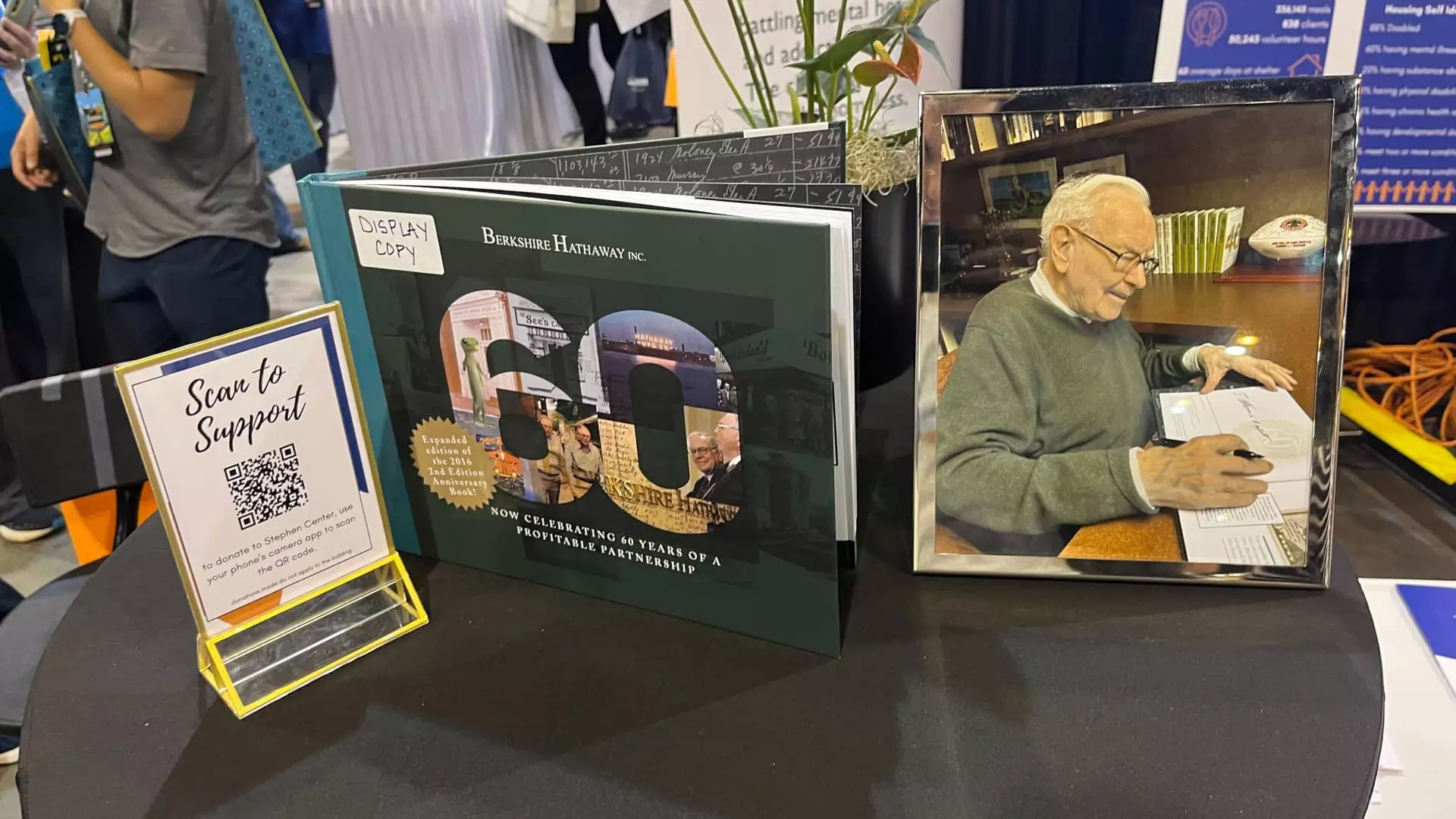

The atmosphere surrounding Berkshire Hathaway’s annual meeting in Omaha was electric, charged by the allure of an auction that blended philanthropy with the charisma of its iconic CEO, Warren Buffett. Investing enthusiasts and devoted shareholders flocked to this gathering not merely for discussions on stocks or profits but to participate in a charitable endeavor that transcended traditional philanthropic norms. This was not just a simple auction; it functioned as a catalyst for community transformation, revealing the passionate connection between wealth, philanthropy, and societal responsibility. The figures involved are staggering and paint a vivid picture of a financial frenzy: over $1.3 million raised, 20 coveted signed books sold, and a community uplifted by individuals driven to support local initiatives.

It’s intriguing to consider how a simple signed book can evolve into a treasure valuable enough to command bids of tens of thousands. In an age where consumerism often overshadows community, events like these remind us that wealth can be utilized as a potent tool for good. Shareholders like Matthew Rodriguez, who actively monitored the auction’s status, signifies a shift in wealth acquisition—one where the act of bidding extends beyond personal gain and enters the realm of social contribution. Rodriguez’s excitement about the auction was palpable, yet his true motivation seemed anchored in a deeper societal connection rather than mere possession of memorabilia.

Buffett’s Astounding Commitment to Local Charity

Buffett’s commitment to charitable causes has always been formidable, but the recent auction took it a step further. His promise to match every dollar donated to the Stephen Center is more than a financial commitment; it encapsulates his philosophy of giving, which is deeply embedded in the fabric of the Omaha community. Rather than simply funneling money into larger, faceless charities, Buffett’s approach emphasizes direct impact, a refreshing deviation from big-money philanthropy that often overlooks the personal side of giving. The local charity that offers housing and addiction recovery programs enriches lives by addressing urgent needs, highlighting how philanthropy can resonate profoundly within a community.

Chris Knauf, CEO of the Stephen Center, eloquently expressed gratitude, remarking on how Buffett’s actions have sparked unprecedented generosity. His quote, “There are truly no words that can adequately express… (the) gratitude for this incredible generosity,” encapsulates the essence of Buffett’s influence, reminding us that monetary contributions are only part of the equation. By rallying local investors and community members around a cause, Buffett is forging bonds that go beyond financial transactions; he is forging connections that could lead to enduring change.

Redefining Ownership and Philanthropy

Interestingly, this event highlighted a subtle shift in how ownership is perceived among affluent individuals. The bidding wars that erupted for signed books were fueled by a desire to possess not just a piece of history but also a legacy intertwined with charitable impact. As buffeted as modern culture can be by materialism, this auction represented a new paradigm: personal ownership linked intrinsically to social responsibility. This profound phenomenon invites questions about the responsibility of wealth and the legacy one leaves behind, urging the affluent to reconsider their role in nurturing their communities.

Moreover, the donation efforts did not stop at the auction. An additional $45,000 was collected from individuals who felt compelled to contribute without even pursuing the auctioned items. Here, we see an inspiring tapestry of altruism woven through personal stories of hardship and resilience. Shareholders, like Jay Ji, exude a commitment to ensuring that no family undergoes the hardships he faced as a child. This acts as a testament to the potential for empathy to spark generosity; it challenges affluent individuals to think critically about their socio-economic responsibilities, advocating a model of philanthropy built on understanding and direct community engagement.

A Legacy Beyond Wealth

As Buffett indicated during the annual question-and-answer session, his dedication to giving back extends far beyond the bounds of traditional philanthropy. The auction and other initiatives underscore his philosophy that wealth should not only serve the individual but enrich the collective community. He has made it clear that the creation of wealth dynasties fails to fulfill the greater responsibility inherent in immense fortunes. Instead, he advocates a model of giving where the focus is on uplifting those in need rather than merely preserving family legacies.

It is a powerful statement about the kind of world we want to build and the role of wealth within that framework. By pledging to give away the majority of his fortune, Buffett invites an important discourse on wealth redistribution, emphasizing that financial success should be paired with a commitment to collective advancement. The stories of those impacted by the Stephen Center compel us to understand that charitable endeavors are more than mere acts of kindness—they are strategic interventions that fortify the very foundations of our communities.

In a time rife with social disparities, Buffett’s philanthropic endeavors remind us that collective progress begins with individuals who recognize their opportunity to effect significant change. By bridging the gap between wealth and responsibility, he not only champions charity but offers a compelling blueprint for the future, one that could inspire generations to build better societal structures to come.