Cody Gude, a 35-year-old resident of Tampa, Florida, was eagerly anticipating his student loan payments dropping from $200 to $100 in July. This decrease in payment meant that he would no longer have to work extra hours delivering groceries on Instacart. However, his relief turned to disappointment when federal judges in Kansas and Missouri put major parts of the Saving on a Valuable Education (SAVE) plan on pause. The new repayment plan introduced by the Biden administration was temporarily halted until further legal rulings were made, leaving millions of student loan borrowers in limbo.

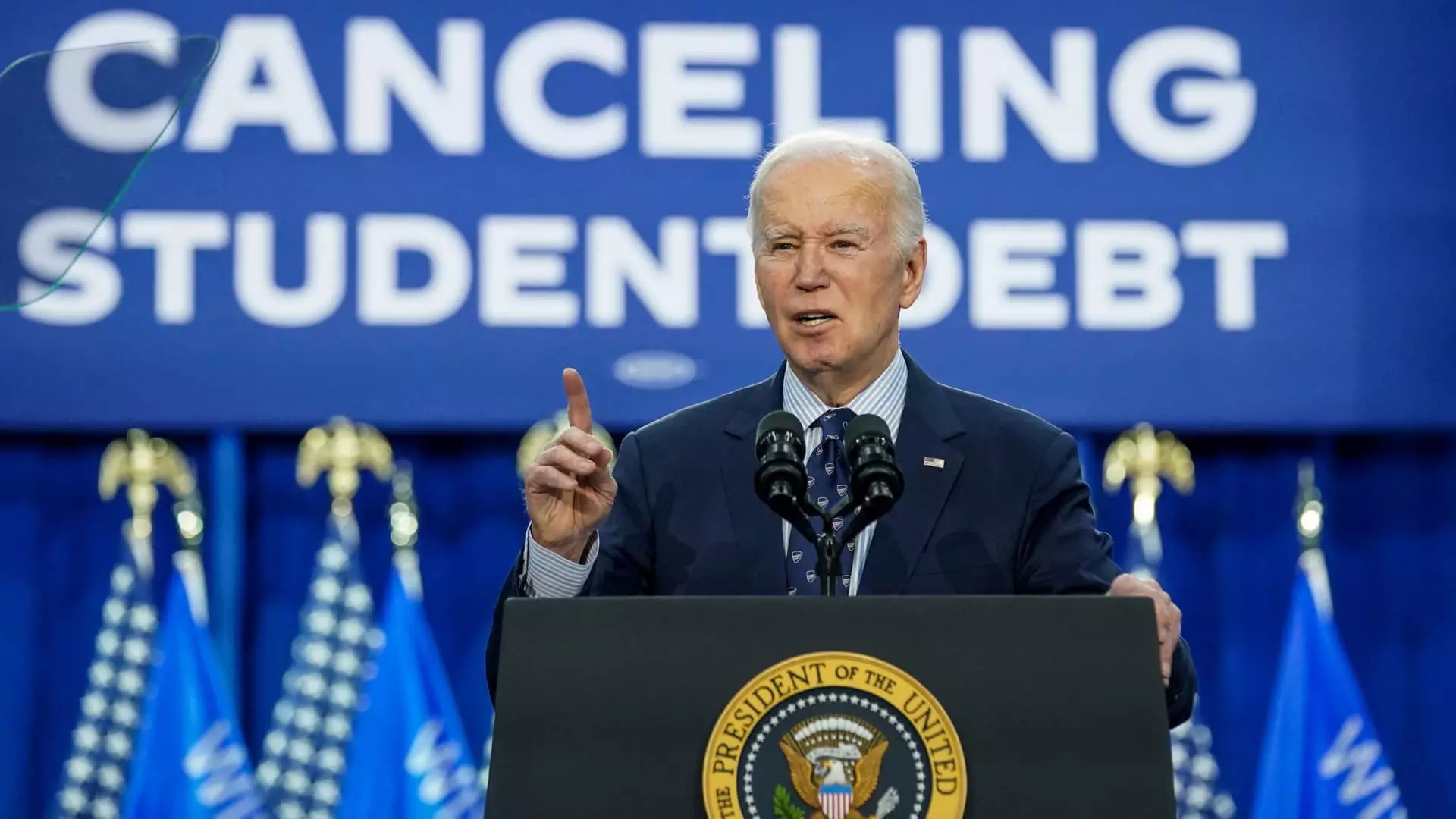

President Joe Biden introduced the SAVE plan last summer, touting it as the most affordable student loan plan ever. The plan aimed to help borrowers by reducing their monthly payments based on income. Under the new plan, borrowers were required to pay just 5% of their discretionary income towards their debt, as opposed to the previous 10% under the Revised Pay As You Earn (REPAYE) plan. The terms of the SAVE plan were considered generous, with some borrowers having $0 monthly payments and others qualifying for loan forgiveness in as little as 10 years.

Several Republican-led states, including Florida, Arkansas, and Missouri, filed lawsuits against the SAVE plan, arguing that the Biden administration was overstepping its authority. The federal judges in Kansas and Missouri responded by temporarily halting the implementation of certain provisions of the plan. The judges raised concerns about the significant cost difference between the previous REPAYE plan and the new SAVE plan, stating that the latter represented an enormous and transformative expansion in regulatory authority without clear congressional authorization.

While borrowers are currently allowed to remain enrolled in the SAVE plan, the legal challenges surrounding its implementation have created confusion and uncertainty. Many borrowers who were expecting lower monthly payments are now unsure of what their future payments will look like. Scott Buchanan, the executive director of the Student Loan Servicing Alliance, believes that the legal cases could drag on for months, potentially reaching the Supreme Court. Borrowers are advised to stay informed about the developments in the legal case and be prepared for their monthly payments to revert back to their June levels.

The halt of the SAVE plan has left many student loan borrowers in a state of confusion and disappointment. While the plan was intended to provide relief to borrowers struggling with student loan debt, legal challenges have delayed its full implementation. As the cases progress through the legal system, borrowers are advised to stay informed about any changes to their monthly payments and be prepared for potential fluctuations in their financial obligations.