Super Micro, a major player in the server manufacturing sector, has encountered turbulent waters that have led to a staggering drop in its stock price. On a particularly grim Wednesday, shares plummeted by 22%, marking their lowest point since May of the previous year. The stock’s decline materialized in response to the company’s release of disappointing and unaudited financial results, compounded by its failure to outline a viable plan to maintain its listing on the Nasdaq exchange. Notably, Super Micro’s market value has diminished by approximately $57 billion from its peak earlier in March, a staggering 82% decrease that raises alarms among investors.

The resignation of Ernst & Young, the firm’s auditor, has further exacerbated the situation. This development signals significant challenges for the company, as Ernst & Young becomes the second accounting firm to sever ties with Super Micro in less than two years. Accusations from activist investors regarding accounting irregularities and violations of export controls deepened the rift, creating an environment of distrust and uncertainty in the market. Super Micro’s inability to file audited financials since May has placed it at risk of being delisted from Nasdaq if it doesn’t submit its fiscal year results to the Securities and Exchange Commission (SEC) by mid-November.

In light of the company’s dismal financial reporting and the concerning developments, analysts have begun to reassess their outlook on Super Micro. Mizuho announced that it would suspend coverage of the stock, citing insufficient detailed and audited financial statements as the primary reason. Meanwhile, Wedbush analysts, who have maintained a hold rating, expressed their concerns about the company’s precarious situation, emphasizing that the management’s focus seems to lie primarily on finding a new auditor rather than addressing the core issues exposed by the initial resignation. The analysts’ comments reflect a broader sentiment of skepticism surrounding Super Micro’s ability to navigate these tumultuous waters and restore trust among stakeholders.

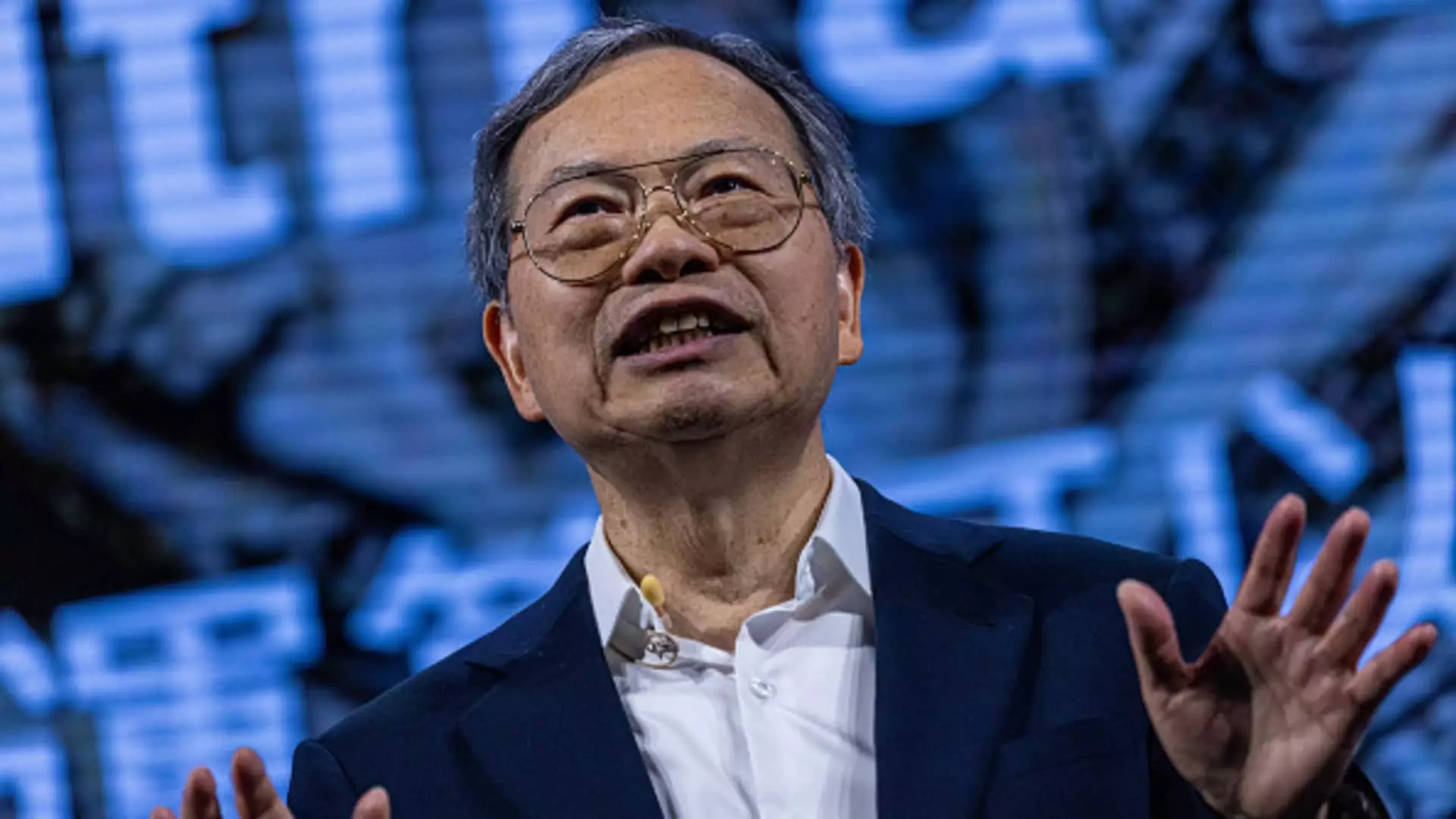

CEO Charles Liang attempted to reassure investors by emphasizing the company’s urgency in resolving its reporting issues and securing a new auditor. However, given the company’s leadership challenges and the churning of its financial practices, many investors are left wondering whether these reassurances are sufficient to stabilize the ship.

Despite the financial upheaval, Super Micro’s underlying business remains strong, showcasing impressive annual growth. The company announced preliminary revenue figures for the first fiscal quarter, projecting net sales between $5.9 billion and $6 billion. While this revenue falls short of analysts’ expectations of $6.45 billion, it represents a commendable 181% growth compared to the same quarter last year. This growth can largely be attributed to Super Micro’s role as a key supplier of servers equipped with Nvidia processors, a cornerstone in the booming artificial intelligence sector.

Liang highlighted the robust demand for Nvidia’s latest GPU, known as Blackwell, asserting that the company is prepared for production, but is currently hindered by insufficient supply of new chips. This reliance on Nvidia points to the interconnected nature of the tech industry, where the fortunes of one company can rapidly influence another.

However, lingering questions arose regarding the company’s strategy moving forward, especially concerning the potential risk that rival firms could gain access to Nvidia’s processors at Super Micro’s expense. The CFO, David Weigand, attempted to alleviate these concerns by emphasizing the strong relationship between Super Micro and Nvidia, assuring analysts that no changes had been made to product allocations and that multiple state-of-the-art projects are on track.

Looking Ahead: The Path to Stability

As Super Micro grapples with its current predicament, expectations for the upcoming December quarter remain subdued, with revenue projections between $5.5 billion and $6.1 billion—a stark contrast to analysts’ average estimates of $6.86 billion. Additionally, adjusted earnings per share are anticipated to be lower than expected, further underscoring the company’s struggle to regain footing.

In response to the concerns raised by Ernst & Young, Super Micro’s board of directors has initiated a special committee to investigate the claims made during a three-month inquiry. The committee, however, reported finding “no evidence of fraud or misconduct” from management, a statement that aims to assuage investor fears but may not be sufficient to restore confidence in light of recent events.

While Super Micro’s operational capabilities may reflect a growth trajectory buoyed by AI demands, the company’s financial governance and auditor volatility create uncertainty that could undermine its recovery efforts in this highly competitive landscape. The coming months will be critical for Super Micro as it strives to rectify its financial reporting deficiencies and regain investor confidence.