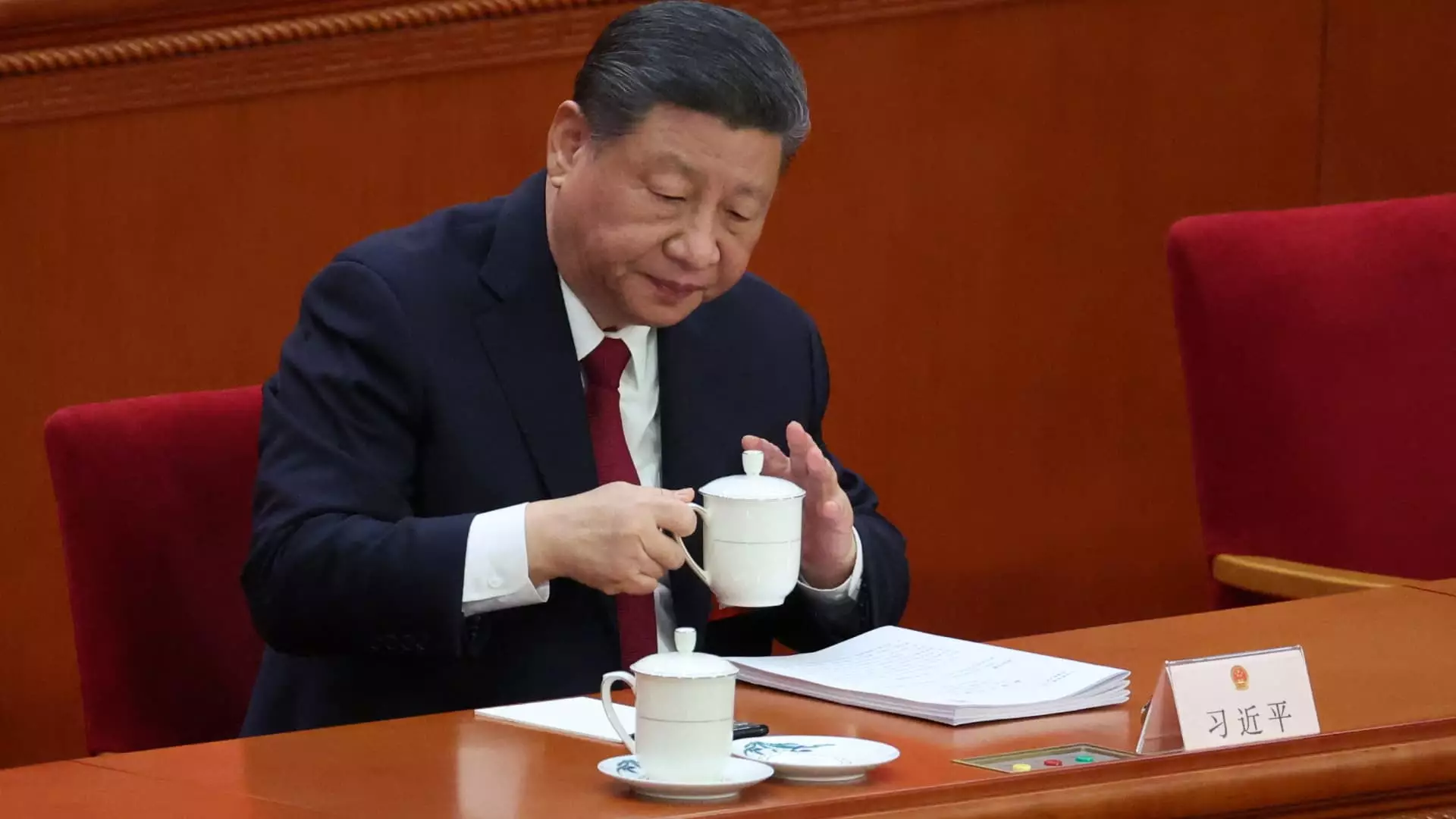

As China faces a whirlwind of external pressures, including escalating tariffs and global economic uncertainties, the looming question is clear: how effective are the government’s targeted measures in supporting struggling businesses? President Xi Jinping recently chaired a critical Politburo meeting aimed at providing aid to enterprises overwhelmed by these external shocks. This initiative highlights a systemic issue that transcends mere financial support; it underscores the vulnerabilities embedded within China’s economic architecture.

With major banks like Wall Street revising their GDP forecasts downward, the ambitious growth target of “around 5%” set earlier in the year appears increasingly untenable. The atmosphere is charged with skepticism, revealing the cracks in an economy that seems more focused on maintaining an illusion of stability than on addressing the underlying crises that businesses face. The urgency for action is palpable, but the approaches being employed feel reminiscent of band-aids on deep wounds, rather than systemic solutions meant to heal.

Targeted Measures or Political Theater?

One cannot help but scrutinize the proposed “targeted measures,” including financial supports and interest rate reductions, as more of a political theater than substantive policy changes. Surely, the rhetoric around assisting the middle and lower-income groups sounds noble; however, the reality often diverges dramatically from intention. Questions linger over whether these measures are truly aimed at bolstering the struggling sectors or merely aimed at appeasing public sentiment amid growing discontent.

The call for improving income among these groups hints at a broader recognition of income inequality in China—a pivotal issue that many would argue requires more than just financial tweaking to resolve. Authorities seem to be playing a fraught balancing act—treading carefully to avoid igniting social unrest while still trying to project an image of control. The disparity between rhetoric and action can breed disillusionment and skepticism among the populace.

The Illusion of Stability

The bold assertion that China has ample room to act on fiscal policy, particularly with a raised deficit target of 4% of GDP, is a double-edged sword. While it offers a façade of fiscal flexibility, it also uncovers a critical dependency on debt that could spiral dangerously if external pressures worsen. The cautious nature of policymakers, as indicated by chief economist Zhiwei Zhang, illustrates not just an unwillingness to commit to expansive stimulus but also an inherent fear of overreach in a fragile economy.

This creeping conservatism further complicates prospects for significant reform. While government meetings release optimistic sound bites about increasing tech advancement—such as integrating artificial intelligence—the truth remains that without a significant overhaul of existing practices, these measures may not suffice to create enduring economic resilience.

The Policy Ping Pong Game

What stands out in this environment is the incessant cycle of policy responses that appear reactive rather than proactive. China’s approach to redirecting exports inward relies on local governments and major businesses working together, yet it reflects a lack of coordinated strategic vision. While attempting to boost domestic consumption sounds pragmatic, it raises questions about sustainability, especially given how external trade has traditionally driven China’s economic miracle.

The Politburo meeting reinforced its commitment to existing policies and stressed high-level collaboration. Yet, beyond the surface, one may find a consistent theme of policymakers fumbling to navigate uncertainties. The stark reality is that many potential reforms remain on paper, waiting for the spark of true crisis to prompt action. Abundant rhetoric surrounding policy effectiveness without timely implementation diminishes the public’s trust.

A Critical Juncture

As the National People’s Congress gears up for meetings that are poised to discuss a new private sector law, one cannot overlook the implications of the current economic climate. It feels as if a precipice is in view; the step forward will require an honest reckoning with not just numbers, but the experiences of ordinary citizens and businesses. As it stands, the promised changes have yet to materialize in transformative ways, leaving many wary of the path ahead.

The next phase in China’s economic narrative is uncertain. Pressured from multiple fronts, the state must decide between merely treading water through surface-level changes or undertaking a more courageous, genuine reform agenda that addresses core issues and rallies public trust in a landscape rife with discontent.