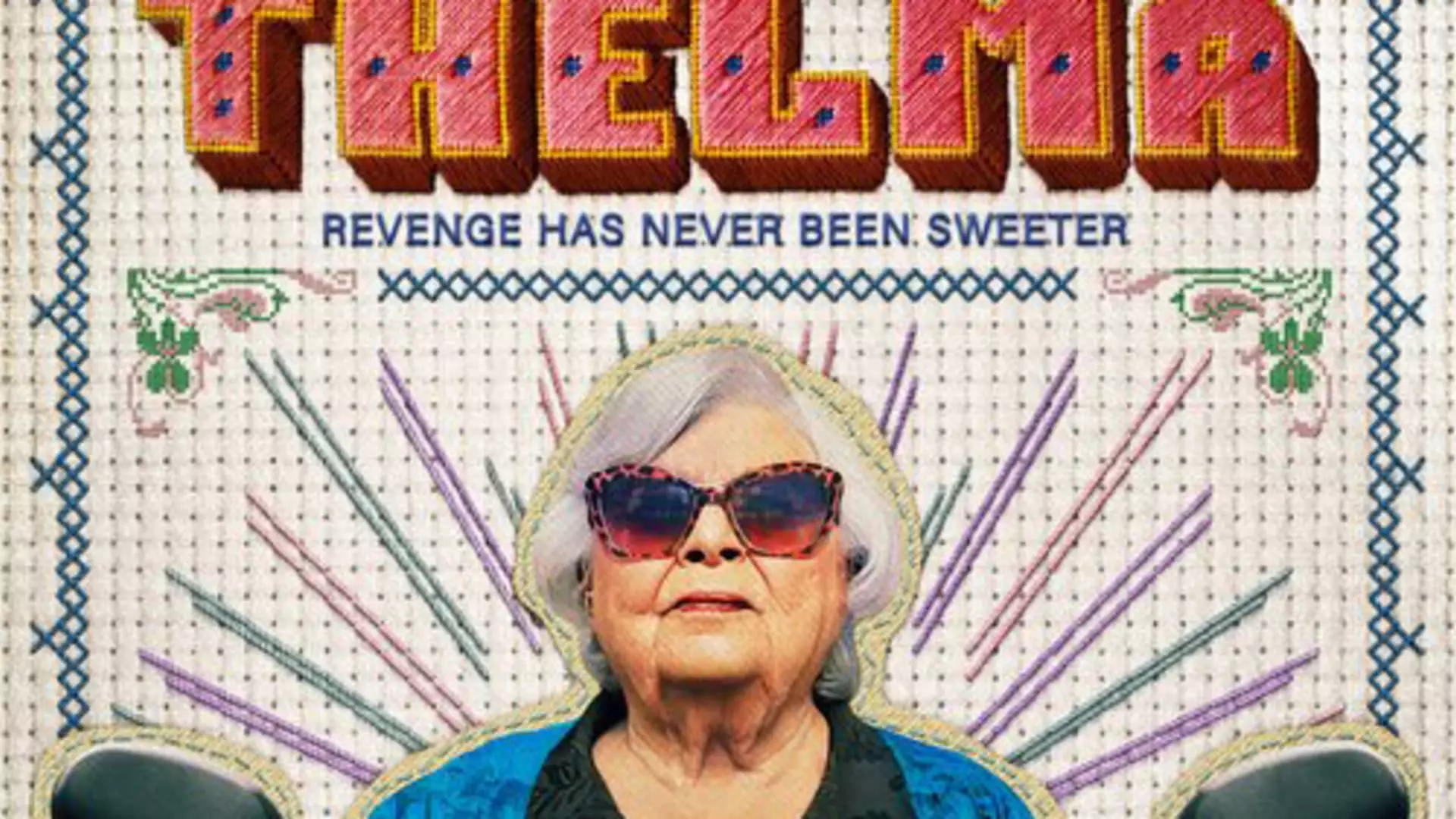

The movie “Thelma” presents a story of a 93-year-old grandmother who falls victim to a scam call from someone claiming to be her grandson in need of financial help. While this scenario was fictionalized for the big screen, the reality of such scams, known as grandparents’ scams or family emergency scams, is more prevalent than we may think. Imposter fraud, as seen in the movie, reached nearly $2.7 billion in total losses last year, according to the U.S. Federal Trade Commission.

With the advancements in artificial intelligence, scammers have found it easier to manipulate and deceive individuals, especially the elderly, into believing their distress calls are genuine. The use of generative AI allows scammers to mimic voices and create realistic scenarios that trigger fear and urgency among victims. Social media platforms have become breeding grounds for scammers to harvest information and create personalized scams designed to manipulate individuals into sending money quickly.

Older adults, like Thelma in the movie, are often targeted by scammers due to their decreased cognitive flexibility and slower decision-making process. Fear and urgency tactics are commonly used by scammers to exploit the vulnerability of older adults. However, it’s essential to note that younger individuals who spend significant time online are also at risk of falling victim to scams due to the increased exposure to fraudulent activities and impersonation online.

Having a conversation with older loved ones about the risks of being scammed can be challenging, as seen in the movie with Thelma struggling to accept help and acknowledge her vulnerabilities. Establishing an aging plan and involving other family members in the discussion can help mitigate the risks and ensure that there is a support system in place to prevent financial exploitation.

In addition to having conversations about aging and vulnerability, implementing basic security practices can serve as a barrier against scams. Measures such as freezing credit, setting up multifactor authentication, and investing in identity theft insurance can help protect personal information and prevent unauthorized access to financial assets.

The rise of grandparents’ scams in the age of AI poses a significant threat to individuals, especially the elderly. By staying informed, engaging in proactive conversations, and implementing security measures, we can safeguard ourselves and our loved ones from falling victim to these malicious scams. It is crucial to remain vigilant and cautious when receiving unsolicited calls or messages, as scammers continue to adapt and evolve their tactics to deceive unsuspecting individuals.