As Nvidia prepares to unveil its third-quarter fiscal earnings, the anticipation is palpable among investors and market analysts alike. Set to be released after the market’s closing today, the results will provide crucial insights into not just the company’s past performance, but also its potential trajectory amid the fervent race for artificial intelligence supremacy. Estimates from market analysts highlight a projected revenue of approximately $33.16 billion with adjusted earnings per share anticipated to be around 75 cents. However, the focus will likely extend beyond these numbers as stakeholders seek a clearer understanding of Nvidia’s growth strategy going forward.

What Nvidia reveals about its current quarter is likely to carry significant weight. The artificial intelligence boom, now reaching its third year, serves as both an opportunity and a challenge for Nvidia. While the company has experienced extraordinary growth previously, sustaining such momentum requires a robust forward-looking perspective. Analysts expect Nvidia to provide an optimistic outlook for the upcoming quarter, with anticipated earnings projected at 82 cents per share on estimated revenues of $37.08 billion. This forecast not only reflects a desire for sustained growth but also highlights how critical Nvidia’s innovation pipeline is in maintaining investor confidence.

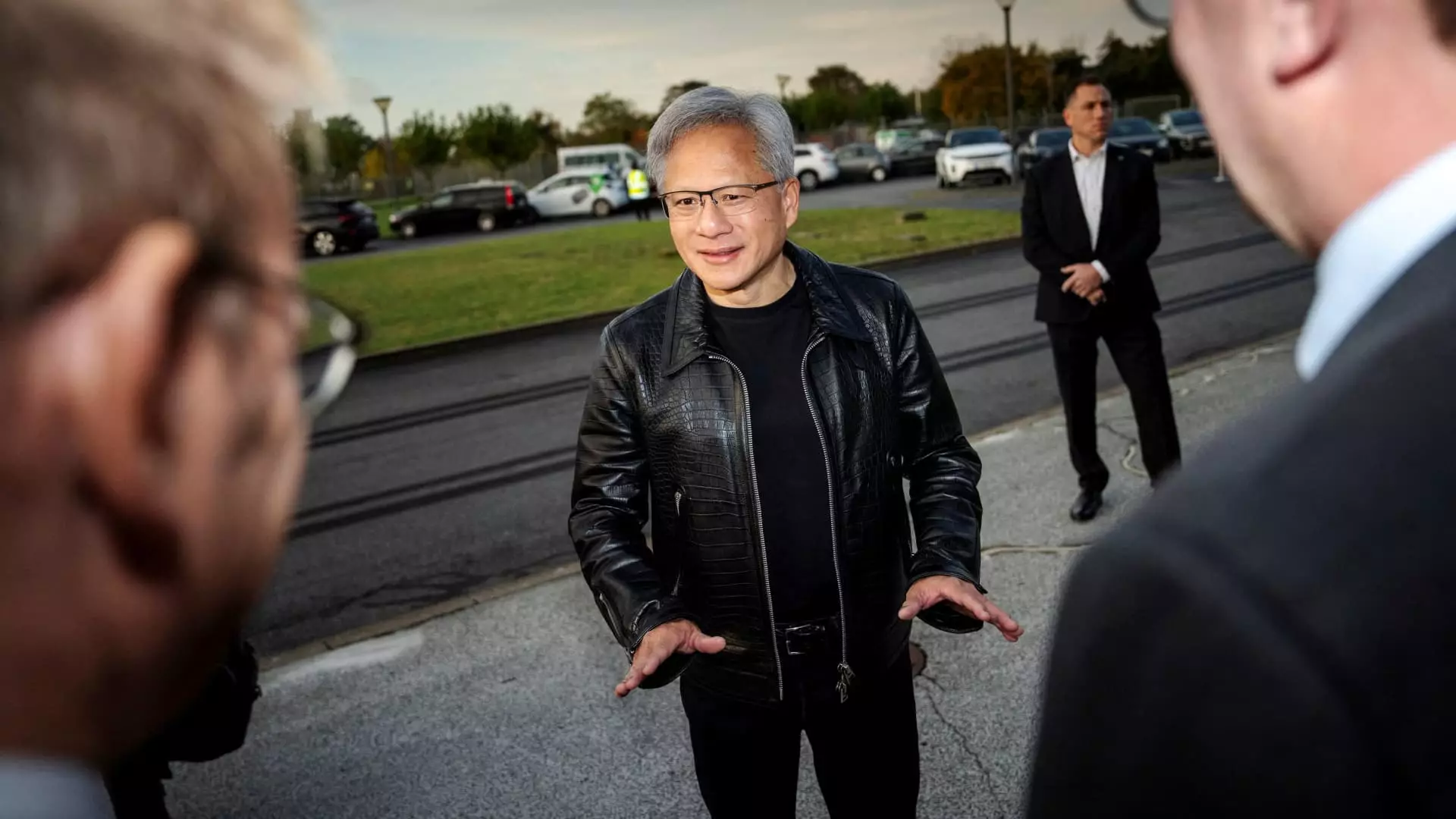

Central to Nvidia’s future growth narrative is its latest AI chip, Blackwell, which is designed for data centers and is already being shipped to major clients such as Microsoft, Google, and Oracle. Investors will be keen to hear any commentary from CEO Jensen Huang regarding the market’s reception of Blackwell and demand levels moving forward. The success of this product could be pivotal as it represents Nvidia’s commitment to staying at the forefront of AI technology. However, concerns have surfaced regarding thermal management issues with some Blackwell systems, adding an element of risk that could weigh on Nvidia’s standing if not adequately addressed.

The Sales Growth Trajectory

Nvidia’s sales growth has been nothing short of meteoric, with last quarter’s figures showing a staggering 122% uptick. Despite this impressive number, it is critical to note this represents a significant slowdown compared to the previous quarters, where increases of 262% and 265% year-over-year were reported in the January and April quarters, respectively. This deceleration raises pertinent questions about the sustainability of Nvidia’s explosive growth as it grapples with an increasingly competitive landscape.

Nvidia’s stock has nearly tripled since the beginning of 2024, reflecting investor optimism. Nonetheless, the market’s reaction will hinge on how the company nuances the challenges it faces alongside the tremendous growth it has achieved. With such high expectations built around Blackwell and continued advancements in AI, Nvidia’s performance, both past and predicted, might dictate the broader financial sentiment towards technology stocks that are heavily reliant on AI advancements.

As Nvidia steps onto the earnings stage, the implications of its report go beyond mere numbers. The potential for future growth amidst the AI boom, coupled with challenges that might not show quick solutions, will test Nvidia’s resilience and innovation. Investors and analysts alike will be watching closely, eager to decipher the company’s path amidst a rapidly evolving tech landscape.