AppLovin, a prominent player in the online gaming and advertising space, witnessed an extraordinary surge in its stock price, soaring by 45% on a Thursday, primarily following the release of financial guidance and earnings that far exceeded market expectations. By early afternoon trading, shares eclipsed the $245 mark, marking a staggering 515% increase since the start of the year. This phenomenal performance places AppLovin at the forefront of the technology sector, outpacing its peers valued at $5 billion or more, which is pivotal given the competitive nature of the industry.

In the third quarter, AppLovin reported a revenue increase of 39%, achieving $1.2 billion. This exceeded the anticipated average estimate of $1.13 billion, illustrating a robust financial health and operational efficiency. Additionally, the company’s earnings per share totaled $1.25, which significantly outperformed the expected 92 cents. These figures not only demonstrate the company’s growth trajectory but also reinforce its strategic positioning in an evolving market landscape. The projected revenue for the fourth quarter, anticipated to range from $1.24 billion to $1.26 billion, indicates sustained growth momentum that encourages investor confidence.

AppLovin’s success can be largely attributed to its advancements in artificial intelligence, particularly through its advertising platform, AXON. Introduced in a new version over a year ago, AXON has revolutionized AppLovin’s advertising capabilities by enhancing ad targeting efficacy, thereby driving revenue growth not just for its games but also for other developers utilizing the technology. The software platform alone saw a remarkable revenue spike of 66%, reaching $835 million, showcasing how technological investments are yielding substantial returns.

While the increasing revenue figures are impressive, it is AppLovin’s profitability that truly captivates Wall Street’s attention. The company reported a net income of $434.4 million, a staggering 300% rise from the previous year, equating to earnings of $1.25 per share. The adjusted profit margin of the software platform reaching 78% highlights not just growth, but efficient management of expenses, a combination that investors find particularly appealing. Analysts from Wedbush are bullish on the stock’s prospects, recommending it as a buy, which further demonstrates growing investor optimism.

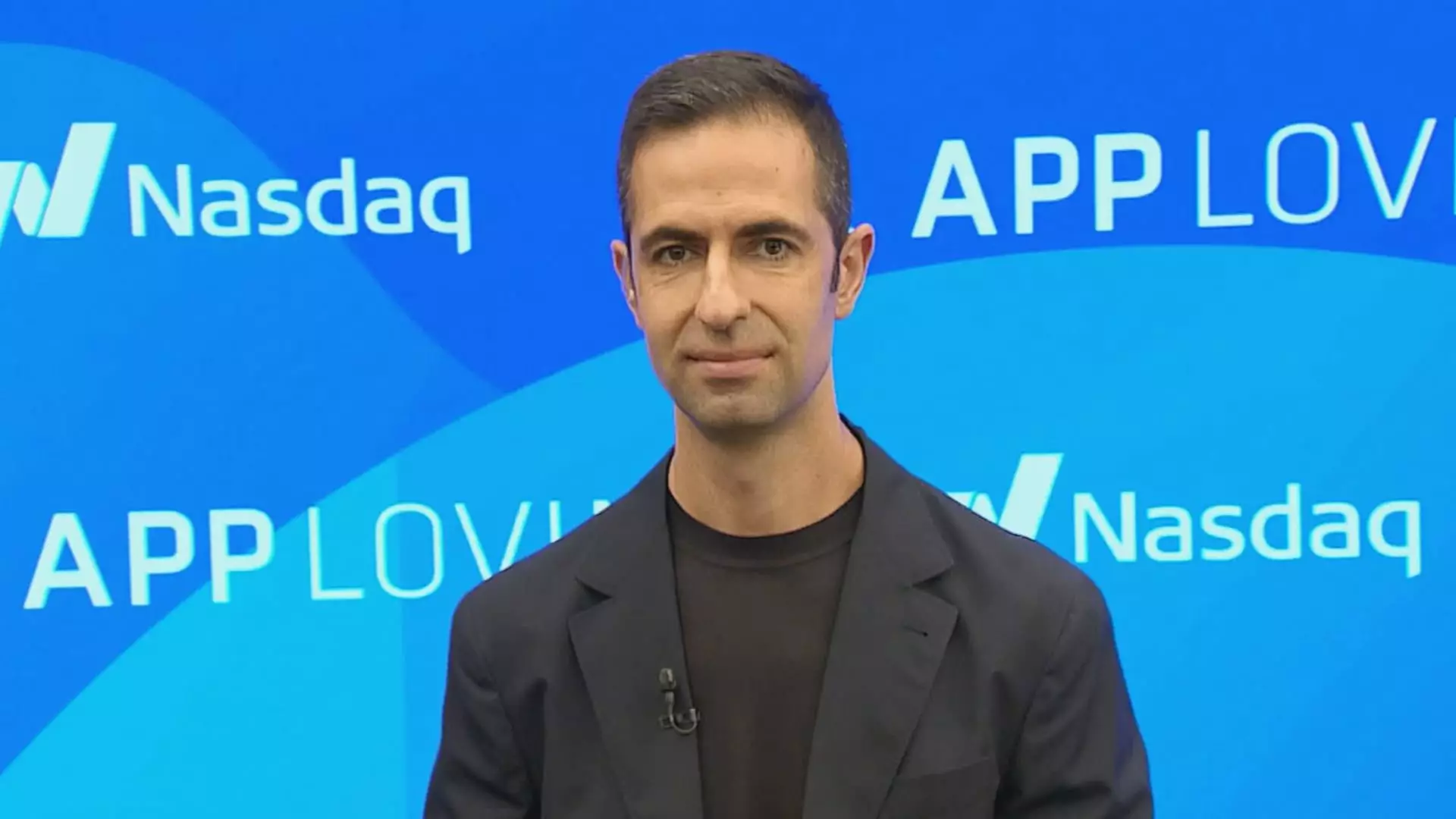

Looking ahead, AppLovin continues to explore new avenues for revenue generation, including a pilot e-commerce initiative aimed at enhancing targeted advertising in games. This project could potentially unlock fresh revenue streams while complementing the existing business model. CEO Adam Foroughi expressed confidence in the product’s potential, reflecting a forward-thinking strategy that leverages core competencies in ad technology.

AppLovin’s remarkable ascent illustrates not only the power of innovative technology in boosting business performance but also the critical importance of financial health and strategic growth in ensuring market leadership. As it navigates the evolving landscape of online gaming and advertising, its commitment to leveraging AI and enhancing profitability positions it well for sustained future success.