Berkshire Hathaway’s decision to further reduce its stake in BYD, China’s largest electric vehicle maker, is a significant development in the financial world. This move comes after the conglomerate’s initial investment in BYD, thanks to the late Charlie Munger, which proved to be extremely profitable over the years.

The recent sell-off involved Berkshire Hathaway selling an additional 1.3 million Hong Kong-listed shares of BYD for $39.8 million. This sale reduced Berkshire’s ownership stake from 7% to 6.9%. The conglomerate had initially purchased approximately 225 million shares of BYD in 2008 for around $230 million, indicating a substantial return on investment.

The decision to trim its stake in BYD reflects Berkshire Hathaway’s strategic approach to capitalize on the explosive growth of the electric vehicle market, particularly in China. The EV market has witnessed significant expansion in recent years, making it a lucrative industry for investors.

BYD’s journey from manufacturing batteries for mobile phones in the 1990s to becoming a leading electric vehicle brand in China highlights the company’s transformation and success. By pivoting to autos in 2003, BYD strategically positioned itself as a major player in the EV market, culminating in surpassing Tesla as the world’s top EV maker in the fourth quarter of 2023.

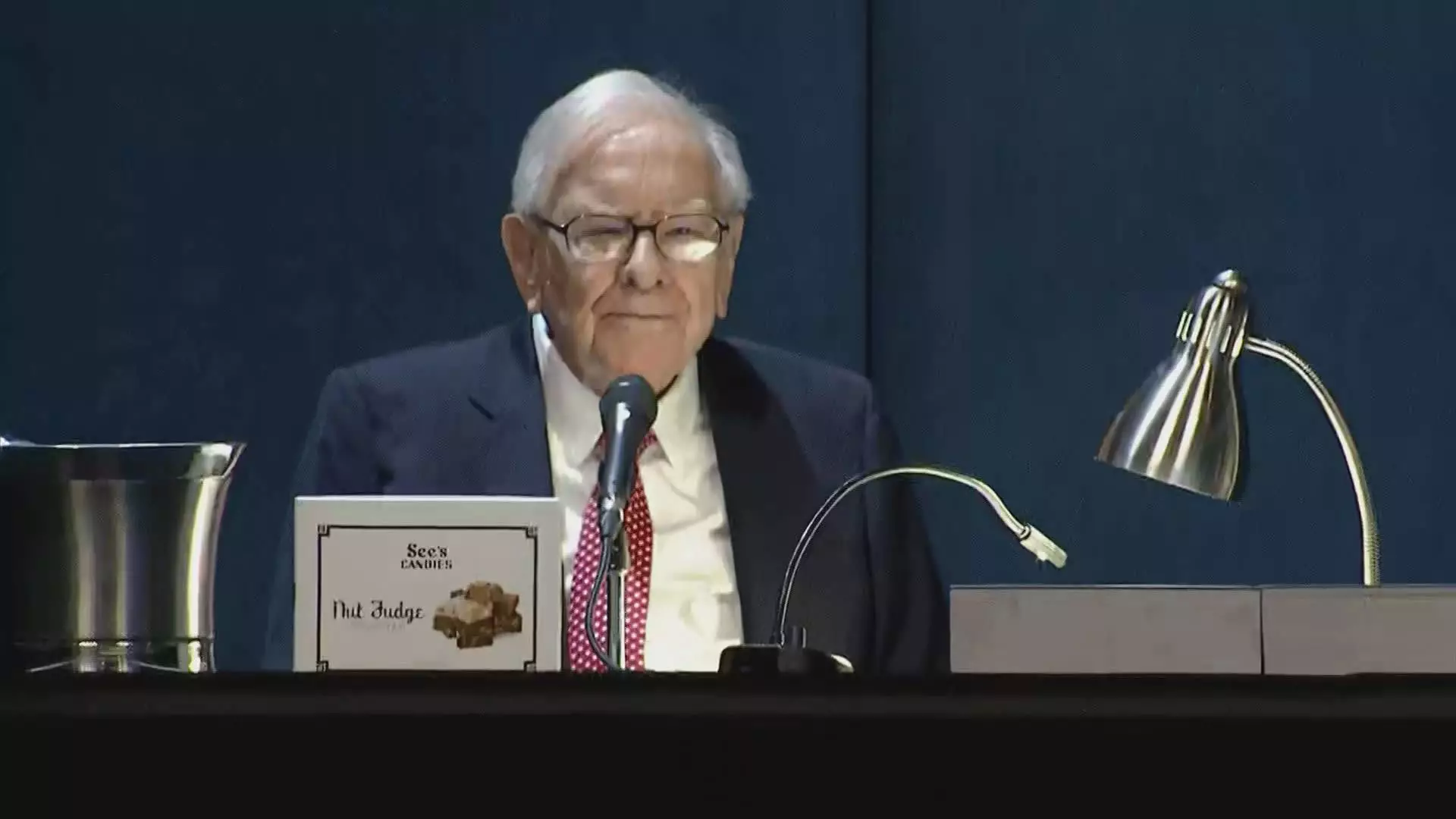

The late Charlie Munger, vice chairman of Berkshire Hathaway, played a pivotal role in identifying the potential of BYD as an investment opportunity. Munger’s relationship with Li Lu, founder of Himalaya Capital, facilitated Berkshire’s initial investment in BYD, showcasing the importance of strategic partnerships in the world of finance.

Berkshire Hathaway’s decision to reduce its stake in BYD reflects the conglomerate’s astute investment strategies and ability to capitalize on market trends. As the electric vehicle market continues to evolve, Berkshire’s sell-off of BYD shares underscores the importance of adaptability and foresight in navigating the ever-changing financial landscape.