The prospect of Donald Trump’s former congressional aide, Billy Long, leading the Internal Revenue Service (IRS) has stirred up significant debate within political and fiscal communities. Long’s selection raises questions about the direction in which the IRS may head, especially considering the organization’s recent multi-billion dollar initiatives aimed at modernization. As we delve further into this controversial nomination, it’s crucial to assess what Long’s leadership could mean for taxpayer services, compliance, and agency independence.

In recent years, the IRS has experienced significant changes fueled by an infusion of nearly $80 billion in funding authorized by Congress. These funds have been earmarked for various enhancements, including technological upgrades, better customer service, and the establishment of a free taxpayer filing program. Furthermore, the agency has intensified its efforts to collect unpaid taxes, zeroing in on high-income individuals, large corporations, and intricate partnerships. Given this ongoing transition, Billy Long’s background and his approach to leadership will be critical in either facilitating or hindering these initiatives.

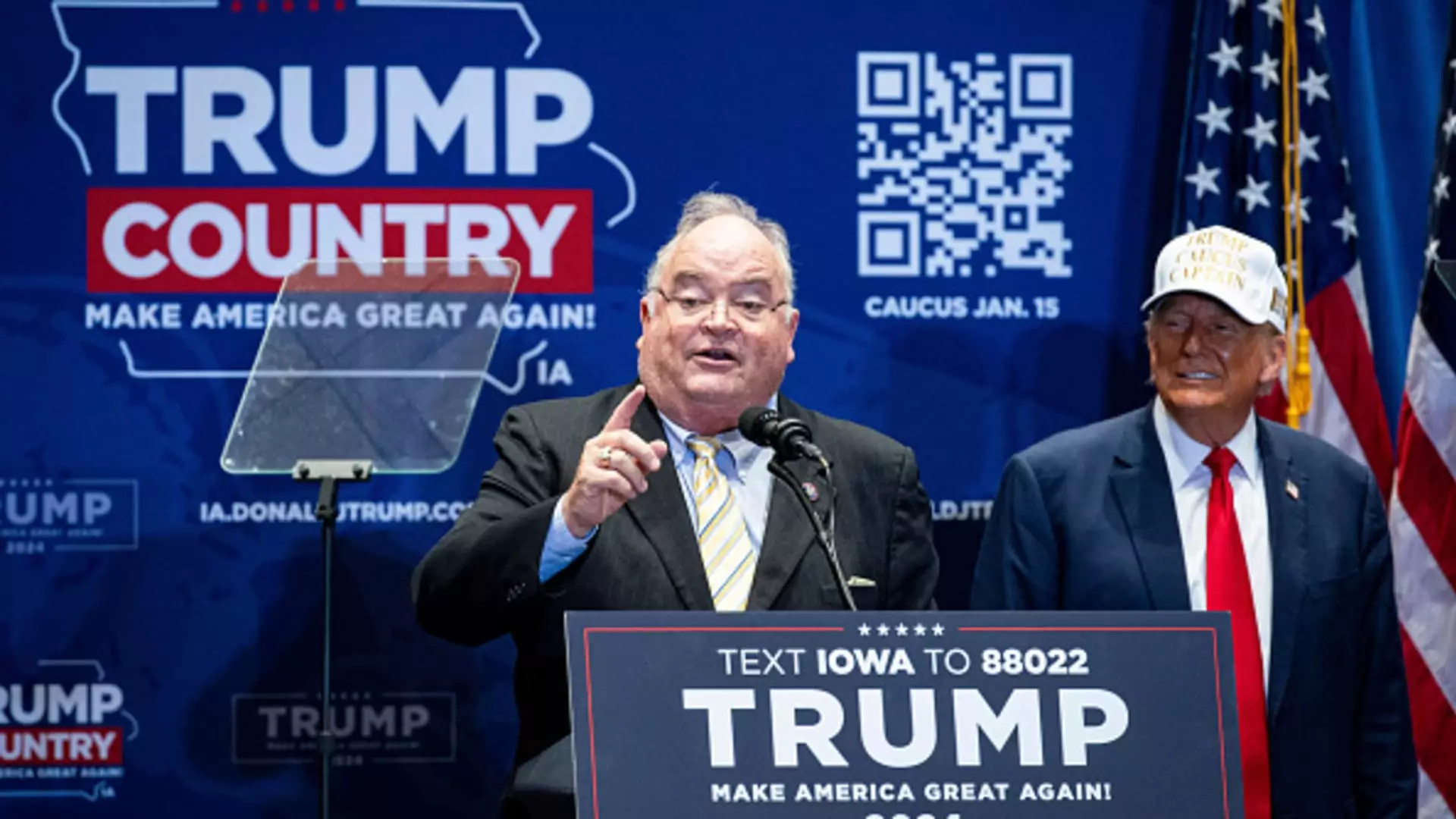

Before entering politics, Billy Long made a name for himself in the auctioneering profession. He served six terms in the U.S. House of Representatives from 2011 to 2023, during which he built a reputation for his business acumen. Post his congressional tenure, Long has worked as a business and tax advisor, helping small enterprises navigate the complex landscape of IRS regulations. Trump’s endorsement of Long highlights a belief that his background will resonate well with the IRS workforce and taxpayers alike, given his supposed practicality and relatability.

However, skepticism surrounding Long’s qualifications is not unfounded. His political history and professional endeavors post-Congress have prompted some lawmakers, particularly from the Democratic side, to express concern about his suitability for a role that requires impartiality and a deep understanding of tax law enforcement.

Political responses to Long’s nomination have been mixed. Advocates from the Republican side, like Sen. Mike Crapo, have put forth a strong argument that IRS has been beset with numerous issues, including inefficiencies and security concerns. They see an opportunity for Long to amend these weaknesses and offer a fresh vision that emphasizes taxpayer protection. Meanwhile, some Democrats question the rationale behind selecting someone who previously dabbled in the controversial Employee Retention Tax Credit (ERTC) industry—a move viewed by Senator Ron Wyden as suspicious.

The ERTC was initially established to provide relief for businesses affected by pandemic restrictions, yet numerous reports of improper claims surfaced later, further complicating the IRS’s enforcement role. Hence, Long’s linked history with this program may not bode well for his candidacy. Democrats are concerned that his potential leadership could shift the agency’s focus away from taxpayer support and towards excessive auditing and enforcement.

Long’s confirmation could redefine the IRS’s operational autonomy. Historical figures in the role have often emphasized the significance of operational independence to effectively carry out their mission. Former IRS Commissioner Charles Rettig voiced hopes that Long would comprehend this importance; however, the potential conflict between a politically intimate appointment and the agency’s required impartiality poses significant quandaries. An IRS commissioner must balance operational efficiency while navigating the political currents expected from a leader appointed by a former president.

Moreover, the expansion of the IRS’s regulatory mandate requires a leader who can advocate for taxpayer interests without politicizing agency functions. If Long is positioned as a politically aligned figurehead, his leadership could invite scrutiny, hampering efforts to enhance taxpayer services.

Billy Long’s nomination as IRS commissioner has opened a Pandora’s Box of discussions about governance, taxpayer relations, and agency integrity. Long’s impending confirmation could usher in an era of amplified scrutiny, heightened enforcement, and significant operational reforms. Yet, the concerns raised by various stakeholders, stemming from his past endeavors and the overarching need for operational independence, highlight the complexity of his potential role. The IRS stands at a crossroads, and the selection of its leader may well dictate the course of its future—either fostering a taxpayer-friendly environment or steering towards heavy-handed enforcement. As debates continue, one thing remains clear: the implications of this appointment will be felt far beyond Washington, deeply impacting taxpayers across the nation.