The stock market’s recent turbulence, driven by the U.S.-China trade war, is a disturbing reminder of how geopolitics can dictate financial stability. Investors are experiencing whiplash as they scramble to respond to contradictory signals from both governments, with each tweet or statement setting the stage for a dramatic intraday market swing. In this landscape of unpredictability, it seems we have become pawns in the political chess game, with regular folks’ pensions and savings caught in the crossfire. This too-close-for-comfort relationship between politics and market performance raises questions regarding the efficacy of free market principles in a world muddled by governmental intervention.

Hopes soared briefly when the White House hinted at a potential thaw in relations, suggesting that China might seek a deal, yet this optimism was countered sharply by Beijing’s retaliatory tariffs. The contrast is jarring: on one hand, talk of collaboration, and on the other, actual policy actions indicating a willingness to dig in and escalate. Investors are left in a perpetual state of anxiety, blindly reacting to the latest headlines. This volatile cycle is not just a product of natural market dynamics but a manufactured storm fed by political posturing and erratic governance.

The S&P 500’s Wild Swings: A Dangerous Game

The S&P 500’s acute rises and falls encapsulate this chaotic behavior. The index registered its third-largest single-session gain since World War II, a flash of hope overshadowed by an equally significant drop the next day. This hollow victory highlights what should be a clarion call for investors: the current volatility is not rooted in the economic fundamentals that typically govern markets. Rather, this is an illustration of how susceptible equity markets are to external shocks and irrational reactions. The market’s resilience—or lack thereof—demands scrutiny.

Investors may feel the adrenaline rush of these sudden gains, but where’s the sustainable growth? Market leaders like Wells Fargo and BlackRock show that even sizeable corporations are grappling with unpredictable earnings results. Stock values may rebound—temporarily—but the underlying volatility only serves to instill greater doubt about long-term stability. Each earnings report becomes a gamble, exposing how quickly fortunes can shift with the tides of international policy.

Chips Ahoy: The Surprising Resilience of Tech

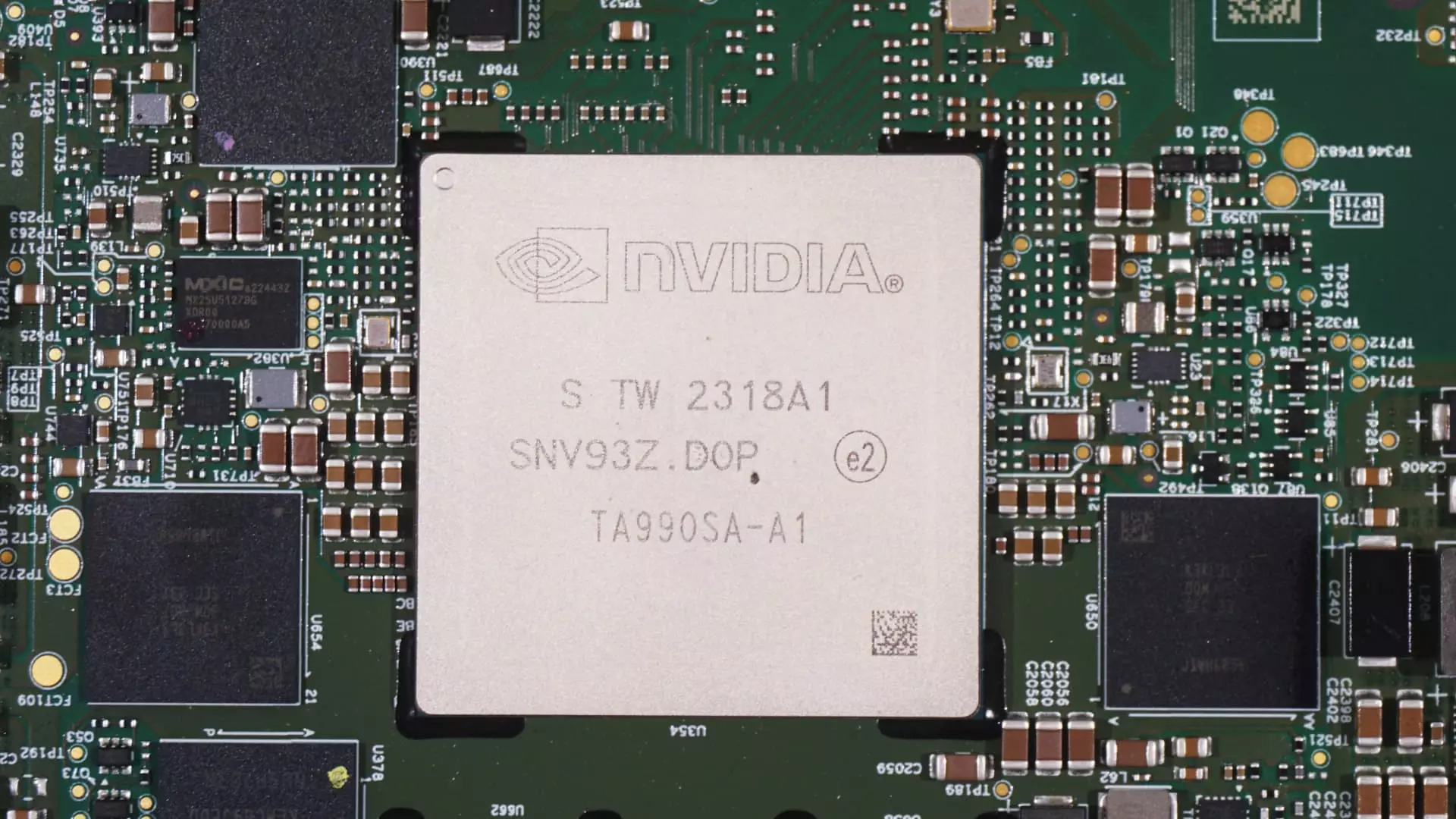

In this unpredictable climate, tech giants like Broadcom and Nvidia emerge as surprising champions, posting staggering week-over-week gains despite the overarching market turbulence. While their performance is impressive, it raises eyebrows about the broader implications. Are these stocks genuinely sound investments, or are they merely the beneficiaries of a fleeting rebound? It’s a question that every investor should ponder, especially as these tech titans, having been significantly affected by recent policy changes, still find pathways to recovery.

Both companies enjoy a unique position driven largely by market demand for semiconductors and AI technologies, yet they remain at the mercy of political decisions that could swing drastically overnight. The idea that tariffs on chips depend on their manufacturing location, rather than shipping origin, is an arbitrary ruling that can be altered with little notice, illustrating just how fragile their success might be. In the grand scheme, we must ask whether the current market performance reflects real growth potential or if it’s simply a mirage created by the tumultuous landscape of U.S.-China trade relations.

The Impending Earnings Season: A Potent Catalyst for Change

As we advance into the next earnings season, marked by missed predictions and fluctuating expectations, investors brace for a new wave of challenges. The uncertainty looms as major companies like Goldman Sachs and Abbott Labs are on deck to report their quarterly data. With mixed signals permeating the market, there’s palpable tension regarding what these reports will indicate about the overall health of the economy. The released data will inevitably offer more fuel to the fire and enable a better analysis of consumer spending trends, which remain a strong indicator of economic health.

However, the marketplace can be excessively pessimistic or optimistic based on external narratives rather than business fundamentals. The upcoming reports may not lay bare the troubling undercurrents but will certainly influence stock prices dramatically—an unfortunate reality for investors who find themselves on an emotional roller coaster. The Bureau of Labor Statistics’ upcoming data should be treated with cautious optimism. A decline in imports and exports could signal a weakening economy, indicating that today’s apparent resilience may evaporate rapidly.

The Broader Question: Are We Trading on Reality or Fear?

As we navigate through this maelstrom of uncertainty, one can’t help but ponder whether this environment offers an opportunity for savvy investors or whether it’s a setup for disaster. The financial system increasingly appears susceptible to manipulation and external influences, stirring fears that we may not be trading on sound financial principles, but rather on a foundation of fear and speculation. The impact of political upheaval and decisions made in distant boardrooms raises profound concerns about the sustainability of any market rebound.

Ultimately, we are witnessing an alarming trend where political narratives overshadow economic realities, forcing serious reevaluation of strategies, objectives, and expectations. If investors continue to react impulsively to the latest policy announcements and trade negotiations rather than engaging with the underlying market fundamentals, we could be headed for a protracted period of uncertainty that impacts all facets of financial interaction.

Only time will reveal whether this current surge is a precursor to long-term stability or merely a flicker in a storm that is far from over.