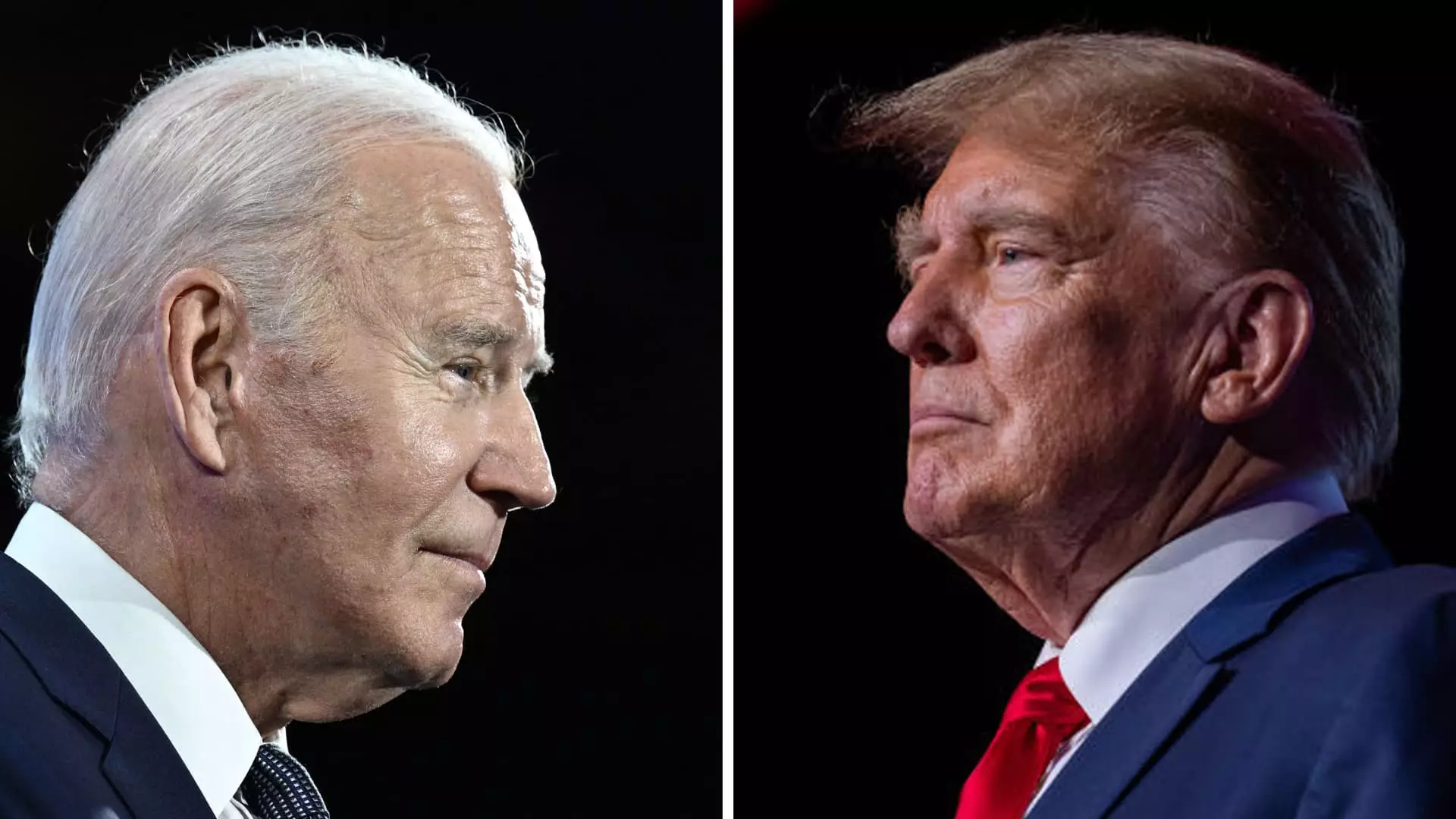

As the 2025 deadline for the expiration of tax breaks enacted by President Trump approaches, both presumptive nominees, President Joe Biden and former President Donald Trump, have vowed to extend these tax breaks. However, the question that remains is how to pay for these extensions. The Tax Foundation has estimated that failing to extend these provisions would result in increased taxes for over 60% of filers, highlighting the urgency of the situation.

One of the major hurdles in extending the tax breaks is the looming federal budget deficit. Erica York, a senior economist, pointed out that the federal budget deficit will be a significant issue as we approach the 2025 tax cliff. Fully extending the Tax Cuts and Jobs Act provisions could potentially add $4.6 trillion to the deficit over the next decade, according to the Congressional Budget Office.

The Economic Impact

Despite claims from some supporters that the tax cuts would pay for themselves through economic growth, studies have shown otherwise. Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center, emphasized that no serious economist believes that the Tax Cuts and Jobs Act came close to paying for itself. With doubts surrounding the economic benefits, the feasibility of extending these tax breaks without incurring further deficit remains uncertain.

While Trump aims to extend all provisions of the Tax Cuts and Jobs Act, Biden has proposed to only extend tax breaks for taxpayers earning less than $400,000, targeting the majority of Americans. Biden’s economic advisor, Lael Brainard, has suggested higher taxes on the ultra-wealthy and corporations to fund these extensions, contrasting Trump’s support for tariffs. The differing approaches reflect the broader economic philosophies of the two candidates.

The debate over extending tax breaks is further compounded by the uncertainty surrounding future policy decisions. With the upcoming presidential election determining which party will control the White House and Congress, the fate of these tax breaks hangs in the balance. Without a clear consensus on how to address the budget deficit and fund these extensions, the future remains uncertain.

The extension of expiring tax breaks is a complex issue that requires careful consideration of economic impacts and budgetary constraints. Both Biden and Trump have put forward their proposals, each with their own set of challenges and uncertainties. As the 2025 deadline approaches, the decision on how to proceed with these tax breaks will have far-reaching implications for American taxpayers and the economy as a whole.