On Thursday, the U.S. stock market saw mixed results as investors reacted to the release of May’s producer price index data, suggesting that inflation pressures may be starting to ease. While the S & P 500 dipped slightly, it continued to hover near record highs. Additionally, higher than expected weekly jobless claims hinted at a slight softness in the labor market. These developments followed the Federal Reserve’s decision to maintain interest rates unchanged, with Fed chief Jerome Powell acknowledging progress on the inflation front.

Stock Movement

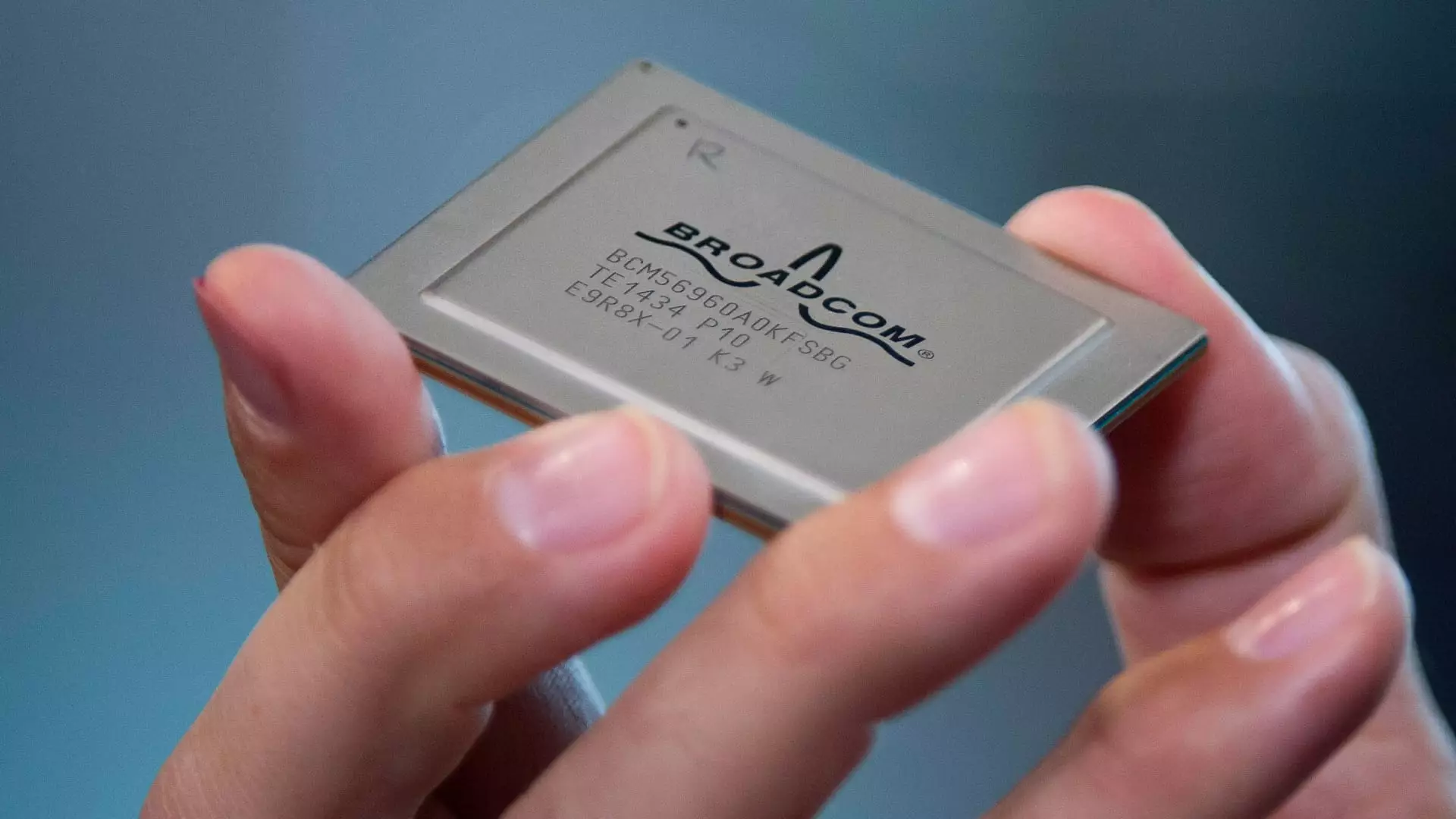

One notable stock that stood out on Thursday was Broadcom, whose shares surged by a substantial 13% after the semiconductor company reported strong earnings driven by artificial intelligence technology. Analysts within the CNBC Investing Club highlighted Broadcom as a top player in the AI chip sector, second only to Nvidia. The company’s decision to raise its full-year guidance and announce a 10-for-1 stock split further bolstered investor confidence.

The news that Blue Cross Blue Shield of Michigan plans to discontinue coverage of weight loss drugs for Eli Lilly and Novo Nordisk on certain insurance plans in 2025 raised concerns among investors. However, the CNBC Investing Club remained steadfast in its investment thesis for Lilly, citing the high demand for drugs like Zepbound and foreseeable supply shortages. Despite this announcement, Eli Lilly’s stock continued on its upward trajectory, marking its sixth consecutive day of gains and heading towards a record close.

As a subscriber to the CNBC Investing Club with Jim Cramer, members have access to trade alerts before Jim executes any trades in the portfolio. It is worth noting that Jim follows a strict protocol before buying or selling any stock, waiting 45 minutes after issuing a trade alert or 72 hours if the stock was discussed on CNBC TV. This cautious approach aims to ensure transparency and allow time for informed decision-making.

The insights provided by the CNBC Investing Club with Jim Cramer offer a unique perspective on market trends and potential investment opportunities. While the market remains volatile and subject to economic indicators, the Club’s focus on research-driven strategies and informed decision-making sets it apart in the realm of financial analysis. Investors can benefit from the Club’s expertise and guidance in navigating the complex landscape of stock trading and investment.