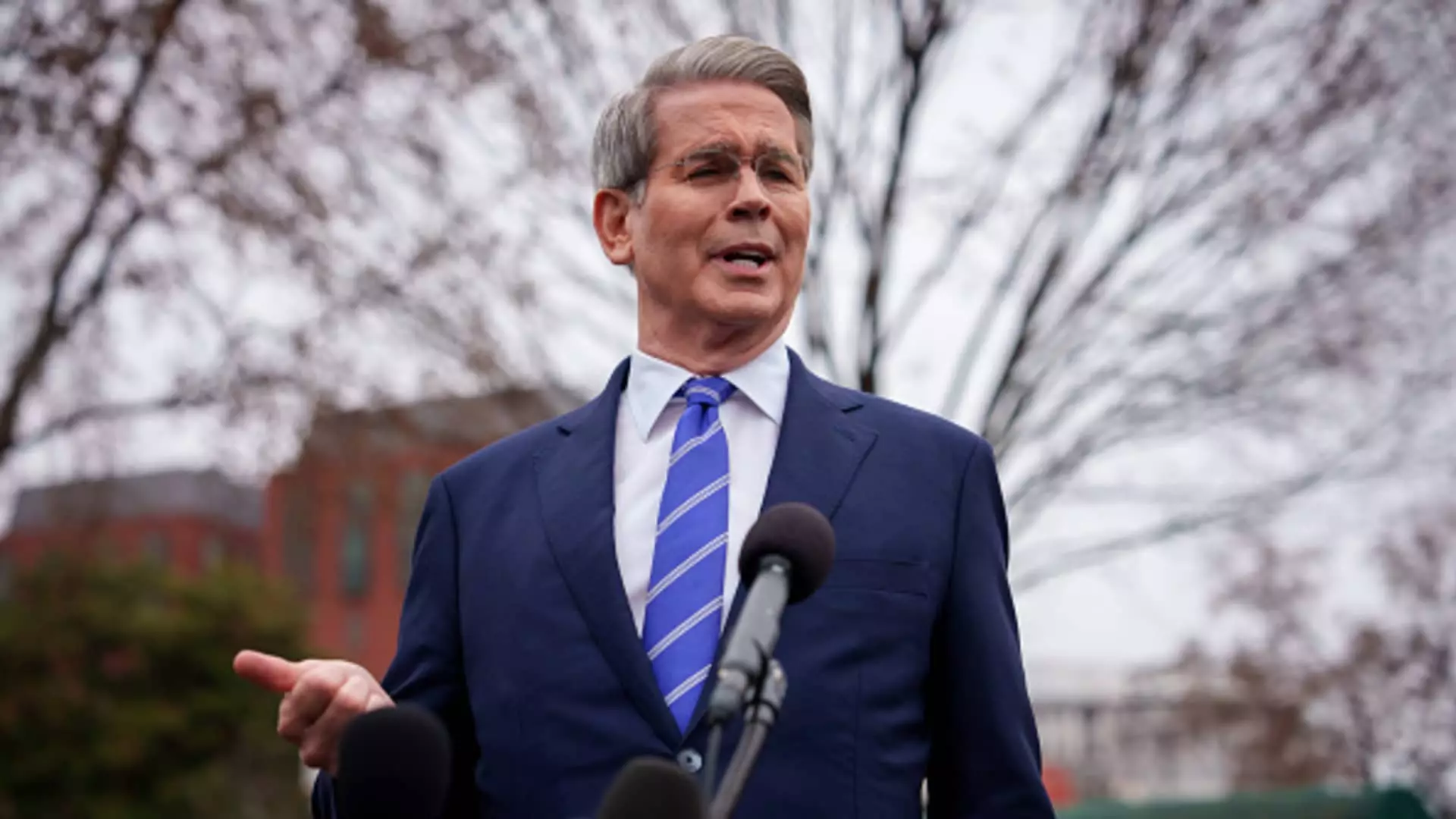

In recent market events, the spotlight has been on the so-called ‘Magnificent 7’—the tech titans that have dominated stock indexes and investor sentiments alike. However, as investors witness a dramatic sell-off in the tech sector, characterized by a staggering 13% decline from a record high, the narrative of invincibility surrounding these major companies is painfully unraveling. Treasury Secretary Scott Bessent claims the catalysts for this decline stem not from the repercussions of protectionist trade policies, particularly those introduced by the Trump administration, but instead from increased competition in the burgeoning world of artificial intelligence, notably following the rise of Chinese startup DeepSeek.

Blaming the Wrong Bogeyman

Bessent’s assertion that the market’s turmoil is a “Mag 7 problem, not a MAGA problem” is disappointingly reductive. While it’s easy to dismiss political policies as an influence, one cannot ignore the broader economic ramifications these actions carry. The aggressive stance on tariffs certainly rattled investor confidence, triggering a near 4% drop in S&P 500 futures and shedding significant points from the Dow Jones Industrial Average. It feels almost disingenuous to claim that the market’s struggles are strictly internal; the interconnectedness of global trade means that decisions made in Washington D.C. tout weighty consequences for businesses and investors across the board.

DeepSeek: A Game Changer or Market Disruptor?

The rise of DeepSeek has sparked speculation and trepidation among traditional tech giants, exposing vulnerabilities that were once hidden beneath layers of aggressive market capitalizations. Investors have pinned their hopes on the multibillion-dollar investments that these companies are pouring into AI technologies, but DeepSeek’s offerings, marketed as not just cheaper but potentially superior, challenge the very foundation of that optimism. What does it say when an upstart can destabilize technological giants that have reigned supreme for so long? The impact is far from superficial; it raises critical questions about the sustainability of the current tech-driven economic model and whether we are on the cusp of a shake-up that could redefine competitive landscapes.

The Tariff Tidal Wave

Even aside from the immediate impacts of competing technologies, Bessent’s nonchalance regarding the effects of tariffs is troubling. The imposition of steep duties on imports poses a dual threat: not only does it disrupt supply chains, but it also has the potential to stoke inflation and further slow down economic growth—exactly the kind of environment that breeds investor insecurity. The market faltering in response to tariff news underscores that businesses that rely on global supply chains or international markets are at the mercy of government policy. Ignoring this interplay neglects a fundamental truth about the economy: intertwined interests yield entwined consequences.

Looking Ahead: An Uncertain Horizon

In a time where consumer tech is increasingly intertwined with international relations and broader economic policies, it is imperative to adopt a holistic view of market dynamics. The ‘Magnificent 7’ might have been poised for unprecedented growth, but as the landscape shifts with the rise of challengers like DeepSeek, the future appears far less certain. Economists, investors, and policymakers must grapple with the reality that not all losses can be placated at the behest of one entity or its policies. Transformational shifts are underway, and ignoring or downplaying them could lead policymakers down a perilous path that neglects the multifaceted realities of today’s economic sheer complexity.