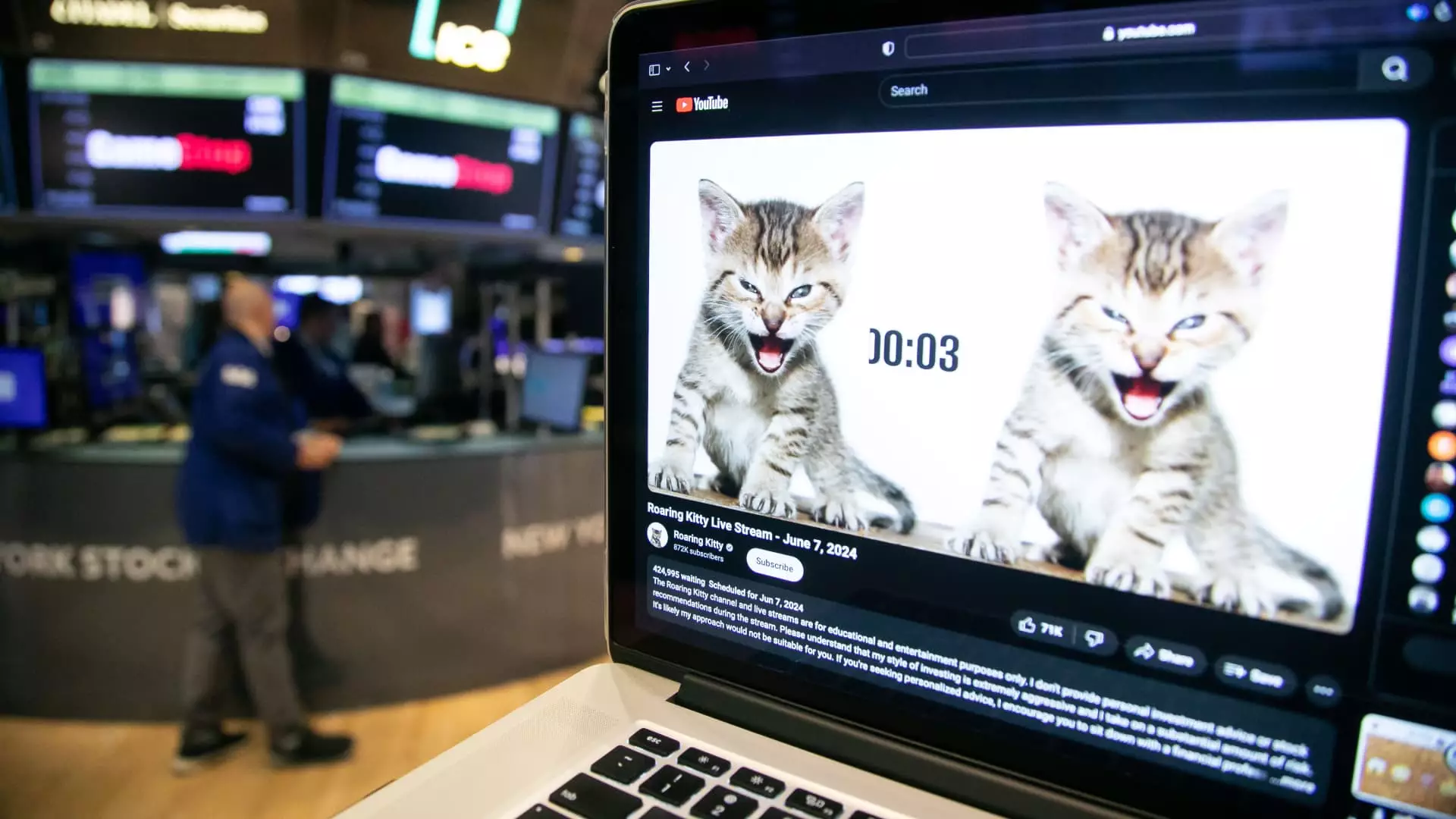

The sell-off in GameStop shares on Wednesday afternoon was further intensified by a spike in trading volume in the call options owned by Keith Gill, also known as “Roaring Kitty.” Despite the lack of confirmation, options traders speculate that Roaring Kitty may have been behind the surge in trading activity, as he is a significant holder of the same contracts that experienced a significant increase in volume.

With 120,000 call options contracts with a strike price of $20 and an expiration date of June 21, Roaring Kitty has been under scrutiny from Wall Street analysts. Speculation suggests that Gill may need to sell his calls before expiration or roll them into another call option to avoid the need to come up with a substantial amount of cash to exercise them. This potential move has put pressure on the stock price, causing a 16.5% plunge as the options’ price dropped by more than 40% during the trading session.

For Roaring Kitty to exercise his calls, he would require $240 million to acquire the 12 million shares at $20 apiece. However, public records of his E-Trade account do not show sufficient funds for such a transaction. This discrepancy has raised concerns among investors, leading to further speculation regarding his trading strategy and potential impact on GameStop’s stock price.

The uncertainty surrounding Roaring Kitty’s options position has resulted in increased volatility in GameStop’s stock, with traders closely monitoring any developments. The unexpected surge in trading volume in the call options associated with Gill has sparked discussions about the potential implications for the stock’s performance in the near future.

The recent sell-off in GameStop shares, coupled with the spike in trading volume in Roaring Kitty’s call options, has raised questions about his trading strategy and its impact on the stock price. The speculation surrounding his position has caused increased volatility in the market, with investors eagerly awaiting further updates on Gill’s next move. As the situation continues to unfold, the market remains on edge, reacting to any new developments that could potentially influence GameStop’s future performance.