Nvidia’s recent surge in stock prices is poised to have a significant impact on the Technology Select Sector SPDR Fund (XLK) as it is set to acquire more than $10 billion worth of shares of the chip giant. This acquisition will lead to a major reshuffling of the fund’s holdings, with a considerable reduction in Apple’s position. According to Matthew Bartolini, head of SPDR Americas Research, Microsoft will emerge as the top stock in the index, followed closely by Nvidia, and then Apple.

Currently, the top three stocks in the XLK are set to have weights above 20% each, in the absence of any caps. However, diversification rules within the index limit the cumulative weight of stocks with at least a 5% share of the fund, leading to adjustments in the weights. As a result, Microsoft and Nvidia are projected to have a weight of around 21%, while Apple’s weight is expected to plummet to approximately 4.5%, a significant decrease from its prior position.

The race to secure a top position in the XLK came down to the wire, with all three companies boasting market caps exceeding $3.2 trillion, separated by a mere $50 million. The rebalance of the XLK, which has assets under management totaling about $71 billion, translates to a substantial shift amounting to more than $10 billion. The extreme revaluation of the XLK showcases how passive index funds can deviate, particularly when focusing on specific market segments.

The impending rebalance of the XLK highlights the importance of understanding how index weights are determined and how rebalances can impact fund exposures. Bartolini emphasizes the significance of being aware of allocation strategies and rebalance frequencies as these factors can contribute to differences in fund compositions. The Technology Select Sector Index, which the XLK follows, utilizes a float-adjusted calculation to ascertain market capitalization, with the rebalancing set to come into effect at the end of the week.

The market cap calculation used in the index accounts for free-float adjustments to accommodate large holders of individual stocks who may not actively trade on a daily basis. For instance, Warren Buffett’s substantial ownership stake in Apple through Berkshire Hathaway influences the free-float market capitalization of Apple, potentially impacting its weight in the index. Despite Apple’s potential outperformance compared to Nvidia in the interim, the rebalance will persist for a quarter.

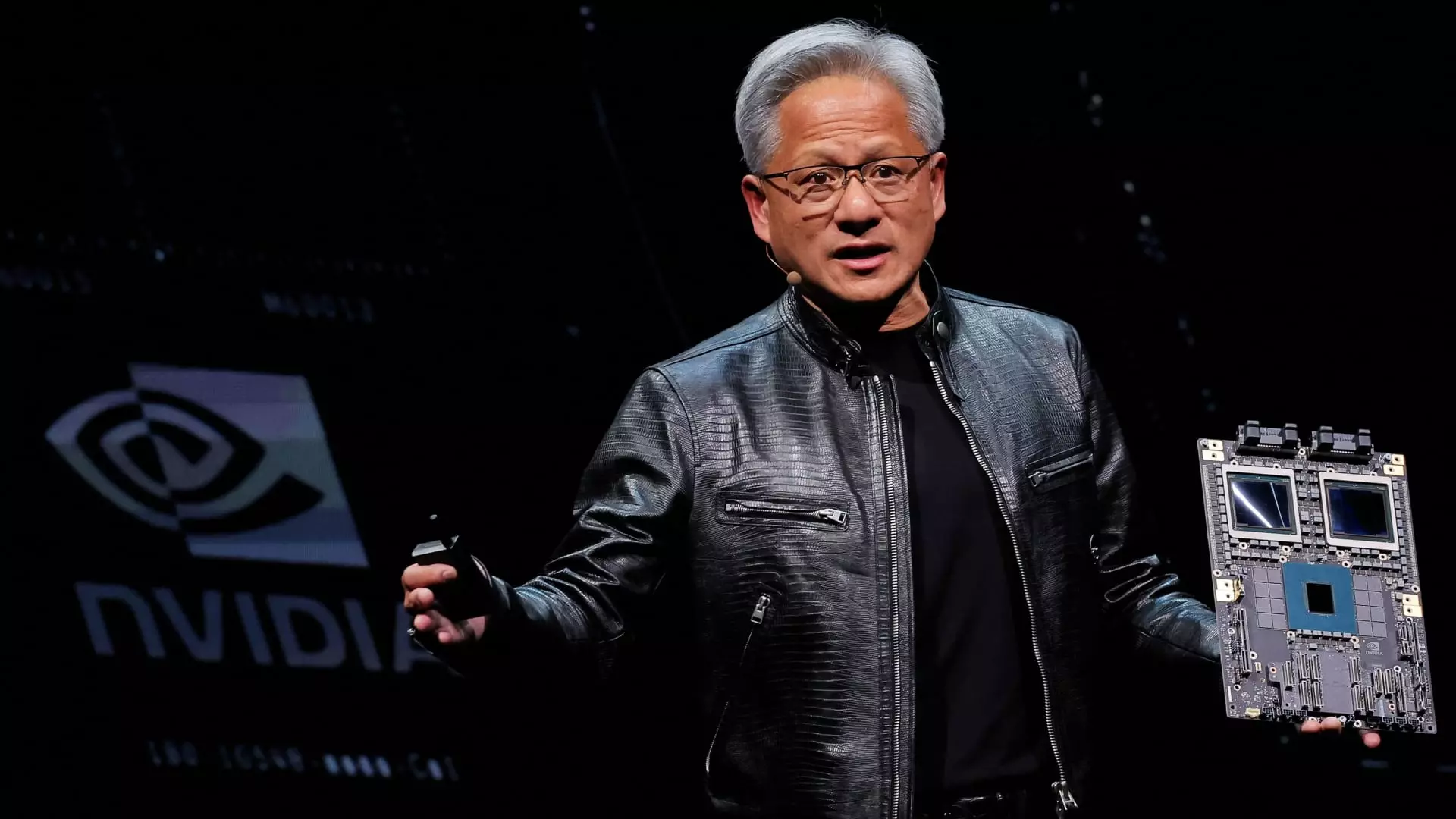

The significant rally experienced by Nvidia has triggered a substantial shakeup in the XLK’s holdings, prompting a reevaluation of weight distributions among the top stocks in the index. As the rebalance takes effect, it underscores the dynamic nature of index funds and the need for investors to closely monitor changes in allocations and exposures within ETFs. The impact of Nvidia’s rally serves as a vivid example of how market developments can swiftly alter the composition and weighting of investment portfolios, highlighting the complexities inherent in passive index investing.