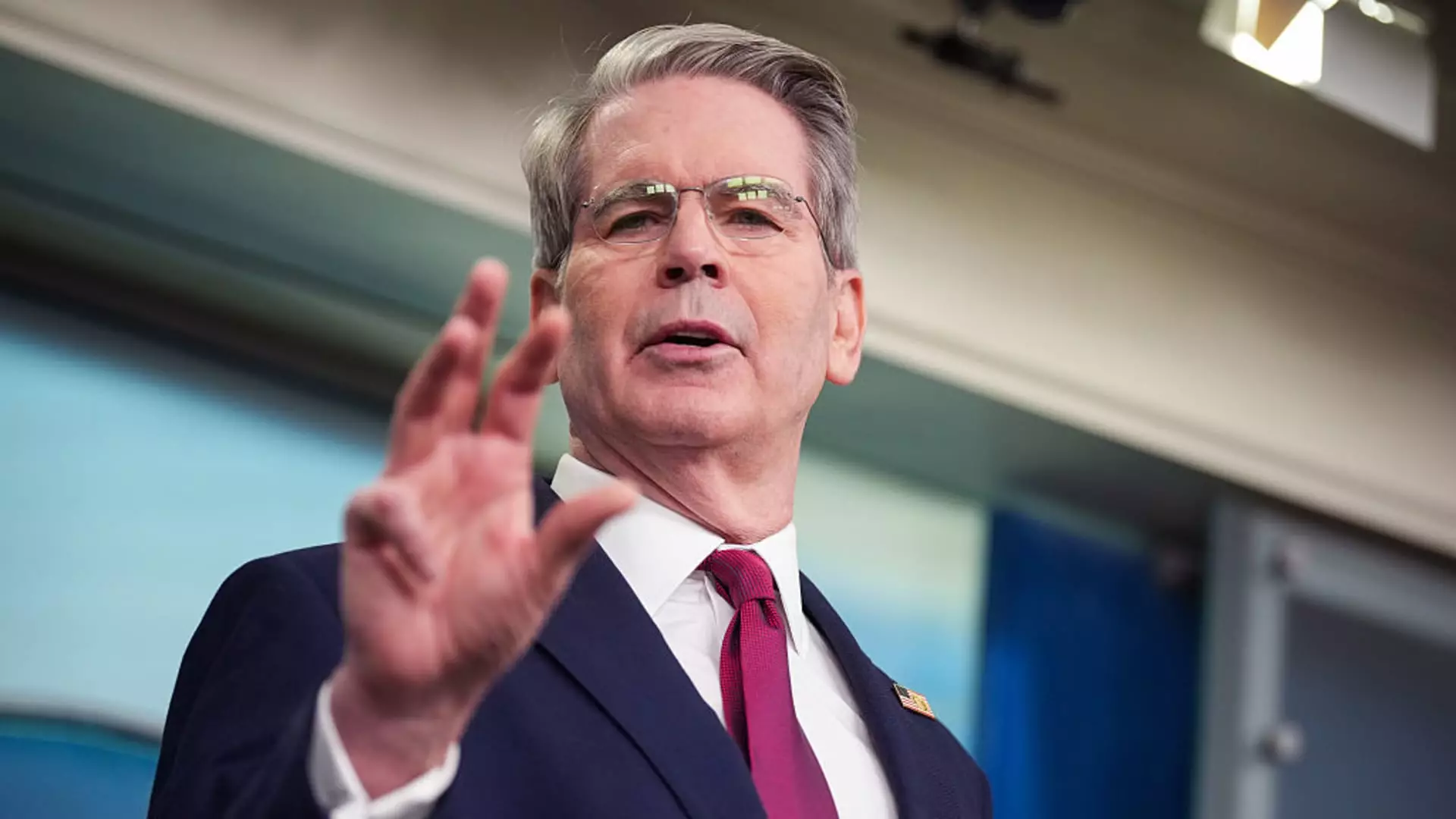

In a recent statement, Treasury Secretary Scott Bessent asserted that individual investors have remarkably maintained their positions during the recent market upheaval, showcasing a steadfast trust in President Trump’s controversial tariff policy. While it is indeed commendable that individual investors have not succumbed to the waves of panic that have overwhelmed institutional traders, one can’t help but wonder if this faith is strongly placed or merely wishful thinking. The numbers presented by Bessent tell a partial story; despite 97% of Americans holding off on trades according to Vanguard, what does this silence imply about the market’s already shaky foundation?

The Disconnect Between Retail and Institutional Investors

Bessent’s comments reveal a notable disconnect—instead of unison between retail investors and the broader economic outlook, we see a dichotomy. Institutional investors, armed with data and market forecasts, have opted for caution, reacting to tumultuous events with bearish strategies. The panic from hedge funds and other professional traders signals an unsettling reality that individual investors seem blissfully detached from. While retail investors view Trump’s tariffs as a temporary hurdle, experienced investors recognize the potential long-term implications—tariffs that do not merely upset markets but can ultimately hurt consumers and inhibit economic growth.

The Tariff Debacle: Short-Term Gains vs. Long-Term Pain

The ramifications of Trump’s tariffs have led to a disarray not witnessed since the pandemic’s onset. Market adjustments have spiraled into a bear market frenzy, ironically countered by retail buyers seeking value in depressed stocks. Yet, this strategy of chasing cheap stocks may backfire as persistent tariffs loom—I fear it is a classic case of short-term greed overshadowing long-term economic prudence. As we witness professional traders dash for cover, one must question whether individual investors are truly acting on informed conviction or merely chasing a mirage of stability.

Consumer Confidence at Risk

Torsten Slok, chief economist at Apollo, foresees a summer recession spurred by the consequences of these tariffs, which will inevitably lead to rising consumer prices and shortages. This invites a troubling question: Can consumer confidence withstand such economic strain amidst a trade war? Should the average investor, who still holds faith in Trump’s policies, not prepare for an imminent reality where prices soar and choices dwindle?

The Unraveling of America’s Global Brand

Ken Griffin, CEO of Citadel, warns that this global trade clash threatens not just market stability but also the very “brand” of the United States. The allure of U.S. Treasury debt, which has long stood as a haven for global investors, may falter amidst rising skepticism. At this crucial juncture, the collective nightmare of economic instability brought on by these aggressive tariff strategies could redefine America’s place on the international stage, a trend that no individual investor’s steadfastness can ignore.

As individual investors stand their ground amid turmoil, one cannot help but question the wisdom of their unwavering confidence in Trump’s policies. This time may herald a hard lesson about the risks tied to blind faith in leadership without thorough contemplation of the complexities at hand.