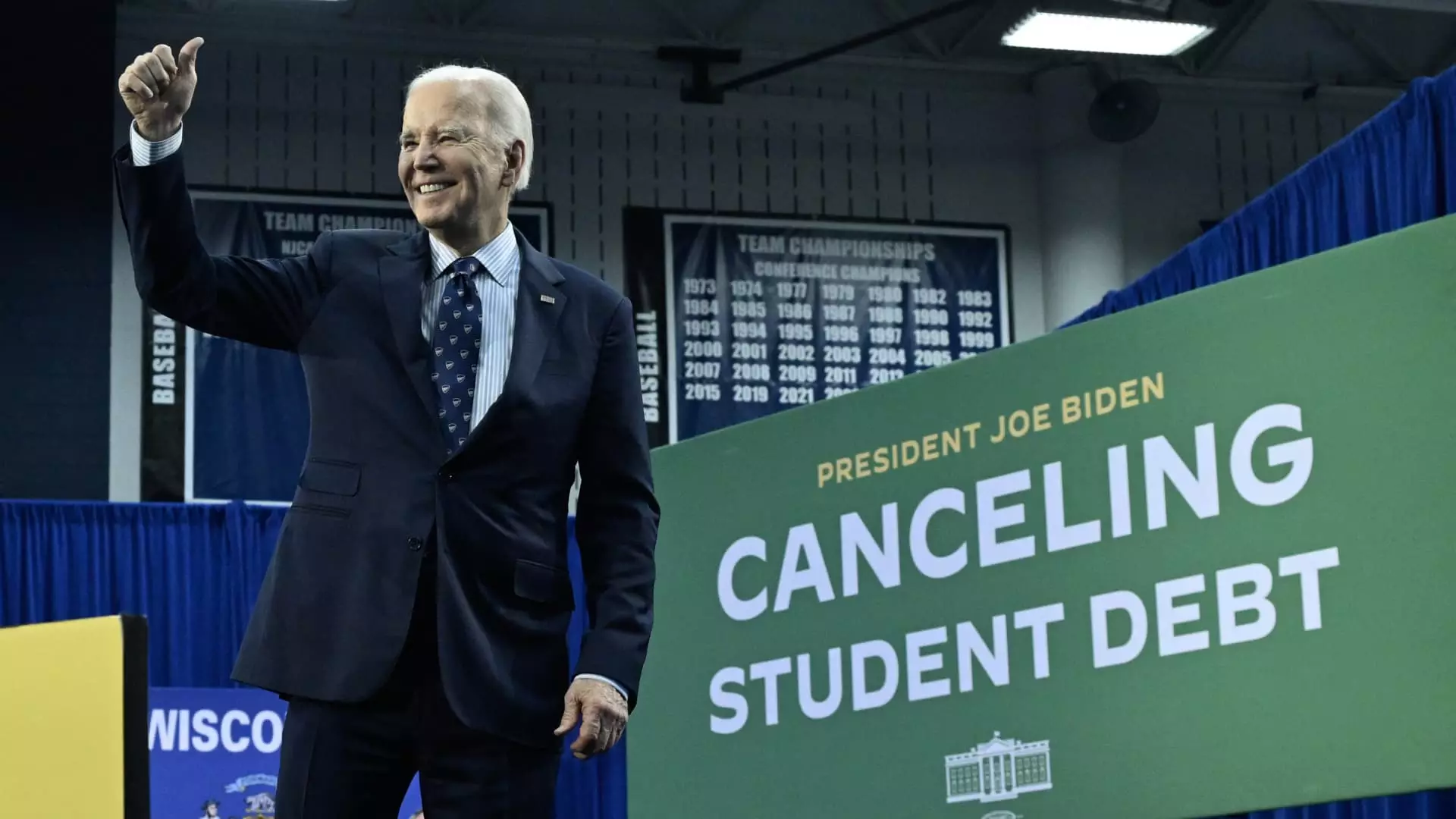

President Joe Biden’s student loan relief plan, known as the Saving on a Valuable Education (SAVE) plan, has faced legal challenges recently. However, a federal appeals court decision from the 10th Circuit U.S. Court of Appeals has allowed a key provision of the plan to resume. This decision is seen as a major win for Biden, as the SAVE plan has been his biggest accomplishment in delivering relief to student loan borrowers.

The SAVE plan has already attracted around 8 million borrowers who have signed up for the new income-driven repayment plan. Under SAVE, borrowers only have to pay 5% of their discretionary income towards their debt each month, with those making $32,800 or less having a $0 monthly payment. This is a significant reduction compared to other income-driven repayment plans where borrowers pay 10% or more of their discretionary income.

Despite the recent ruling in favor of the Biden administration, there are still legal challenges against the SAVE plan. A federal judge in Kansas issued an injunction blocking the plan from lowering borrowers’ monthly payments, while a judge in Missouri issued a separate injunction preventing the forgiveness of student debt under the plan. These injunctions are a result of lawsuits filed by Republican-led states, arguing that the administration was exceeding its authority with the SAVE plan.

The Justice Department is expected to appeal the decision from Missouri and continue to defend the SAVE plan. As of mid-April, 360,000 borrowers had already received $4.8 billion in debt relief under the plan, highlighting its significant impact on student loan borrowers. Moving forward, the Biden administration will continue to face challenges in implementing the SAVE plan, but the recent court ruling is a positive step towards providing much-needed relief to millions of borrowers.

The future of Biden’s student loan relief plan remains uncertain due to ongoing legal challenges. However, the recent appeals court decision is a significant victory for the administration and a step towards fulfilling Biden’s promise of delivering relief to student loan borrowers. With millions already benefiting from the SAVE plan, the impact of this initiative cannot be understated in addressing the student debt crisis in the country.