As the global tech landscape continues to evolve, Nvidia Corporation has once again showcased its strength in fiscal Q4 2024 results, surpassing expectations and solidifying its stature as a leader in the artificial intelligence (AI) chip segment. The company’s robust performance reflects its extensive capabilities in meeting both current and anticipated market demands. However, a closer analysis reveals complexities and marks a shift that could impact its future growth trajectory.

Robust Revenue Growth Amid a Challenging Climate

Nvidia reported a remarkable revenue of $39.33 billion, exceeding analysts’ predictions of $38.05 billion. This substantial growth of 78% over the previous year underscores Nvidia’s dominance in AI-driven sectors. The market has increasingly relied on Nvidia’s cutting-edge graphics processing units (GPUs), particularly within data centers, which have turned into a major growth driver. The full fiscal-year revenue crescendoed to $130.5 billion, a staggering increase of 114%, highlighting the company’s successful penetration into the AI space.

Yet, while the numbers reflect an impressive performance, there’s an undeniable deceleration in growth rates compared to the staggering 262% from the previous year for the same quarter. This slowdown raises critical questions about Nvidia’s ability to sustain its growth pace as the company matures and scales. The challenge lies not just in market dynamics but also in potential saturation within key segments, as demand shifts and new competitors arise.

Blackwell: The Catalyst for Future Growth

Key to Nvidia’s future is the anticipated ramp-up of its next-generation AI chip, Blackwell. CFO Colette Kress has indicated that the company expects a “significant ramp” in sales, an assertion supported by a projected revenue of approximately $43 billion for the upcoming first quarter. Blackwell’s sales accounted for $11 billion in the fourth quarter and were largely driven by large cloud service providers, which made up about 50% of data center revenue. This suggests that Nvidia is not only staying attuned to AI advancements but is also adapting its strategies to align with evolving consumer needs.

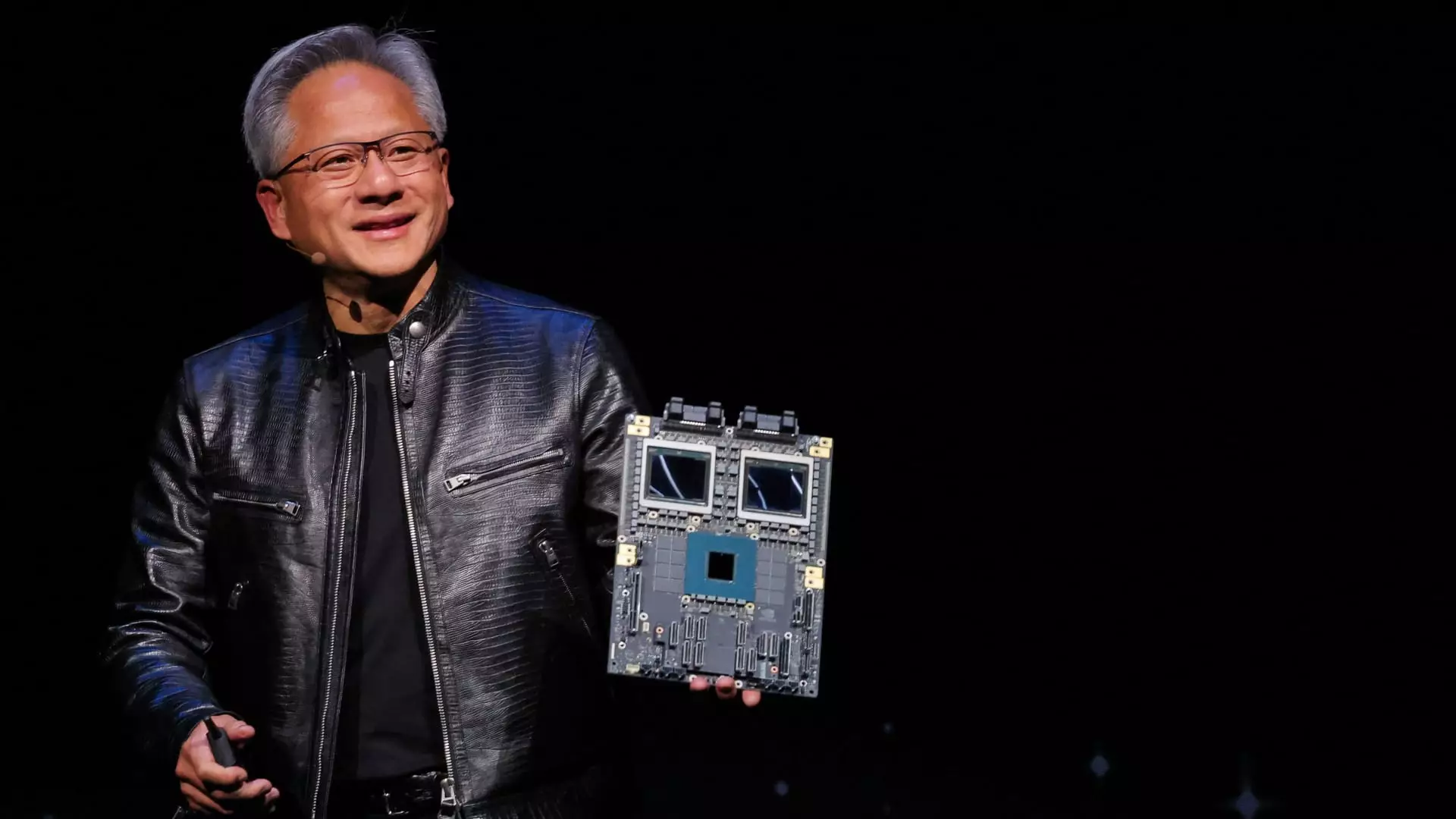

However, the path ahead is not devoid of challenges. As Nvidia faces emerging competitors, particularly from tech behemoths like Amazon and Google, there could be implications for its market dominance. Jensen Huang, the CEO, alluded to these competitive threats, emphasizing that designing chips is just one aspect and actual deployment presents its own complexities. This suggests a nuanced landscape in which operational execution and innovation will play pivotal roles in maintaining Nvidia’s competitive edge.

With a gross margin of 73%, down from 76% a year ago, Nvidia also flagged concerns regarding its profitability amidst its growth surges. The downward trend in gross margins is attributable to the complexities and costs associated with new data center products. As the industry matures, persisting margins at current levels while expanding service offerings and managing operational costs will be imperative.

The company’s venture into sectors like automotive—where it reported an impressive 103% year-over-year revenue growth—highlights its strategy to diversify. However, automotive revenue remains a minor component of its overall business structure, prompting discussions about the need for robust growth sources beyond its traditional strengths in AI. While AI remains a significant revenue generator, Nvidia must navigate these adjustments to sustain its compelling narrative.

Investors have traditionally held high expectations for Nvidia, and while the fourth-quarter results exceeded market estimates, the future remains uncertain. Concerns regarding potential market saturation, alongside a deceleration in revenue growth, could temper optimism and lead to cautious sentiment within investor circles. Nvidia’s historical rapid growth has fueled demand for its stock, and any faltering could influence broader market perceptions.

The competitive pressures intensify with new technologies emerging that seek to challenge Nvidia’s supremacy in the AI hardware market. As outlined by Kress, the uptake of innovative AI applications that require unprecedented computing power could present both challenges and opportunities. There’s potential for Nvidia to extend its offerings and develop new markets; however, agile responses and strategic foresight will be critical.

Nvidia’s fiscal fourth-quarter earnings depict a company at a pivotal juncture. The exceptional growth in revenue and the promising horizon defined by innovations like Blackwell affirm its leadership in AI. Nevertheless, the implications of a slowing growth trajectory, margin pressures, and fierce market competition necessitate critical navigation in the upcoming quarters. Nvidia’s ability to adapt and pivot in this rapidly evolving environment will dictate whether it continues to thrive as a dominant force in the tech industry. As it stands, while the past quarter’s performance has undoubtedly reinforced Nvidia’s credibility, the future hinges on its strategic execution and response to a complex, dynamic market landscape.